Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 05, 2018

Week Ahead Economic Preview

US inflation and retail sales figures are in focus next week as analysts search for clues as to the timing of the next Fed rate hike. A host of data from China, including trade, credit growth and inflation, will meanwhile provide signals of underlying growth and price trends. Other key data highlights include UK industrial production and construction output.

The release of detailed global and regional sector PMI data by IHS Markit will offer more nuanced insights into recent economic trends.

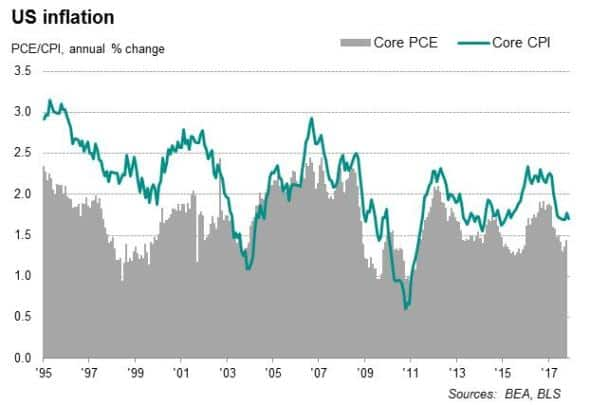

US inflation

US PMI surveys indicated that the economy ended 2017 in good shape. The combination of steady growth, a solid labour market and rising prices have added to expectations that the Fed will remain on track for another rate hike in the near future, with March looking likely. Markets are assigning a probability of over 60% to a March rate move (with incoming Fed chairperson Jerome Powell helming his first policy meeting).

On that note, official statistics on US inflation will provide further insights into price pressures, with market expectations of an annual rise of 1.8% for core inflation, slightly higher than November. A stronger number will add to expectations that the Fed will revise up its current projection of three rate rises this year. Other notable US data releases include retail sales and wholesale inventories.

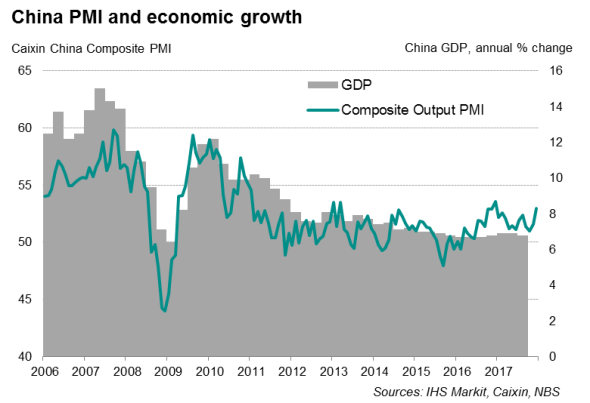

China data

China watchers will look out for a host of data for December published during the week, including trade, fixed asset investments, credit and monetary growth, ahead of official fourth-quarter GDP figures due on January 15. Caixin PMI surveys showed the Chinese economy ending 2017 on a strong note, marking its best year since 2010.

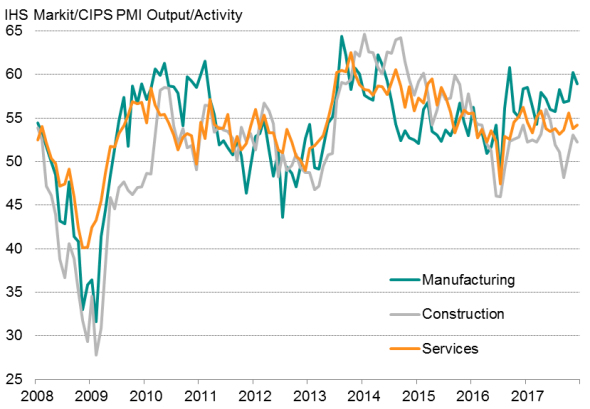

UK output indicators

In the UK, updates to industrial production and construction output will be watched for clues as to the health of the UK economy.

Market expectations are for industrial production to grow at an annual rate of 3.5%, close to that recorded in October and among the highest rates seen in recent years. This will be consistent with the UK PMI surveys, which indicated that solid export gains have recently helped boost the goods-producing sector.

In contrast, the predicted rebound in construction output from October's decline is expected to be a weak one, with markets looking at annual growth of 1.9%. Nevertheless, PMI survey evidence noted that improved house building activity provided a fillip to the construction sector in the final months of 2017, helping the sector stabilise from its recent downturn.

UK PMI: Output of the three main sectors

Sources: IHS Markit, CIPS

Download the full report for a full diary of key economic releases.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-Economics-Week-Ahead-Economic-Preview.html&text=Week+Ahead+Economic+Preview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-Economics-Week-Ahead-Economic-Preview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012018-Economics-Week-Ahead-Economic-Preview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}