Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2016

Week Ahead Economic Overview

Eurozone policy makers will keep an eye on industrial production numbers and updated first quarter GDP data for signs that the region's economy is reviving, while the Bank of England announces its latest monetary policy decision. Over in the US, retail sales figures will be the focus.

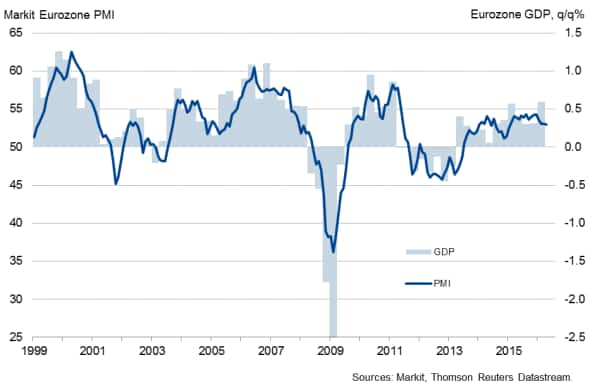

ECB policy makers must have felt some relief when Eurostat last week announced that the region's economy grew 0.6% in the first quarter, as markets were only expecting a 0.4% rise. Particularly strong growth was reported in Spain (+0.8%) and France (+0.5%). Updated numbers will be released on Friday (13 May) and will include more national detail, which could also lead to a revision to the surprisingly strong flash estimate.

Eurozone GDP and the PMI

The publication of industrial production figures will meanwhile provide insight into how the ECB stimulus and signs of increased bank lending are affecting goods producers. Official data from Eurostat pointed to a 0.8% decline in industrial output in February, but business survey data signalled subdued growth over the first quarter as a whole, with exporters still struggling to secure new business. Other important euro area publications include inflation updates in France, Germany and Spain and unemployment data in Greece.

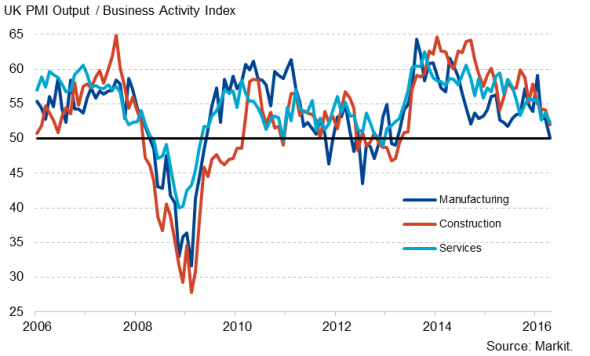

Over in the UK, signs are growing that the Bank of England may have to intervene at some point to revive the UK economy, after GDP growth slowed during the first quarter and PMI data pointed to a near-stalling at the start of the second quarter. Worryingly, an increasing number of companies reported that uncertainty about the EU referendum caused customers to hold back on purchases, exacerbating already-weak demand linked to global growth jitters and ongoing government spending cuts. However, it is widely expected that the Bank will leave interest rates at their current lows when policy makers meet on Thursday, choosing to wait until after the June 23rd referendum before deciding on any course of action.

UK PMI output/activity indexes

There are other notable releases in the UK during the week, including official updates on construction output, industrial production and international trade. Business survey data signalled a stagnation of manufacturing output and the weakest rise in construction activity (in part linked to a lack of momentum in residential building) for close to three years during April. Moreover, exporters have now been reporting falling levels of new work for four consecutive months, attributed partly to a weakening global economic environment.

In the US, latest retail sales numbers will provide analysts with more information on consumer spending trends in the world's largest economy and are likely to add to the policy debate at the Fed, after GDP disappointed in the first quarter. Retail sales unexpectedly fell during March, suggesting that consumers are holding back spending decisions despite a strong labour market and low inflation. That said, markets are currently pencilling in a 0.5% rebound in sales in April. If the data continue to disappoint, however, this would add to signs that the Fed will hold off on raising interest rates further during the summer.

Monday 9 May

The Japanese Cabinet Office releases consumer confidence numbers.

The latest Eurozone Sentix Index is published.

In Germany, industrial orders figures for March are out.

UK regional PMI results are published.

Canada sees the release of housing starts numbers.

Tuesday 10 May

Global sector PMI results are released

Consumer price data are published in China.

In South Africa, unemployment numbers are issued.

Industrial production data are updated in France, Greece and Germany, with the latter also seeing the release of trade figures.

The British Retail Consortium releases retail sales numbers in the UK, while The Office for National Statistics updates trade data. Moreover, the latest UK & English Regions and Scotland Reports on Jobs are published.

NFIB business optimism data are released alongside wholesale inventories numbers.

Wednesday 11 May

Mortgage lending data are released in Australia.

In Japan, the Cabinet Office issues its Leading Indicator.

India sees the publication of trade data.

UK industrial output numbers are released by the Office for National Statistics.

Retail sales figures are meanwhile issued in Brazil.

Mortgage application data are published in the US.

Thursday 12 May

Current account numbers are published in Japan.

Industrial output and inflation figures are meanwhile issued in India.

Russia sees the release of trade data.

Manufacturing and mining production numbers are out in South Africa.

Eurostat issues industrial output figures for the eurozone.

The Bank of England announces its latest monetary policy decision.

Consumer price numbers are released in France, while Greece sees the publication of unemployment data.

House price data are updated in Canada.

Initial jobless claim and import price figures are issued in the US.

Friday 13 May

First quarter GDP numbers will be updated in the eurozone.

Germany and Spain see the release of final consumer price data for April, while non-farm payroll figures are issued in France.

In the UK, construction output numbers are updated by the Office for National Statistics.

Retail sales and producer price figures are released in the US alongside the latest Reuters/Michigan Consumer Sentiment Index.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-economics-week-ahead-economic-overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-economics-week-ahead-economic-overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052016-economics-week-ahead-economic-overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}