Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2016

Eurozone sees best quarter for 4 ' years despite stalling French economy

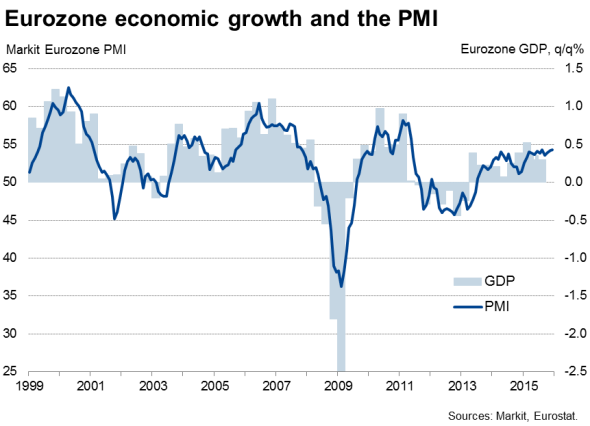

The eurozone economy starts 2016 on a solid footing and well placed to enjoy a year of robust growth. The pace of expansion in business activity continued to edge higher at the end of 2015, with an upturn in the PMI rounding off the strongest quarter for four-and-a-half years.

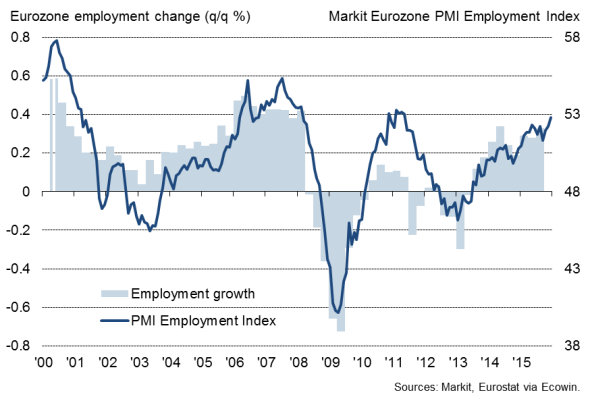

Employment

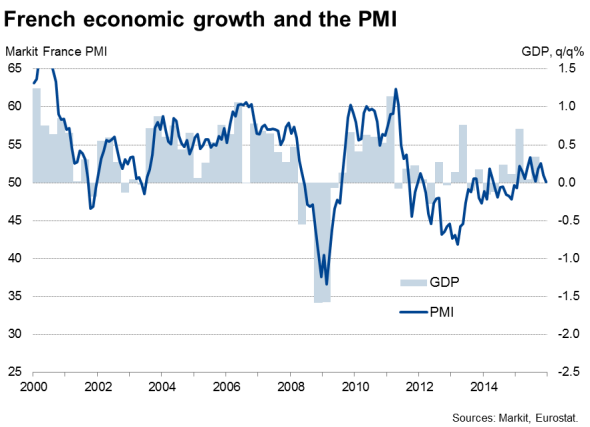

However, solid growth is by no means broad-based, with strong expansions recorded in all major economies with the exception of France where the upturn has ground almost to a halt.

The final Markit Eurozone PMI rose above the earlier flash estimate to reach 54.3, the joint-highest since May 2011. However, despite the improvement, the survey data merely signal a modest 0.4% increase in GDP in the fourth quarter, which would mean the region grew 1.5% in 2015. Given that we have seen almost a year's worth of quantitative easing, the weakness of the rate of growth seen last year raises concerns that policy is proving somewhat ineffectual.

