Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2017

UK PMI surveys signal weaker growth and lower optimism at end of Q2

Business activity in the UK grew at its weakest pace for four months in June, with slower rates of expansion seen across three major sectors of the economy. Business optimism meanwhile slumped amid heightened political uncertainty.

The all-sector IHS Markit/CIPS PMI fell from 54.5 in May to 53.9 in June, down for a second successive month to its lowest since February.

The weakest rate of growth was seen in the service sector, where output showed the second-smallest increase in the past nine months. Weaker consumer spending continued to be a major factor behind the slowdown. Over the second quarter as a whole, the worst performing service sectors were hotels, restaurants and other consumer-facing businesses. In contrast, business services, financial intermediation and computing and IT continued to show robust growth over the second quarter.

Construction activity growth meanwhile pulled back from May's 17-month high and manufacturers failed to match the strong gains in production seen in the prior two months.

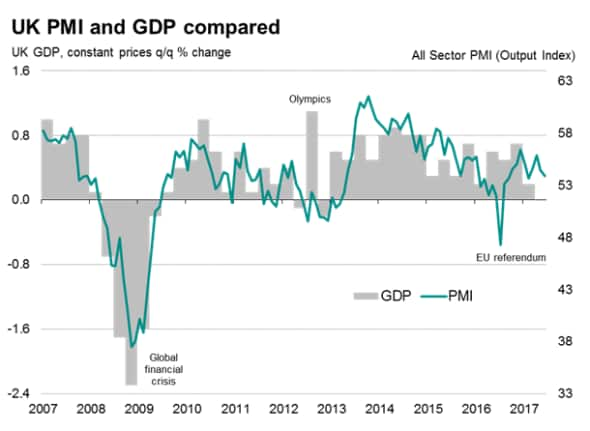

However, despite the slowdown in June, the surveys have signalled a relatively solid second quarter as a whole. Thanks to a strong April reading, the all-sector PMI is running at a level historically consistent with 0.45% GDP growth in the second quarter, albeit with a rate of 0.35% signalled in June alone.

Hiring meanwhile remained robust, with the rate of new jobs being added continuing to run at the fastest rate for around one-and-a-half years. Such solid hiring suggests that companies remained in expansion mode on average, albeit with slower rates of job creation seen in manufacturing and construction.

Darker outlook

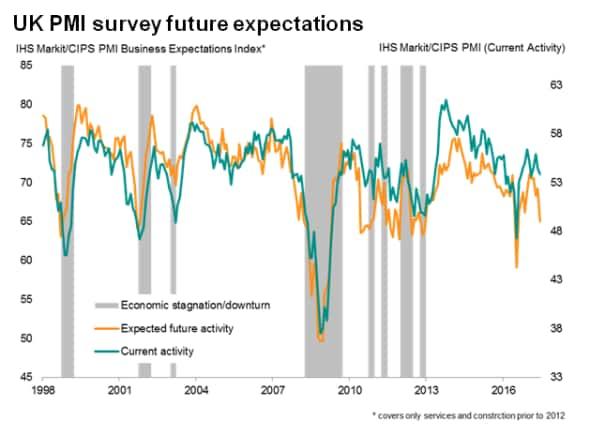

The relative resilience of the survey data in the second quarter provides welcome news on the economy, but the survey also points to risks of further weakness ahead. Most notably, business confidence about the next 12 months suffered one of the biggest one-month falls on record. With the exception of the slide seen immediately after the EU referendum, the latest reading was the lowest since December 2012.

Optimism about the outlook deteriorated in all three sectors, though was weakest sentiment was seen in the service sector.

Companies' concerns included heightened political uncertainty since the general election (the survey data were collected after the election, in which the government lost its working majority), and in particular the difficulties the government may now face in Brexit negotiations, as well as worries about household finances being squeezed from rising prices.

In a further sign of weakness ahead, inflows of new orders also slowed across all three sectors, resulting in the smallest overall rise for nine months.

