Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2016

Vietnam PMI - 2015 review

At the end of December the General Statistics Office of Vietnam announced that GDP rose 6.7% in 2015, above the target of 6.2% and bringing a positive end to the five-year plan of 2011-2015. The Nikkei Manufacturing PMI, produced by Markit, was also generally positive in 2015, although the latter part of the year saw a slowdown in growth. This note looks at the key themes of 2015 and looks forward to 2016.

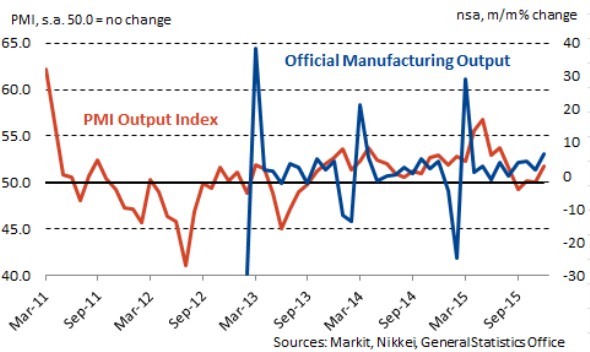

The Nikkei Vietnam Manufacturing PMI signalled improvements in the health of the sector in ten of the 12 months of 2015. The performance of manufacturers was particularly strong around the middle of the year, with sharp growth of output recorded amid improving client demand and competitive pricing. The official manufacturing data were also generally strong throughout the year, though the data are not seasonally adjusted, which can make it more difficult to see the underlying performance, particularly around the Tet festival.

Vietnam Manufacturing Output

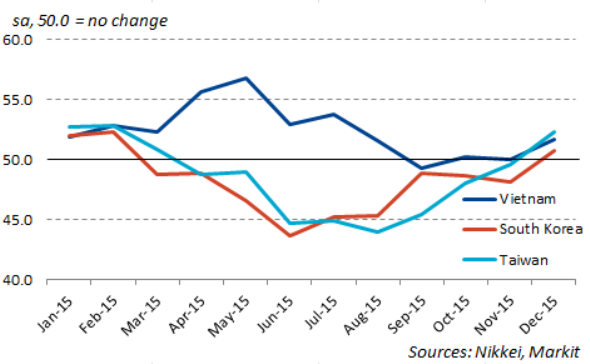

During the middle part of the year the Vietnamese PMI was performing particularly strongly compared to regional partners such as South Korea and Taiwan, who were undergoing sharp downturns. This partly reflects the fact that Vietnam exports a sizeable proportion of its goods to the US and Europe and is therefore less reliant on the faltering Chinese economy than Taiwan and South Korea.

Manufacturing PMI Output Indices 2015

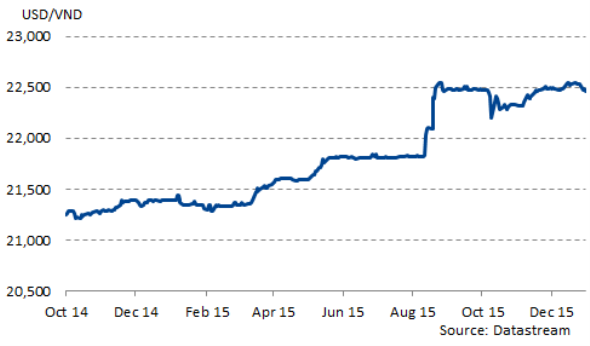

There have been efforts to support Vietnamese manufacturing through changes in the exchange rate, with the State Bank of Vietnam devaluing the dong at various points during the year. The currency operates in a crawling peg with the US dollar and the strength of the dollar in 2015 therefore led the dong to appreciate in value against other currencies. In order to combat this, the central bank moved the mid-point exchange rate three times during the year, from 21,246VND to the US dollar at the start of 2015 to 21,890VND at the end of the year (a depreciation of 2.9%).

