Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 05, 2017

China PMI surveys point to best quarter for nearly six years

Chinese business conditions strengthened further at the end of 2016, thereby sustaining the solid upturn seen throughout the final quarter. However, although the stronger expansion helped to limit job cuts, the upturn was accompanied by a further sharp rise in commodity and raw material prices.

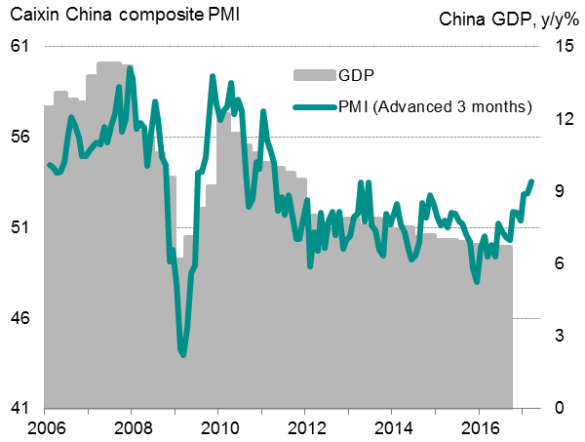

The Caixin China Composite PMI Output Index, compiled by Markit, rose from 52.9 in November to 53.5 in December, the joint-highest since the start of 2011. The latest reading signalled an acceleration in the pace of business activity growth. The average PMI reading for the past three months picked up to 53.1 from 51.7 in the third quarter. This was the strongest quarter in almost six years.

Caixin PMI v China GDP

Stronger expansions in both manufacturing and services lifted the composite reading in December. The back-story of weak manufacturing conditions amid ongoing economic restructuring has subsided, with manufacturing growth now broadly in line with that seen in the service sector.

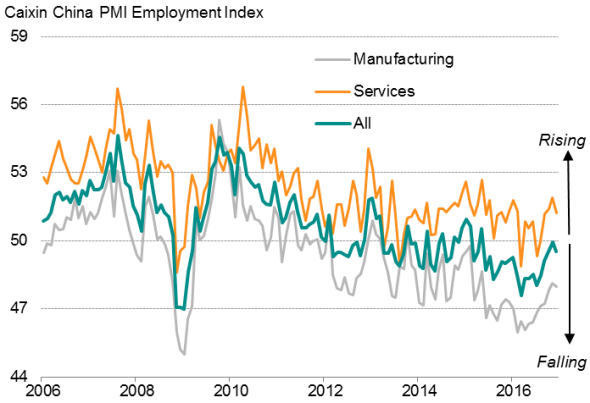

Employment close to stabilisation

The recovery in business conditions, particularly in the manufacturing sector, helped to further slow the rate of job shedding. While hiring in the service sector slowed marginally in December, and manufacturing jobs remained in decline, latest PMI employment indicators at least suggest a stabilising job market. Further expansions in activity and new business in 2017 could help reverse the current contraction in China's workforce in coming quarters.

Employment

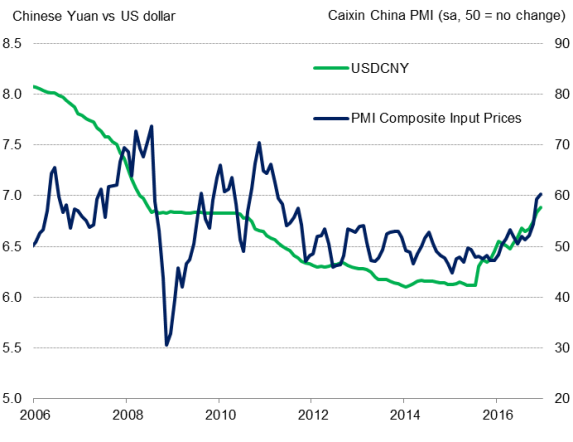

Surging prices

Prices for raw materials and commodities surged. A strong dollar has also exacerbated the costs of US$-denominated imports. Manufacturing input prices soared to the highest since March 2011. In contrast, cost inflation in the service sector remained comparatively muted despite picking up to the quickest in almost two years, in part reflecting the inclusion of wages in the services cost index (manufacturing just includes purchase prices).

Weaker CNY adds to inflation

Headwinds abound

The combination of improving client demand and shrinking manpower has meanwhile boosted productivity, especially in the manufacturing sector. For a government seeking to reduce excess capacity in the industrial economy, this is welcome news.

However, the shift towards a consumption-based economy appears to be far from done. Growth in the service sector, a proxy for domestic consumption, remained below its long-run series average. Moreover, modest job creation at service providers failed to offset the decline in manufacturing payrolls.

The upturn in business conditions amid signs of greater client demand is yet to be accompanied by stronger growth in private investment, suggesting that businesses remain cautious. Expectations of slowing support from fiscal and monetary policies, as well as uncertainties concerning global trade growth, are among the economic headwinds in China.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012017-Economics-China-PMI-surveys-point-to-best-quarter-for-nearly-six-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012017-Economics-China-PMI-surveys-point-to-best-quarter-for-nearly-six-years.html&text=China+PMI+surveys+point+to+best+quarter+for+nearly+six+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012017-Economics-China-PMI-surveys-point-to-best-quarter-for-nearly-six-years.html","enabled":true},{"name":"email","url":"?subject=China PMI surveys point to best quarter for nearly six years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012017-Economics-China-PMI-surveys-point-to-best-quarter-for-nearly-six-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+PMI+surveys+point+to+best+quarter+for+nearly+six+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012017-Economics-China-PMI-surveys-point-to-best-quarter-for-nearly-six-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}