Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2017

Eurozone PMI signals steady growth in August, boding well for robust third quarter

The latest survey data reveal how the summer months have seen eurozone economic growth moderate only slightly from the rapid pace seen in the spring.

Economy on course for best year since 2007

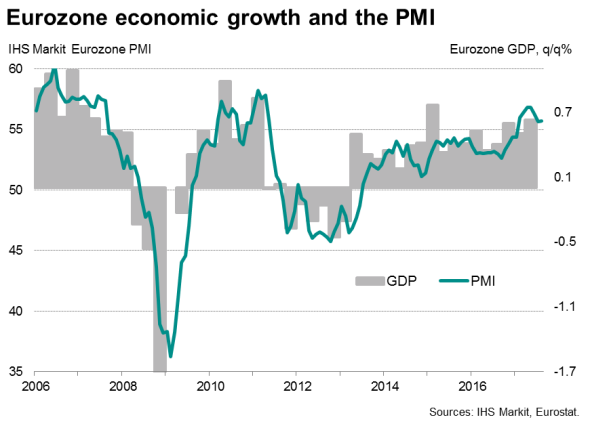

The headline IHS Markit Eurozone PMI held steady at 55.7 in August, down from an average of 56.6 in the second quarter but setting the scene for another strong GDP number. So far in the third quarter, the PMI is running at a level historically consistent with 0.6% growth (the surveys had indicated 0.7% in the second quarter, slightly above the current official estimate of 0.6%).

With such robust growth being sustained into August, the region is on course to see GDP rise by 2.1% in 2017, which would represent the best performance since 2007.

Although service sector growth eased in August to the lowest since January, manufacturing growth revived to one of the fastest seen over the past six years.

The survey also provided good reason to be optimistic that the current growth spurt has further to run. Although forward-looking indicators such as new order inflows and future expectations dipped to levels seen back at the turn of the year, these indices remain sufficiently elevated to suggest that any potential slowdown in growth in coming months will be only very modest.

Stronger labour market

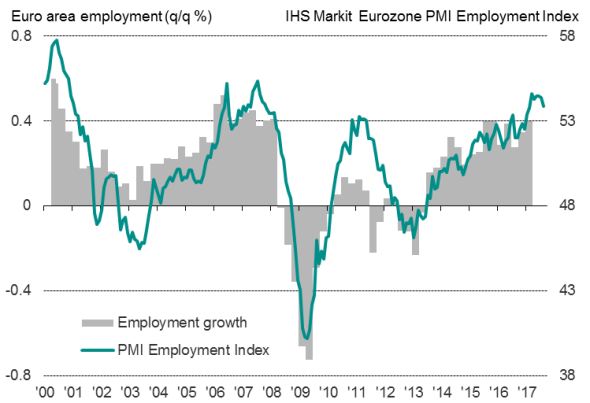

The August PMI results also showed that employment growth has likewise cooled but remains among the best seen over the past decade, suggesting eurozone unemployment will continue to edge lower, helping support consumer confidence and spending.

Eurozone employment

Sources: IHS Markit, Eurostat.

Upturn in price pressures

The survey data also highlight how price pressures have meanwhile edged higher alongside the strong economic upturn. Rates of increase in output charges and input costs both hit three-month highs, albeit remaining below peaks seen earlier in the year

The sustained strong expansion and renewed upward price pressures will add to the perception that the ECB will soon announce its intention to taper its stimulus in 2018 if conditions remain supportive, most likely at its October policy meeting.

Broad-based growth in big-four nations

By country, similar robust rates of expansion were seen in all big-four euro nations, albeit with only Germany recording faster growth in August. Seven month lows were seen in France and Spain. Third quarter GDP growth of approximately 0.4-5% is being signaled for Germany, France and Italy, while Spain's PMI is running at a level historically consistent with growth of 0.7-8%.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-Eurozone-PMI-signals-steady-growth-in-August-boding-well-for-robust-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-Eurozone-PMI-signals-steady-growth-in-August-boding-well-for-robust-third-quarter.html&text=Eurozone+PMI+signals+steady+growth+in+August%2c+boding+well+for+robust+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-Eurozone-PMI-signals-steady-growth-in-August-boding-well-for-robust-third-quarter.html","enabled":true},{"name":"email","url":"?subject=Eurozone PMI signals steady growth in August, boding well for robust third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-Eurozone-PMI-signals-steady-growth-in-August-boding-well-for-robust-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+PMI+signals+steady+growth+in+August%2c+boding+well+for+robust+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-Eurozone-PMI-signals-steady-growth-in-August-boding-well-for-robust-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}