Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 05, 2017

Australia PMI surveys signal growth pick-up in November, led by manufacturing

The Australian economy picked up momentum in the middle of the fourth quarter, led by rising manufacturing activity, according to Commonwealth Bank PMI surveys. The latest survey results help to allay concerns about the recent growth slowdown.

Manufacturing-led growth

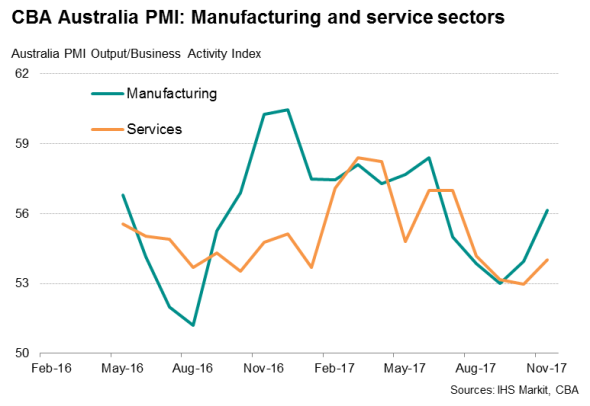

After adjusting for seasonality, the Commonwealth Bank of Australia Composite PMI Output Index (which covers both manufacturing and services), compiled by IHS Markit, rose from 53.1 in October to a four-month high of 54.3 in November. While the manufacturing and service sectors both recorded stronger growth of activity during the month, it was the former that led the latest upturn.

Manufacturing output rose to the greatest extent since June, driven higher by a sharp increase in new orders. Perhaps more important was the growth in the labour market, with the rate of job creation in the sector the fastest since survey data were first collected in May 2016. Backlogs of work nevertheless continued to rise, showing signs that operating capacity remained stretched despite an expanding workforce.

Similarly, the service sector exhibited robust growth, with business activity, new orders and employment all rising at increased rates.

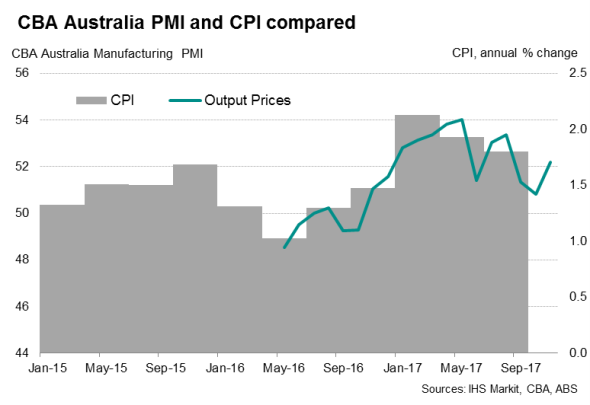

Although there was further relief on the inflation front, with input price inflation easing further from July's peak, cost increases remained sharp. Higher costs commonly reflected rising global commodity prices, especially for oil and metals. There were also reports that China's crackdown on pollution had led to supply shortages, resulting in higher prices of certain raw materials.

Australian service providers meanwhile also frequently reported higher labour costs, supporting the Reserve Bank of Australia's view that a tighter labour market will eventually feed through to higher wage pressures.

In response to firm upward pressure on costs, average prices charged for goods and services rose solidly, with the inflation rate above the average seen so far this year.

Positive outlook

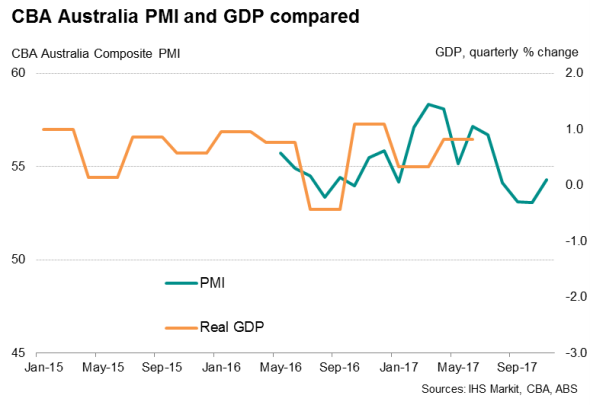

>Official statistics showed the economy expanding 0.8% in the second quarter, up from the 0.3% rise seen in the opening three months of 2017, corroborating the PMI surveys. However, the third quarter average composite PMI reading came in at 54.7, noticeably lower than the 56.8 seen in the second quarter, and therefore points to slower economic growth in the three months to September. A further slowing is also on the cards for the fourth quarter, given PMI readings so far.

The good news is that business confidence remains elevated, suggesting that growth should continue to run at a steady pace into 2018. Business expectations about future output remained high across both manufacturing and service sectors.

The latest manufacturing sector survey found that almost 65% of survey respondents are anticipating higher output over the coming year. Organic business growth, new marketing campaigns and increased customer acquisitions are all expected to bolster activity.

Similarly, around two-thirds of services survey panellists are forecasting growth in the coming year. Respondents widely expect organic growth, increased marketing and higher demand in coming months.

Global ranking

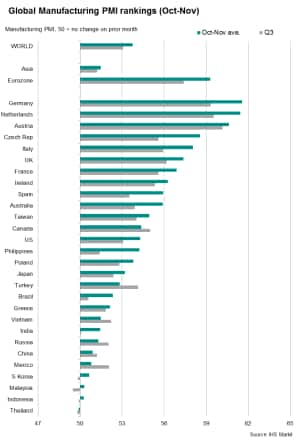

So far in the fourth quarter, there has been a noticeable improvement in the performance of the Commonwealth Bank PMI for manufacturing compared to the previous three months. Australia has moved up from twelfth position to tenth of all countries covered by the manufacturing PMI surveys. The robust performance makes Australia the strongest performing manufacturing economy in Asia Pacific.

With an average of 55.9 over October and November, the Australian manufacturing sector has so far also outperformed the global manufacturing PMI, surpassed only by European economies.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Australia-PMI-surveys-signal-growth-pick-up-in-November-led-by-manufacturing.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Australia-PMI-surveys-signal-growth-pick-up-in-November-led-by-manufacturing.html&text=Australia+PMI+surveys+signal+growth+pick-up+in+November%2c+led+by+manufacturing","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Australia-PMI-surveys-signal-growth-pick-up-in-November-led-by-manufacturing.html","enabled":true},{"name":"email","url":"?subject=Australia PMI surveys signal growth pick-up in November, led by manufacturing&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Australia-PMI-surveys-signal-growth-pick-up-in-November-led-by-manufacturing.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Australia+PMI+surveys+signal+growth+pick-up+in+November%2c+led+by+manufacturing http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05122017-Economics-Australia-PMI-surveys-signal-growth-pick-up-in-November-led-by-manufacturing.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}