Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2016

Global economy sees weakest quarter since 2012

Global economic growth failed to pick up from the sluggish pace seen in May, indicating that the world remains mired in the worst growth phase for three-and-a-half years. Once again, the lack of any growth driver was evident: weak rates of expansion in the US and UK, linked in part to rising political uncertainty, a struggling recovery in the Eurozone and renewed downturn in Japan coincided with an ongoing near-stagnation of the emerging markets.

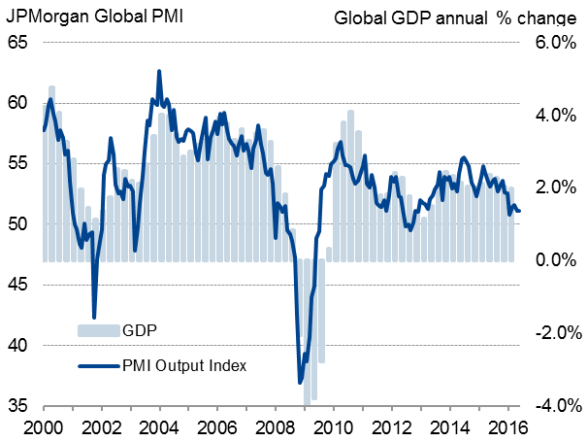

Global economic growth

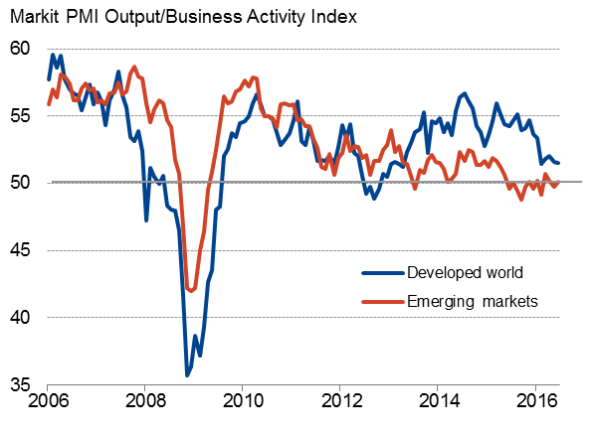

Developed v emerging markets

Second-weakest expansion in 3" years

The JPMorgan Global PMI, compiled by Markit from its worldwide business surveys, held steady at 51.1 in June, rounding off the weakest quarter since the fourth quarter of 2012.

The data point to global GDP (at market prices) rising at an annual rate of just 1.5%, below the long run average of 2.3% and signalling the weakest growth spell since the first half of 2013.

Emerging markets remained in an overall state of stagnation, continuing the trend seen over much of the past year. The emerging market-weighted PMI merely edged up from 49.8 in May to 50.1 in June.

Developed world growth meanwhile slipped to the second-lowest in just over three years, maintaining sluggish growth that has been evident since the down-shifting of gear back in February. The developed world PMI fell from 51.6 in May to 51.5.

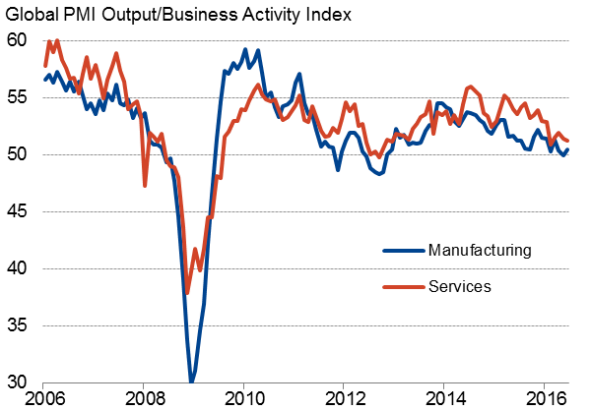

The malaise was broad-based, with both manufacturing and services recording only modest growth rates in June. Services remained the stronger-growing sector, albeit by only a small margin, with the pace of expansion much reduced compared to that seen at the start of the year.