Selling price inflation cools

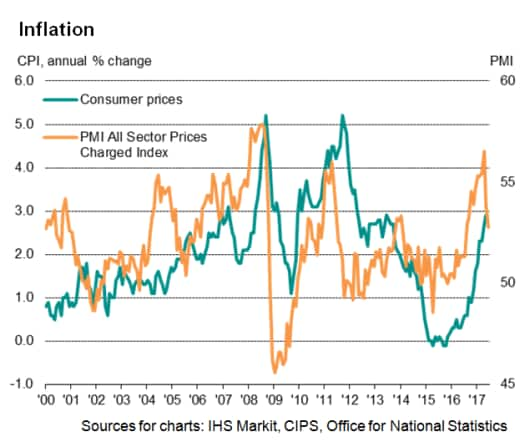

There were mixed messages as far as inflation is concerned. Input cost inflation edged higher, but remained below levels seen earlier in the year. Manufacturing input cost inflation has eased especially markedly, mainly reflecting lower global commodity prices (notably oil), though service sector and construction cost inflation picked up in June, in part reflecting supply exceeding demand or rising wages.

Although costs continued to rise at an historically marked pace, the waning of cost pressures since earlier in the year has meant the overall rate of increase of average prices charged for goods and services fell to the lowest since last July, easing especially in the service sector.

Policy tensions

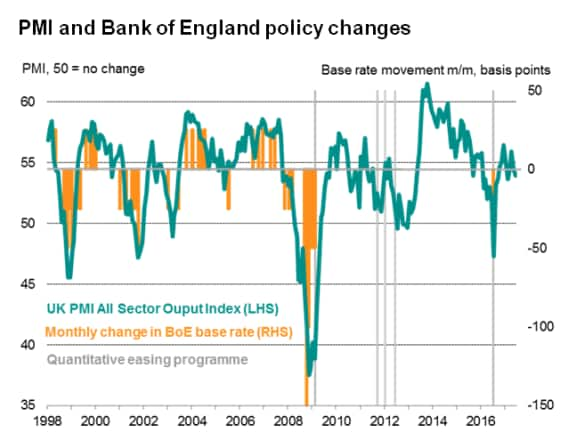

The survey results come at a time of increasingly divergent views among Bank of England policymakers on the appropriate course for interest rates.

The solid second quarter growth signalled by the PMI surveys arguably lends weight to the hawks, in that the economy has continued to show surprising resilience since the Brexit vote one year ago.

However, business optimism has clearly been hit by the intensification of political uncertainty following the election and commencement of Brexit negotiations, at the same time that households are battling against rising inflation, the indications are that the economy's resilience is being tested.

With the PMI losing momentum, the surveys indicate that business spending, investment and exports are not providing sufficient growth to fully offset the consumer slowdown.

The MPC has never hiked interest rates when the most recent all-sector PMI reading has been below 54.3 (as was the case in 1998, after which much higher thresholds have needed to be breached before tightening policy). It would therefore be a surprise to see policymakers vote for a rate increase given the PMI's current reading of 53.9.

More information on the business outlook will be available with the publication of the tri-annual Outlook Survey on 17th July.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-Economics-UK-PMI-surveys-signal-weaker-growth-and-lower-optimism-at-end-of-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-Economics-UK-PMI-surveys-signal-weaker-growth-and-lower-optimism-at-end-of-Q2.html&text=UK+PMI+surveys+signal+weaker+growth+and+lower+optimism+at+end+of+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-Economics-UK-PMI-surveys-signal-weaker-growth-and-lower-optimism-at-end-of-Q2.html","enabled":true},{"name":"email","url":"?subject=UK PMI surveys signal weaker growth and lower optimism at end of Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-Economics-UK-PMI-surveys-signal-weaker-growth-and-lower-optimism-at-end-of-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+surveys+signal+weaker+growth+and+lower+optimism+at+end+of+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-Economics-UK-PMI-surveys-signal-weaker-growth-and-lower-optimism-at-end-of-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}