Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 05, 2016

UK PMI signals near-stalling of economy in June

The PMI surveys indicate that the pace of UK economic growth slowed to just 0.2% in the second quarter, losing further momentum in June as Brexit anxiety intensified.

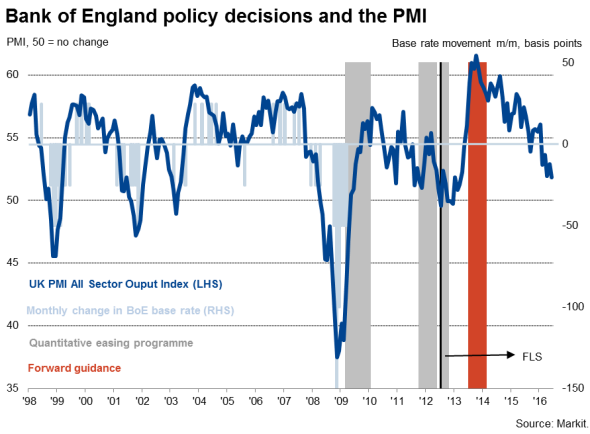

A further slowing, and possible contraction, looks highly likely in coming months as a result of the uncertainty created by the EU referendum. However, with the June PMIs having already fallen into territory that would normally be associated with the Bank of England cutting interest rates, it's unlikely that policymakers will feel the need to wait for more data before unleashing additional monetary stimulus. More policy action is therefore likely following the Monetary Policy Committee's next assessment of the economy on July 14th.

Economic growth slowed to 0.2% in Q2

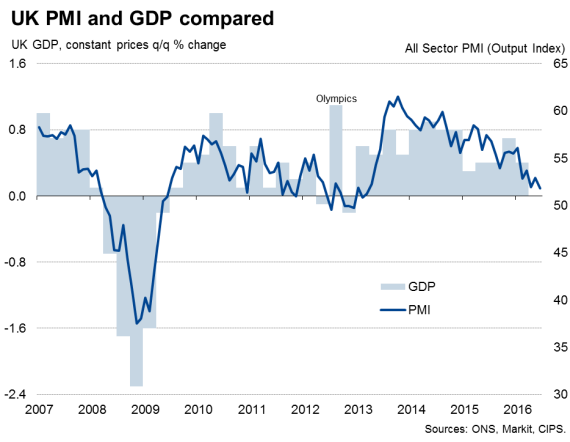

At 51.8, down from 52.9 in May, the weighted average output index from the three Markit/CIPS PMI surveys for June was the lowest since March 2013, coming in just below April's reading of 51.9.

The second quarter average of 52.2 was down from 54.2 in the first quarter and signals an easing in the rate of GDP growth from 0.4% to 0.2% between the first and second quarters. That would be the weakest pace of economic growth since the fourth quarter of 2012.

Companies reported that uncertainty created by the UK's EU referendum had often led to cancelled or postponed orders from clients in recent months, exacerbating existing worries about slowing economic growth at home and abroad and causing inflows of new work to run far lower than earlier in the year.

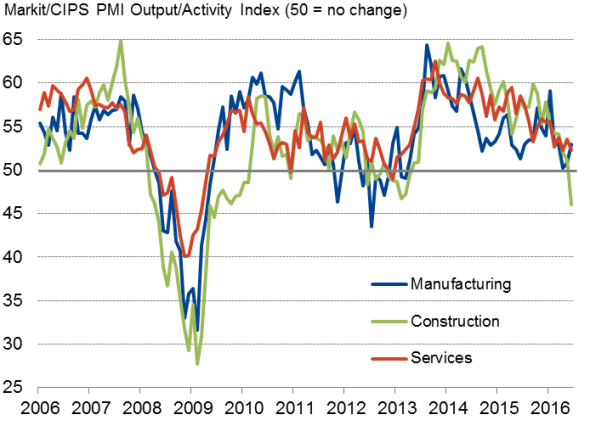

Construction hit hardest

The downturn was especially marked in the construction sector , where activity fell at the fastest rate since June 2009, led lower by steep drops in both house building and commercial construction. The building sector has seen growth weaken steadily since the start of the year, but June's fall in activity was the first recorded since 2013.

Service sector growth also waned as uncertainty spiked higher. The expansion was the joint-weakest since February 2013, and a slump in optimism about the year ahead to its lowest since December 2012 suggests the pace could weaken further as we move into the third quarter.

Manufacturing bucked the trend, reporting a surprise pre-referendum upturn in the rate of growth of output on the back of a surge in new orders, helped in turn by renewed growth of exports. However, anecdotal evidence from the survey found producers reporting higher levels of uncertainty about the outlook amid concerns about the potential impact of Brexit.

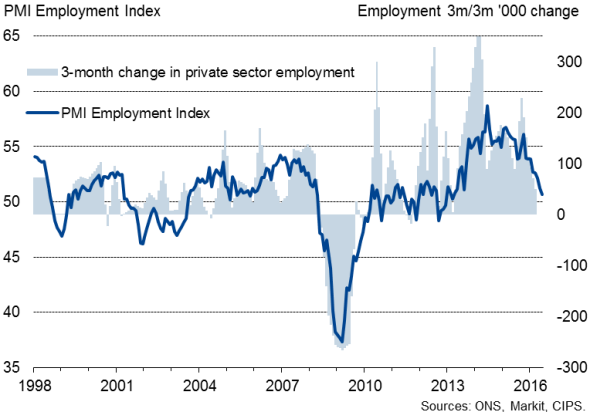

Jobs growth weakest for over three years

Employment was also hit by rising uncertainty, with the rate of net job creation dropping to the lowest since March 2013. A steepening rate of factory job losses was accompanied by weaker employment growth in both the construction and service sectors, the latter down to a near-three year low.

Employment

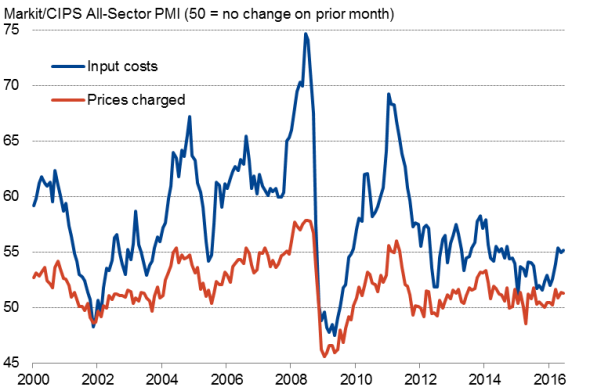

Higher input costs - a reflection of rising oil and fuel prices alongside wage pressures, in turn linked in many cases to the Living Wage - meanwhile fed through to another modest increase in average prices charged for goods and services. However, weak demand meant the overall rate of inflation remained only modest.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-Economics-UK-PMI-signals-near-stalling-of-economy-in-June.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-Economics-UK-PMI-signals-near-stalling-of-economy-in-June.html&text=UK+PMI+signals+near-stalling+of+economy+in+June","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-Economics-UK-PMI-signals-near-stalling-of-economy-in-June.html","enabled":true},{"name":"email","url":"?subject=UK PMI signals near-stalling of economy in June&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-Economics-UK-PMI-signals-near-stalling-of-economy-in-June.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+signals+near-stalling+of+economy+in+June http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072016-Economics-UK-PMI-signals-near-stalling-of-economy-in-June.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}