Manufacturing v services

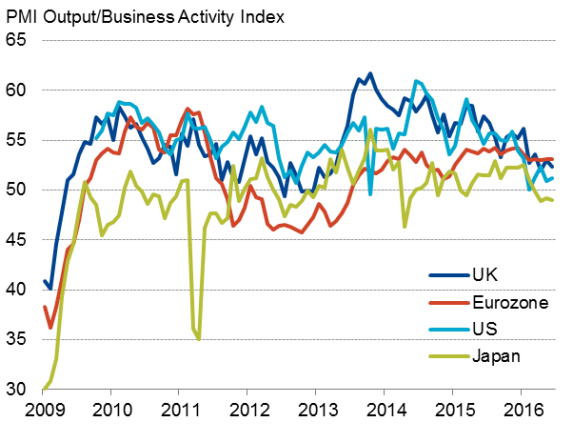

Eurozone leads developed world

Of the four largest developed world economies, the Eurozone held on to the top spot in the PMI growth rankings, albeit by a slim margin, fuelled in particular by faster manufacturing growth. Producers continued to benefit from the weak euro as well as sluggish but ongoing improvements in domestic demand, the latter also helping drive further service sector growth. The surveys are signalling just 0.3% GDP growth, however.

The UK also continued to expand, though much of the June data were collected prior to the country's referendum vote to leave the EU. Uncertainty regarding the referendum had already been a major factor bringing the PMIs down to a level that signals just 0.2% GDP growth in the second quarter, and the intensification of uncertainty after the vote, including the political upheaval, suggests there is a strong risk of the economy deteriorating in coming months.

Growth also remained disappointingly weak in the US compared to that seen at the turn of the year, with Markit's flash PMIs suggesting that the US economy continued to grow at an annualised pace of just less than 1% again in the second quarter. This represents the weakest extended period of growth seen in the US since the 2009 financial crisis, with businesses struggling amid weak global demand, the energy sector downturn, the strong dollar and uncertainty caused by the upcoming presidential elections.

Japan remained the worst-performing of the major developed economies - the Nikkei PMI surveys indicate one of the worst periods of growth seen over the past four years. The surveys point to a strong risk that the economy has slipped back into contraction in the second quarter as manufacturing has been hamstrung by the appreciation of the yen and services growth has failed to gain momentum.

Mixed news in emerging markets

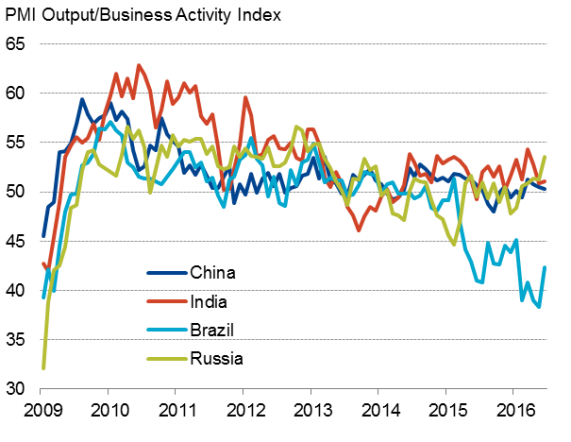

The overall stagnation signalled across the emerging world masked marked variations by country.

The best news was seen in Russia, where the PMIs signalled the fastest rate of economic growth since February 2013, buoyed by expansion in both manufacturing and services. The improvement in the survey data suggests that Russia is pulling out of the energy-related slowdown and questions widespread expectations of ongoing recession.

There was also better news out of Brazil, where the PMIs signalled an easing in the rate of decline to the slowest since January. That said, Brazil clearly remains the worst performing of the four 'BRIC' economies.

The Nikkei PMIs for India picked up signs of faster growth in manufacturing, but also suffered a slowdown in service sector growth, leaving the overall pace of economic expansion stubbornly subdued.

Similarly, in China the Caixin PMI pointed to overall ongoing malaise in June. The bright spot was services, which reported the strongest upturn for 11 months, but that was offset by the steepest fall in manufacturing output since February. While the divergence in the two sectors points to a rebalancing of the economy towards services, the headline rate of growth eased to the weakest in four months and signalled a near-stagnation of overall business activity.

Major developed markets*

*uses Flash US PMI for June

Major emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-economics-global-economy-sees-weakest-quarter-since-2012.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-economics-global-economy-sees-weakest-quarter-since-2012.html&text=Global+economy+sees+weakest+quarter+since+2012","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-economics-global-economy-sees-weakest-quarter-since-2012.html","enabled":true},{"name":"email","url":"?subject=Global economy sees weakest quarter since 2012&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-economics-global-economy-sees-weakest-quarter-since-2012.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+economy+sees+weakest+quarter+since+2012 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-economics-global-economy-sees-weakest-quarter-since-2012.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}