Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2017

Singapore PMI surveys hint at manufacturing led slowdown in Q2

The Singaporean economy started the year on a firm footing, with recent official data confirming the robust survey evidence. However, there's a strong chance that growth will lose a little momentum in the second quarter, as the very latest Nikkei PMI survey suggested further strains on the manufacturing sector.

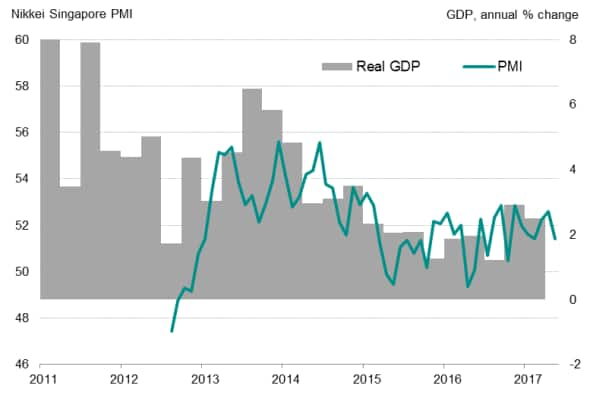

Historical comparison of the PMI against GDP indicate that the whole economy PMI is running at a level broadly consistent with the economy growing at 2.3% in the second quarter.

Singapore PMI and GDP

Good start to 2017

The final estimate of gross domestic product from the Ministry of Trade and Industry showed the economy growing 2.7% in the first quarter of the year, up from an advance estimate of 2.5% but declining from 2.9% at the end of last year.

By sector, manufacturing grew 8% and contributed the lion's share to economic growth in the first three months of the year, accounting for 52% of overall Q1 GDP growth. The recent upturn in the global electronics industry provided a boost to electronic manufacturers. The broader service sector, which is an important pillar of growth, expanded 1.6%.

Construction growth shrank by 1.4%, extending the 2.8% decline seen in the fourth quarter of 2016. That knocked 0.1% off overall GDP growth in the first quarter. Stronger growth in exports offset a softer expansion in domestic demand, with household spending and private investment contracting further in the quarter.

Cloudy outlook

There were mixed signals for the outlook. Optimism about the year ahead rose further in May but PMI survey data also indicated that the pace of economic growth lost some momentum in the middle of the second quarter, owing to a slowdown in output growth and new order inflows, including a markedly slower expansion in export orders.

Employment levels were broadly stagnant in May, after jobs growth was recorded for the past six months, with increased reports of staff layoffs at some firms.

A key concern is that Singapore's manufacturing sector remained under pressure. The latest survey showed new orders falling back into contraction in May, with new export sales declining at a faster rate. The trade deterioration could weigh on second quarter GDP, and may add to the government's concerns regarding external risks.

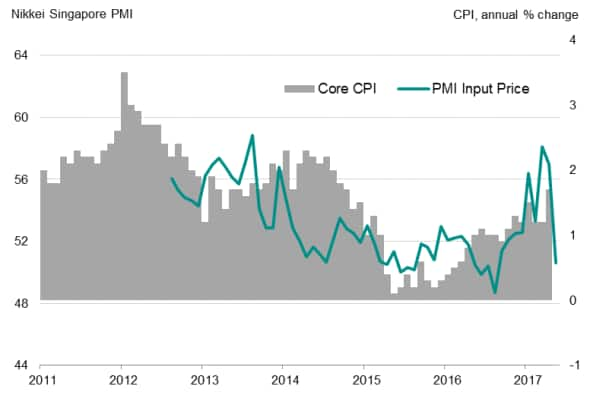

Easing inflation

One area that may be welcomed by firms was a significant pullback in input costs. The PMI survey's index of overall input costs indicated a sharp deceleration from recent peaks to register the weakest rise in costs since a decrease was reported last August. A combination of lower prices for inputs and slower

wage inflation led to the moderation in overall costs. This development is also in line with similar observations in regional economies.

The resulting reduced pressure on profit margins may prompt businesses to look favourably on hiring and investment plans.

Slowing inflation

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-singapore-pmi-surveys-hint-at-manufacturing-led-slowdown-in-q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-singapore-pmi-surveys-hint-at-manufacturing-led-slowdown-in-q2.html&text=Singapore+PMI+surveys+hint+at+manufacturing+led+slowdown+in+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-singapore-pmi-surveys-hint-at-manufacturing-led-slowdown-in-q2.html","enabled":true},{"name":"email","url":"?subject=Singapore PMI surveys hint at manufacturing led slowdown in Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-singapore-pmi-surveys-hint-at-manufacturing-led-slowdown-in-q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Singapore+PMI+surveys+hint+at+manufacturing+led+slowdown+in+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-singapore-pmi-surveys-hint-at-manufacturing-led-slowdown-in-q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}