Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 05, 2015

Shorts not betting against credit card market

The US credit card market is undergoing what is arguably its greatest period of change in the last decade, but short sellers have so far held back from betting on the sector's downfall.

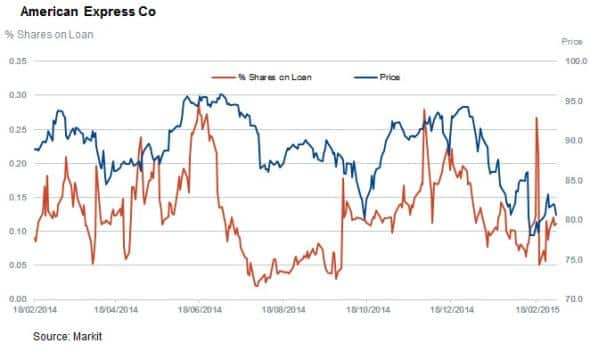

- American Express has less than 0.2% of shares out on loan despite recent troubles

- Visa had been targeted by short sellers, but demand to borrow has tapered off after hitting new record in September

- One firm being targeted is international payments provider Western Union which has 16% of shares out on loan

Credit card companies are arguably some of the best placed firms to take advantage of rising American consumer spending as their agnostic revenue generating model, which charges volume based fees, ought to reflect the fact that US consumer spending has largely outpaced the wider economy.

But recent court judgements and increasingly heated (arguably zero sum game) competition between Visa, MasterCard and American Express, which are responsible for over 80% of credit card purchases by volume look set to shake up the established industry status quo.

Despite recent drastic share price movements, short sellers have shown little appetite to trade on the back of the recent industry changes over the last few weeks.

American Express sees headwinds

American Express, which unlike its other two large peers is both a primary issuer and payment processor, has been at the losing end of both industry shifts over the last month. The firm recently lost an antitrust ruling, which could see retailers shun its higher cost cards; something which its previous merchant agreements forbade.

This ruling added to an already fraught month for the firm as Costco, a large retailer and American Express' largest co-branded card partner terminated its relationship and ultimately partnered with Visa. The end of this longstanding relationship, which was responsible for one tenth of American Express cards on issue, has been viewed as a shift in the established status quo between card issuing firms and partner firms. This development could see competition grow for consumers by credit card providers. Incentives such as miles and cash back have already started to eat into industry profits and an all-out price war between card issuers could further eat into profits.

Shares of American Express have taken a double digit percent hit following the recent developments, but short sellers have not shown much appetite to bet against the firm, which has less than 0.2% of shares out on loan. This is despite the fact that analysts are expecting the company to post flat revenues for the coming year, contrasting with a forecast 10% gain from rivals Visa and MasterCard.

Visa and MasterCard benefit

Visa, which is arguably best placed to capitalise from the recent developments, sees much higher levels of short selling activity compared to American Express. Demand to borrow Visa shares now stands at 6.5% of shares outstanding. Borrow demand has remained roughly flat since the start of the year despite the recent announcement that Visa would replace American Express as the current exclusive Costco credit card partner; news that sent Visa shares to a new record high.

MasterCard has also seen its shares trade at all-time highs in recent weeks, but the firm has not been the target of any tangible short interest, with just 0.4% of its shares out on loan at present.

Western Union targeted by short sellers

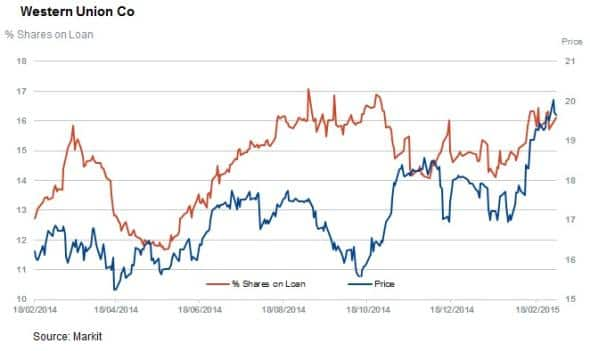

One firm that has seen consistent short selling activity in the payment services space is Western Union. While the company operates largely outside the scope of the big three credit card firms, advances in mobile payments could challenge the firm's existing transfer business. The firm has seen short interest climb to recent highs and there are now 16% of Western Union shares out on loan, three times the level seen two years ago.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Equities-Shorts-not-betting-against-credit-card-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Equities-Shorts-not-betting-against-credit-card-market.html&text=Shorts+not+betting+against+credit+card+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Equities-Shorts-not-betting-against-credit-card-market.html","enabled":true},{"name":"email","url":"?subject=Shorts not betting against credit card market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Equities-Shorts-not-betting-against-credit-card-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Shorts+not+betting+against+credit+card+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Equities-Shorts-not-betting-against-credit-card-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}