Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 06, 2015

Credit markets positive on ECB and US banks

The latest ECB meeting spurs on risk assets, while across the Atlantic US banks fare well in stress tests.

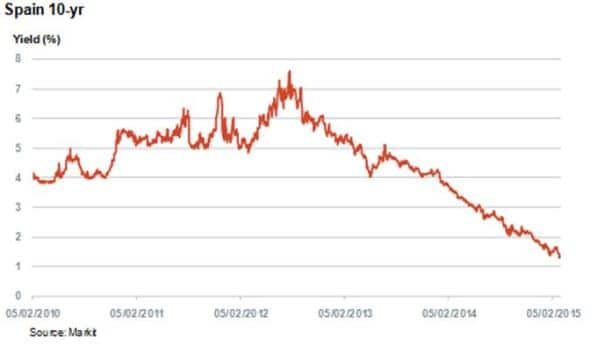

- Latest ECB QE comments boost periphery bonds with Spanish ten year bonds yields hitting new five year lows

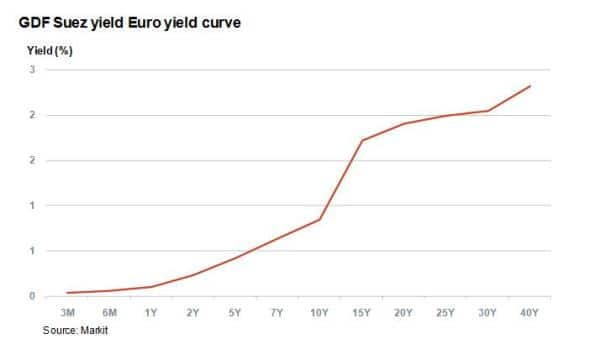

- Buoyant European corporate bond market allows GDF Suez to issue 0% bond

- US banks pass stress tests; CDS market indicates they are healthier than this time last year

Europe optimistic

The ECB outlined its QE programme, intended to spur growth and boost inflation, due to start on March 9th. ECB president Mario Draghi reiterated the purchases will amount to €60bn per month and will exclude Greek and Cypriot debt.

Growth and inflation projections were upgraded, while euro/dollar hit fresh 11 year lows. Peripheral bonds rallied with the Spanish ten year bonds hitting new five year lows.

Zero coupons

QE continues to spill over into the European corporate bond market with GDF Suez, a French utility company, issuing the first ever zero coupon corporate bonds; the two year, €500m issue priced to yield 0.13%. Whether GDF joins other European multinationals like Nestle, EDF and BMW in offering negative bond yields will be closely watched in the markets.

The impact was also felt among sovereign issuers and Austria joined the list of sovereigns seeing their 5-yr bonds trade with a negative yield. Germany, Sweden, and Finland are all also currently trading with negative yields.

Greece lingers

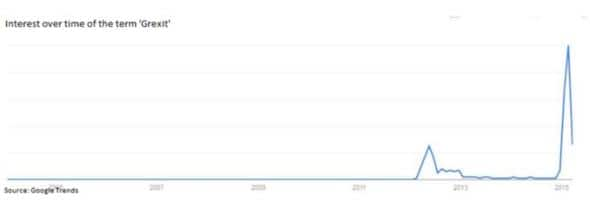

The Greek debt saga continues as a third bailout is negotiated. With talks drawn out, markets have remained stagnant as Greek 5-yr CDS has remained in the 37-39% (upfront payment) region for the last two weeks.

Despite the continuing negotiations, talk of a "Grexit" has recently diminished.

US bank stress tests

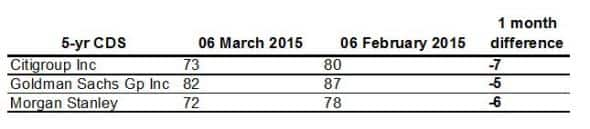

Round one of the Federal Reserve's annual bank stress tests concluded with all 31 banks under scrutiny passing. The tests include how a bank's Tier 1 ratio, a measure of capitalisation, would react under a hypothetical crisis. This year's tests included a more stringent corporate debt default scenario.

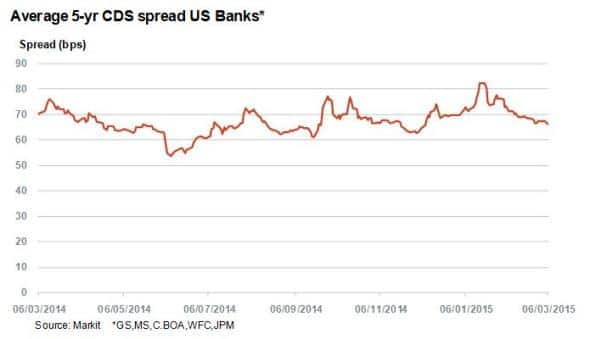

Goldman Sachs and Morgan Stanley scraped through with Citigroup faring much better than last year. It was the first time that all banks passed the first stage since 2009. In an upbeat signal from the markets, all three banks saw tightening in their CDS spreads.

During last year's stress tests the average CDS spread among US banks was 73bps. The current average stands at 66bps; an indication that the US banking system is healthier this time around.

Round two results, which are due to come out next Wednesday, will delve deeper into how banks will allocate future profits, in a much more comprehensive capital analysis. All eyes will be on the big banks JP Morgan, Bank of America and Citigroup.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-credit-credit-markets-positive-on-ecb-and-us-banks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-credit-credit-markets-positive-on-ecb-and-us-banks.html&text=Credit+markets+positive+on+ECB+and+US+banks","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-credit-credit-markets-positive-on-ecb-and-us-banks.html","enabled":true},{"name":"email","url":"?subject=Credit markets positive on ECB and US banks&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-credit-credit-markets-positive-on-ecb-and-us-banks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Credit+markets+positive+on+ECB+and+US+banks http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06032015-credit-credit-markets-positive-on-ecb-and-us-banks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}