Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 05, 2015

UK economy grows at slowest rate for 2" years as weakness spreads to services

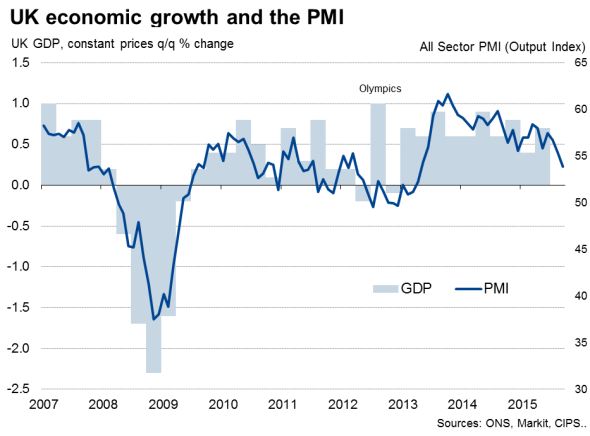

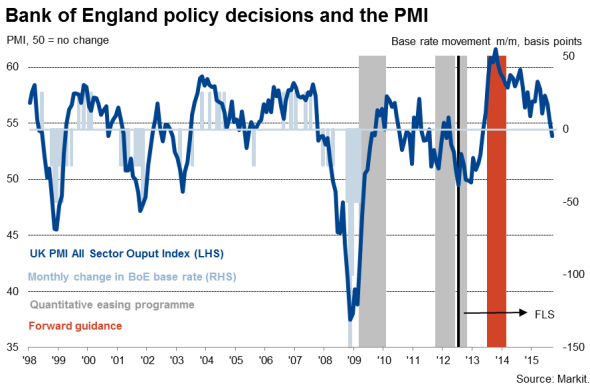

The rate of UK economic growth slowed to a two-and-a-half year low in September, according to PMI survey data, suggesting that the economy sank further into a soft patch at the end of the third quarter.

The survey data suggest that GDP growth slowed to 0.5% in the third quarter, but that the economy is entering the fourth quarter at a pace down to just 0.3%.

At the moment, sustained strong hiring in services and construction suggests that companies are generally expecting weakness to be short-lived, but this could soon change unless demand shows signs of reviving.

Growth at 2" year low

The all-sector Markit/CIPS PMI fell from 55.4 in August to 53.9, its lowest since April 2013, to signal an easing in the pace of growth for a third straight month.

The September reading rounds of the worst spell of growth since the second quarter of 2013, with the surveys indicative of GDP growth waning from 0.7% in the second quarter to 0.5% in the third quarter. However, growth clearly eased during the quarter, with the survey data indicating that the quarterly rate of growth eased to a mere 0.3% in September compared to 0.7% in July.

