Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 05, 2017

China PMI shows growth momentum gathering pace in third quarter

China's economy kicked up to a higher gear in August, setting the stage for a stronger GDP expansion in the third quarter. However, employment gains remained out of reach despite increased capacity strains.

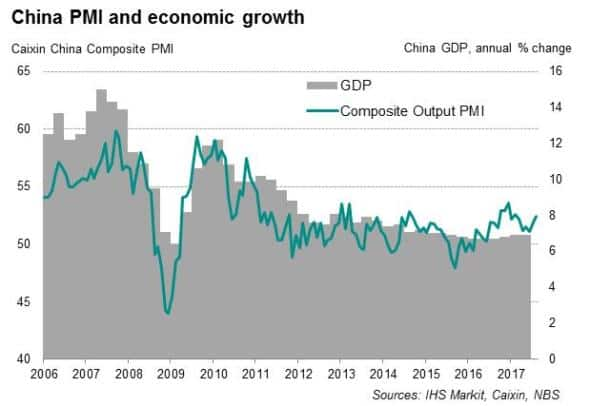

The Caixin China Composite PMI Output Index rose to 52.4 (a six-month high) in August ? and picked up momentum for a second consecutive month. The latest upturn, which has now stretched to 18 months, was supported by rising demand. Volumes of new business rose at the joint-strongest pace seen so far this year, leading to a further increase in backlogs of work, especially in the manufacturing sector.

The strength of China's performance in the second quarter prompted a number of analysts, including IHS Markit, to upgrade their GDP forecasts for 2017. IHS Markit raised China's GDP projection from an annual rate of 6.6% to 6.8% for this year, in line with what the latest PMI data are showing. The on-going robust survey data for August underscore this improved outlook.

Broad-based upturn

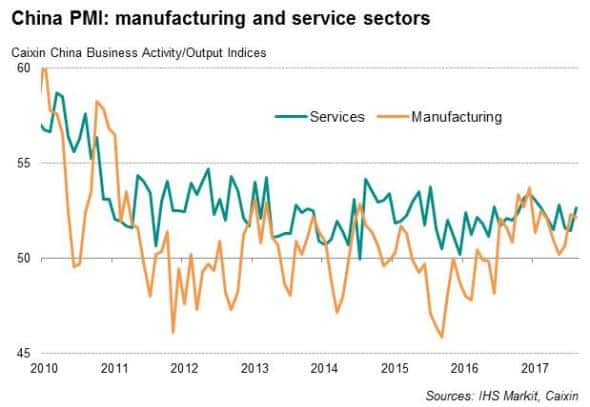

The latest survey data signalled a broad-based improvement in the economy, with manufacturing and services activity growing at similar speeds. A pickup in new sales for both sectors, but particularly in manufacturing, pointed towards further growth in the economy over the coming months. Business confidence also remained positive.

Notably, forward-looking indicators suggest that the manufacturing upturn has further room to run. The increase in client demand continued to outpace the rise in production, leading to another drawdown in stocks of finished products, suggesting that future output needs to be raised to replenish inventories.

To prepare for higher future production, Chinese factories stepped up purchasing activity at the quickest pace in over three years, which in turn led to a further increase in pre-production stock levels.

Employment

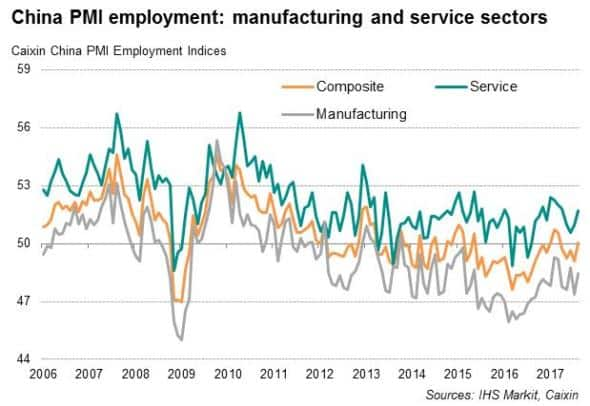

Increased output failed to encourage a net increase in staffing levels, but a stagnation of overall employment at least represented an improvement on the declines seen in the prior four months. Furthermore, growth in service-sector jobs increased at the fastest rate since April ? and was sufficient to offset the loss of manufacturing employment. Looking ahead, the hope is that Chinese manufacturers may well boost labour capacity to meet increased demand.

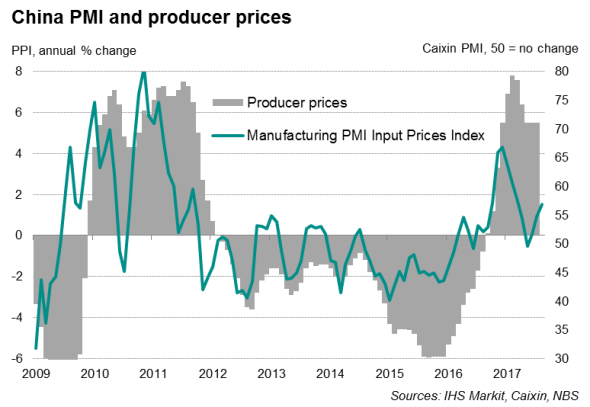

Rising factory output prices contrast with falling service sector charges

One concern is that the on-going squeeze on profit margins remained an obstacle to hiring in the manufacturing sector. Input cost inflation picked up in August to a level not seen since March, linked to rising costs for raw materials, which in turn pushed factories to raise selling prices. Average factory gate charges were increased at the quickest rate so far this year.

Service sector charges, in contrast, fell slightly for the first time since March of last year, largely in response to the need for firms to offer discounts in the face of sluggish demand.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-China-PMI-shows-growth-momentum-gathering-pace-in-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-China-PMI-shows-growth-momentum-gathering-pace-in-third-quarter.html&text=China+PMI+shows+growth+momentum+gathering+pace+in+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-China-PMI-shows-growth-momentum-gathering-pace-in-third-quarter.html","enabled":true},{"name":"email","url":"?subject=China PMI shows growth momentum gathering pace in third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-China-PMI-shows-growth-momentum-gathering-pace-in-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+shows+growth+momentum+gathering+pace+in+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092017-Economics-China-PMI-shows-growth-momentum-gathering-pace-in-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}