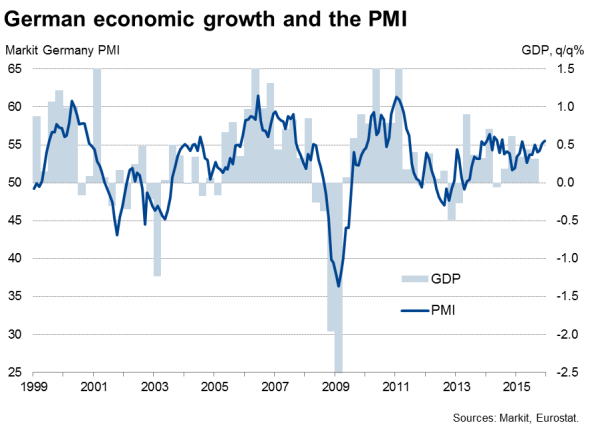

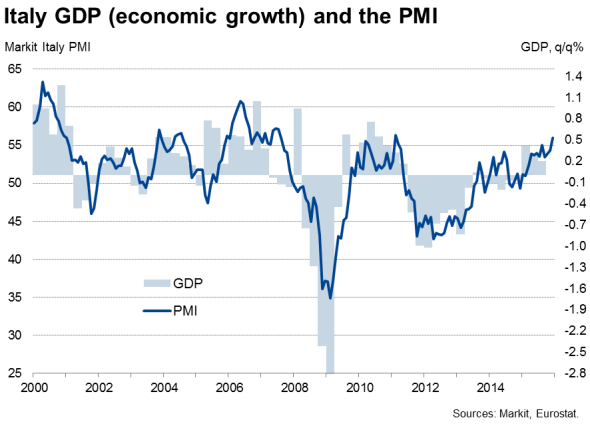

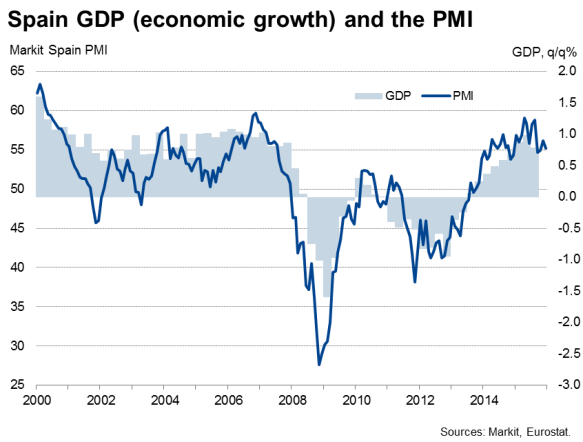

But dig deeper into the numbers and the concern is mainly focused on France. Ireland, Spain, Italy and Germany are all enjoying strong economic expansions, but France is showing signs of stalling once again.

Survey responses have indicated that some of the renewed weakening of the French economy may have arisen from the Paris terrorist attacks, in which case the slowdown may proved temporary. A rebound in France is clearly needed to help drive a strong year of growth for the region as a whole.

The survey data point to a 1.0% GDP expansion in Ireland in the fourth quarter, with Spain also enjoying another quarter of strong, 0.8%, growth. Both Germany and Italy meanwhile look set to see 0.5% expansions, but France looks to be on course to only eke out 0.2% growth.

Where policymakers will be particularly encouraged is in the employment trend. The December survey saw firms taking on staff in increased numbers, leading to the fastest growth of employment since May 2011. The additional hiring suggests that businesses are preparing for stronger demand in the coming year, hinting that 2016 may see both faster economic growth than the 1.5% expansion seen in 2015, as well as a meaningful drop in joblessness.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Eurozone-sees-best-quarter-for-4-years-despite-stalling-French-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Eurozone-sees-best-quarter-for-4-years-despite-stalling-French-economy.html&text=Eurozone+sees+best+quarter+for+4+%27+years+despite+stalling+French+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Eurozone-sees-best-quarter-for-4-years-despite-stalling-French-economy.html","enabled":true},{"name":"email","url":"?subject=Eurozone sees best quarter for 4 ' years despite stalling French economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Eurozone-sees-best-quarter-for-4-years-despite-stalling-French-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+sees+best+quarter+for+4+%27+years+despite+stalling+French+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Eurozone-sees-best-quarter-for-4-years-despite-stalling-French-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}