Business activity by sector

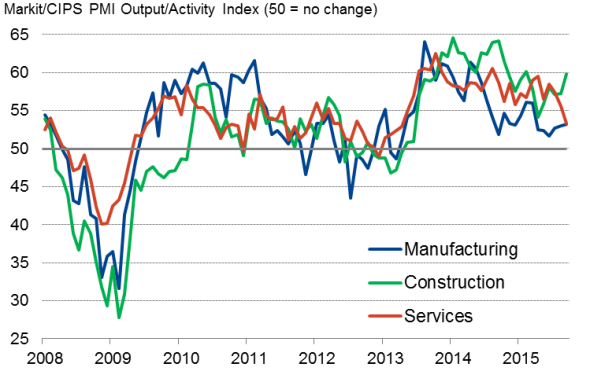

Slowdown spreads beyond manufacturing

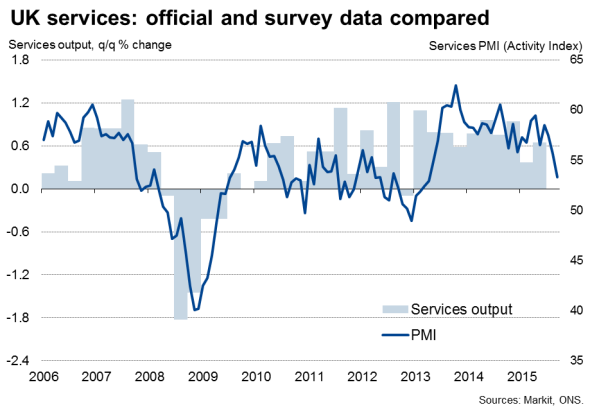

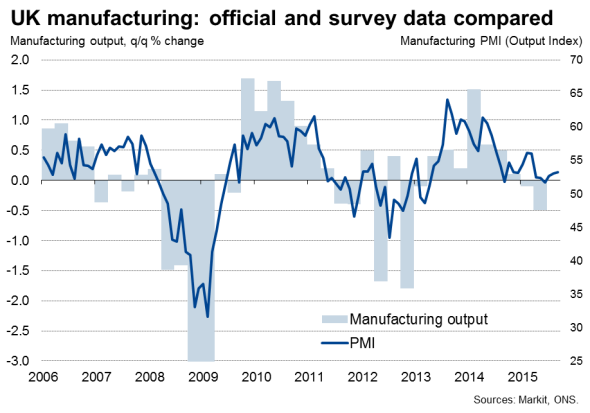

Persistent weakness of the manufacturing sector has increasingly spread to the far larger services economy in recent months, hitting transport and other industrial-related services in particular. However, there are also signs that consumers have become more cautious and are pulling back on their leisure spending, such as restaurants and hotels. Wider business service sector confidence has meanwhile also been knocked by global economic worries and financial market jitters.

The service sector consequently reported the slowest growth of both business activity and inflows of new business for 29 months in September. Business confidence in the service sector also dropped to the lowest for just over a year. Manufacturers have also suffered a marked deterioration in growth of demand from consumers in particular in recent months, joining sluggish demand for investment goods such as plant and machinery amid still-weak capital expenditures by businesses.

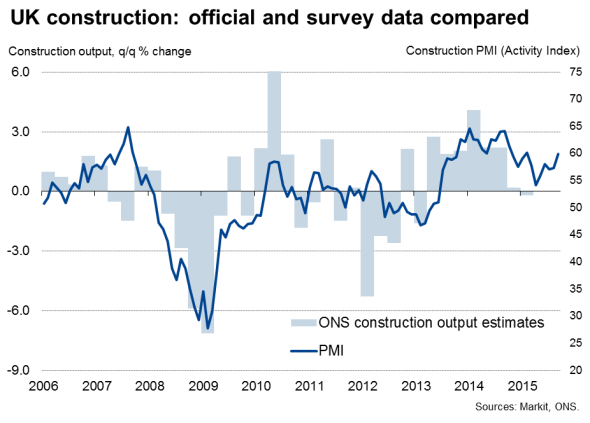

Slower growth of manufacturing and services has left construction as the fastest-growing part of the economy, although even here inflows of new business grew at the second-slowest rate since mid-2013.

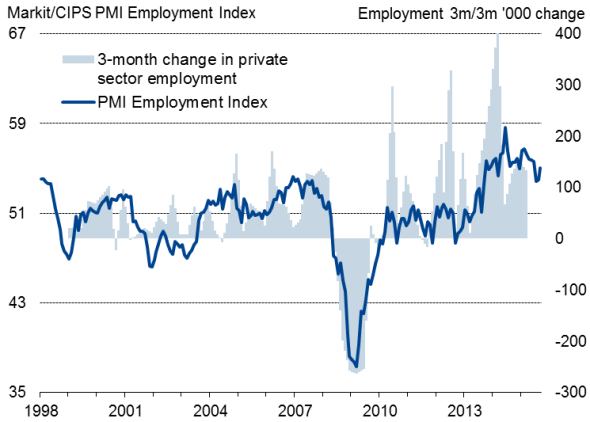

Solid hiring trend, for now

Although the pace of economic growth slowed in September, firms continued to take on staff at an impressive rate. September saw the fastest increase in employment for three months, as a pick-up in hiring in services and construction more than offset the first (marginal) decline in factory jobs for two-and-a-half years.

Employment

At the moment, the sustained strong hiring in services and construction therefore suggests that companies are generally expecting the slowdown to be short-lived. But with the three PMI surveys collectively recording the weakest inflows of new business for two-and-a-half years, there's a strong likelihood that the slowdown could intensify in coming months.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-Economics-UK-economy-grows-at-slowest-rate-for-2-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-Economics-UK-economy-grows-at-slowest-rate-for-2-years-as-weakness-spreads-to-services.html&text=UK+economy+grows+at+slowest+rate+for+2%22+years+as+weakness+spreads+to+services","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-Economics-UK-economy-grows-at-slowest-rate-for-2-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"email","url":"?subject=UK economy grows at slowest rate for 2" years as weakness spreads to services&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-Economics-UK-economy-grows-at-slowest-rate-for-2-years-as-weakness-spreads-to-services.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economy+grows+at+slowest+rate+for+2%22+years+as+weakness+spreads+to+services http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05102015-Economics-UK-economy-grows-at-slowest-rate-for-2-years-as-weakness-spreads-to-services.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}