In addition, in August the central bank widened the trading range in which the dong can move against the dollar from 1% to 3%, largely in response to a weakening currency in China amid similar moves by the authorities there. At the time, some PMI respondents had reported lost exports as a result of a reduction in competitiveness against Chinese firms. Altogether, the value of the dong dropped 5% against the US dollar during 2015.

Vietnamese dong per US dollar

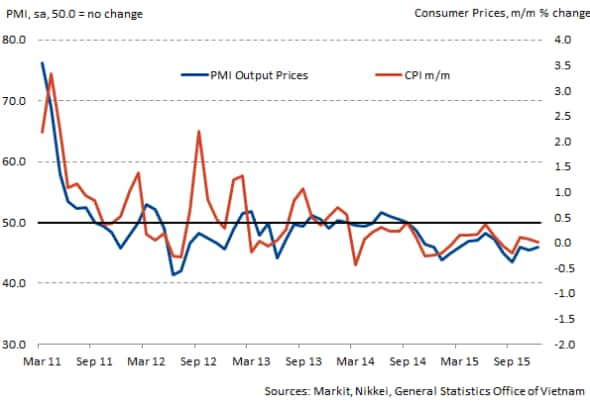

A weaker currency showed no signs of adding to inflationary pressures during 2015. In fact, consumer price inflation was the lowest in 14 years and has been below 1% since July amid falling prices in global commodity markets. PMI data has signalled reductions in manufacturing selling prices in each of the past 15 months.

PMI Output Prices v Consumer Prices

Key to the falls in commodity prices have been ongoing worries about the health of the Chinese economy, which also started to affect the Vietnamese manufacturing sector during the second half of the year. Total new orders decreased between September and November, with new export business falling in six successive months from June. The sector was therefore unable to generate any meaningful production growth during the final five months of 2015 and job creation was marginal at best. There were signs in December, however, that the worst of the slowdown might be over as output, new orders, employment and exports all returned to growth.

Looking ahead to 2016

The Vietnamese Communist Party will hold its National Congress in 2016 to choose a new government and set out a new five-year plan for the economy. The GDP target for 2016 has been set at 6.7%, the same rate of growth as achieved in 2015. Whether or not this is achievable will depend to a large extent on how the global economy performs should weakness in China and other emerging markets persist. If global conditions improve, Vietnamese firms should be well placed to see a return to the growth rates enjoyed in the first half of 2015.

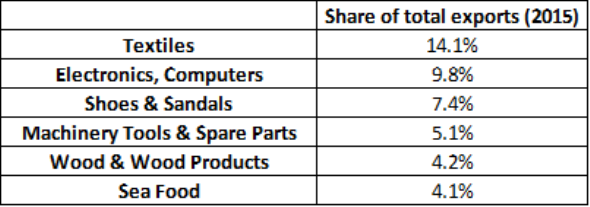

Looking further ahead, there are reports that the Trans-Pacific Partnership (TPP) trade deal will be signed in February. The deal, as well as a separate agreement with the EU, is expected to greatly benefit Vietnamese exporters, particularly those in the textiles and food sectors which are so important to the Vietnamese economy and are a key part of the agreement.

Main Vietnamese Exports

Source: General Statistics Office

Signing the agreement, however, is not the crucial stage of the process. This comes with the ratification stage and could lead to delays and complications, particularly in the US where key presidential candidates have expressed doubts about the deal.

The Nikkei Vietnam Manufacturing PMI for January will be released on February 1st and provide an indication as to the health of the sector at the start of 2016.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Economics-Vietnam-PMI-2015-review.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Economics-Vietnam-PMI-2015-review.html&text=Vietnam+PMI+-+2015+review","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Economics-Vietnam-PMI-2015-review.html","enabled":true},{"name":"email","url":"?subject=Vietnam PMI - 2015 review&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Economics-Vietnam-PMI-2015-review.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+PMI+-+2015+review http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Economics-Vietnam-PMI-2015-review.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}