Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 05, 2015

Investors turn to niche assets in hunt for yield

The current trading environment has seen investors struggle to secure yield, pushing many towards riskier or more niche assets in order to gain the most attractive returns.

- Three high yield ETFs have seen some of the largest inflows so far this year; led by the iShares iBoxx $ High Yield Corporate index with over $3bn of inflows

- Yields in euro denominated subordinated debt have tightened to around 2% in the last six months from around 3%

- Investors have been actively adding to funds benchmarked to longer dated issuances

Investors hunting for yield

Bond funds have seen a strong start to the year, with investors already piling $30.5bn into fixed income ETFs to date. This figure is well over a third of the total 2014 inflows, with the first quarter yet to conclude.

The biggest net inflows in 2015 have come into to funds in the high yield space, which have seen a total of $7.29bn worth of new assets; the top performer being the iShares iBoxx $ High Yield Corporate Bond ETF with over $3bn of net inflows. This sets high yield up for its best quarter since Q1 2012. While bonds in general have been popular for ETF investors, both in the US and Europe, new appetite for high yield highlights an increased willingness to take on more risky forms of debt in search for higher returns.

Over in Europe, high yield has also been popular with investors. The iShares Euro High Yield Corporate Bond ETF has attracted inflows of $1.36bn this year driven by the ECB's QE programme

Lower credits appealing

Debt issued by riskier firms has been a popular vehicle for investors to secure yield, as evident by the large inflows into high yield debt products. The trend remains popular in Europe and the UK where issuance is picking up to meet demand.

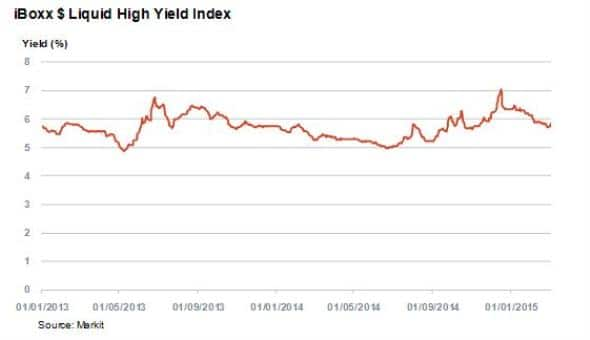

Relative to the European market, where low government bond yields have taken their grip, yields in the US have remained high. The iBoxx $ Liquid High Yield Index yields around 5.8%, a 2.1% premium over US investment grade bonds, and offers consistently higher yield than in June of last year when yields dipped below 5%, a recent low. Supply is strong, with issuers such as Valeant, a pharmaceuticals company, in the process of issuing the second largest "junk' offering to date.

Subordinated debt offers attractive returns

Moving deeper down a firm's capital structure also offers room for heightened yield.

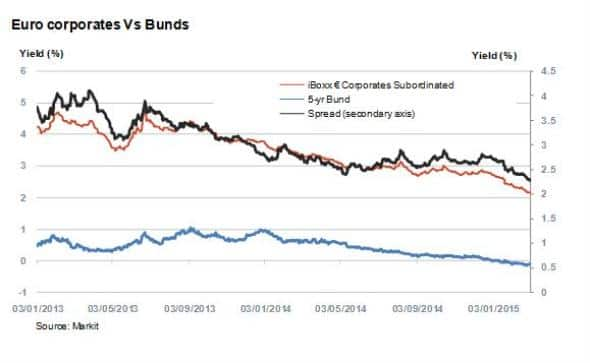

Subordinated debt yields in Euros provide around 2.28% over 5 year Bunds as measured by the iBoxx € Corporate Subordinated index. A similar spread to that of US High yield over US Treasuries. Investors have found this extra yield very attractive, as the spread of the index over Bunds has narrowed significantly in the last six months.

Total, an AA rated oil company recently issued deeply subordinated 6 year debt offering a 2.25% coupon, to great investor demand.

Looking up the yield curve

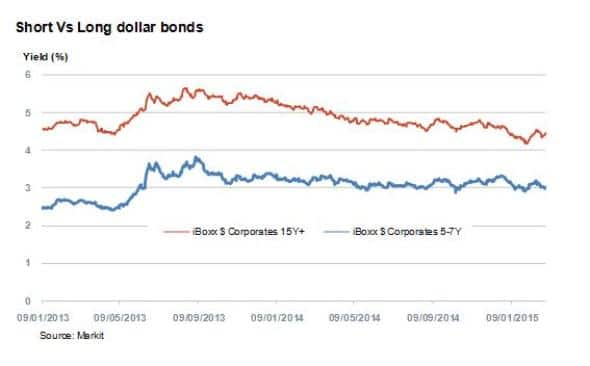

Taking a longer view on duration has been another popular strategy for investors to achieve yield. In Europe, a recent deal by GDF Suez, an "A' rated French utility company, priced a 20 year bond in euros at a yield of 1.58%, a meagre 73bps over 20 year Bunds.

To put this into perspective, the iBoxx $ Corporates 15Y+ index, which has an average maturity of 25 years, provides 185bps over 25 year US treasuries, and a headline yield above 4%.

Funds which offer long term exposure have proved popular, with the Vanguard Long-Term Corporate Bond Index fund growing its AUM base by over a third since the start of the year, driven by large inflows. Another long dated corporate product from iShares, the 10+ Year Credit Bond ETF has also experienced the same trend to take its AUM to a new all-time high.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Credit-Investors-turn-to-niche-assets-in-hunt-for-yield.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Credit-Investors-turn-to-niche-assets-in-hunt-for-yield.html&text=Investors+turn+to+niche+assets+in+hunt+for+yield","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Credit-Investors-turn-to-niche-assets-in-hunt-for-yield.html","enabled":true},{"name":"email","url":"?subject=Investors turn to niche assets in hunt for yield&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Credit-Investors-turn-to-niche-assets-in-hunt-for-yield.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+turn+to+niche+assets+in+hunt+for+yield http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05032015-Credit-Investors-turn-to-niche-assets-in-hunt-for-yield.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}