Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 04, 2016

Week Ahead Economic Overview

The focus is on the US where the presidential campaigns of Hillary Clinton and Donald Trump come to an end, as the 45th President of the United States is elected. Although the outcome of the election is likely to dominate the markets, analysts will also be viewing some key economic data releases. Industrial production numbers are released across Europe and will provide information on latest industry trends, while retail sales numbers in the eurozone will give insight into how consumers are faring.

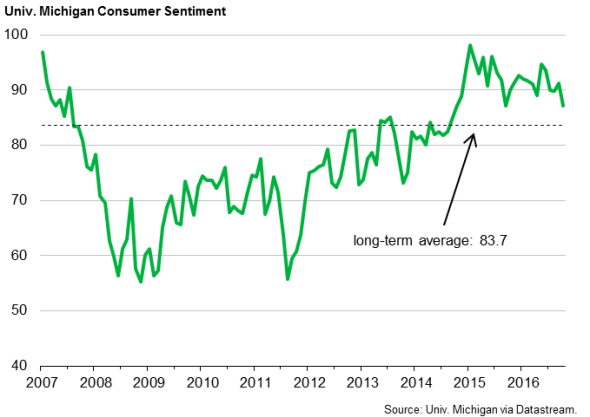

The outcome of the US presidential election has the potential to move markets around the world, and any disruption could thwart the Fed's growing appetite to raise interest rates further at its December meeting. Consumer sentiment and mortgage data are also likely to add to the policy debate. The University of Michigan Index fell to its lowest level in over a year in October, with some of the weakness linked to uncertainty around the upcoming presidential election.

US consumer sentiment

After the Bank of England left monetary policy unchanged and raised its UK economic growth forecast for 2016 to 2.2% (previously 2.0%) and for 2017 to 1.4% (previously 0.8%), eyes will now turn to the Office for National Statistics, which publishes construction, industrial output and trade data during the week. The releases will add important information to third quarter economic growth, after the preliminary estimate (which includes only roughly half of the final data) signalled GDP growth of 0.5%, and the economy's trajectory heading into the fourth quarter.

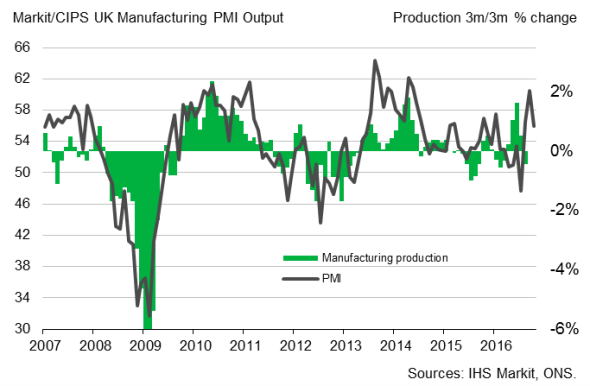

According to the ONS's first estimate, industrial production declined 0.4% over the third quarter as a whole, dragged down by a 1.0% relapse in manufacturing output, but the manufacturing PMI data signal a marked rebound in production volumes.

UK construction output data are also out and business survey results point to a recovery of the sector in September.

Meanwhile, the weak pound should be a boon to exporters as it makes UK produced goods and services cheaper elsewhere. Trade data, released by the ONS on Wednesday, will show the extent to which exporters were benefitting in September.

UK manufacturing production and the PMI

In the eurozone, retail sales and retail PMI data will provide data watchers with important information on consumer spending trends. Although an improving labour market and weak inflation (despite hitting a two-year high of 0.5%) should benefit consumer spending, the latest official data for Germany pointed to a 1.4% drop in retail sales in August and Eurozone Retail PMI results for September also signalled a decline. On Monday, Eurostat releases retail sales results for September, while IHS Markit publishes PMI results for October.

Industrial production numbers are meanwhile released in a number of euro area countries, including Germany, France and Italy. In August, industrial output in the currency union as a whole rose 1.6% and was supported by solid expansions in the region's largest member states. The latest IHS Markit prediction sees industrial production in the euro area having grown 1.1% in September.

China data watchers will keep a close eye on inflation and trade data for more information on the health of Asia's largest economy. In September, consumer prices rose 1.9% and producer prices increased for the first time since 2012, thereby relieving a source of global deflationary pressure. Latest manufacturing PMI data from Caixin highlighted the strongest rise in factory gate prices since early-2011, thereby supporting the view that producer prices should continue to rise.

Monday 7 November

The latest AIG Construction Index is released in Australia.

Eurostat issues retail sales numbers in the currency union. Moreover, the Eurozone Sentix Index and the latest Retail PMI are out.

Germany sees the publication of factory orders data, while industrial output figures are issued in Spain.

Halifax house price data are updated in the UK.

Tuesday 8 November

The US presidential election takes place.

Global sector PMI results are released.

Business confidence numbers are published in Australia.

Trade data are out in China.

In Germany, industrial production and trade figures are updated by Destatis.

Current account and trade balance numbers are released alongside latest results from the INSEE Investment survey.

In the UK, the British Retail Consortium issues retail sales data, while the Office for National Statistics publishes industrial output figures. Moreover, the latest UK & English Regions Report on Jobs is out.

Canada sees the release of housing starts and building permit numbers.

Consumer credit figures and the latest NFIB Business Optimism Index are published in the US.

Wednesday 9 November

Australia sees the release of consumer sentiment figures.

Current account and bank lending data are published in Japan.

In India, M3 money supply numbers are issued, while inflation figures are out in China.

Business confidence data are released in South Africa.

Greece sees the publication of industrial output figures.

Trade data are meanwhile issued in the UK.

Mortgage data are released in the US.

Thursday 10 November

In Australia, mortgage lending data are updated.

Machinery orders figures are out in Japan.

Trade data are issued in India.

South Africa sees the publication of manufacturing and mining production numbers.

Industrial production are updated in Italy and France, with the latter also seeing the release of third quarter non-farm payroll figures.

In Greece, inflation and unemployment data are issued.

Retail sales numbers are updated in Brazil.

Initial jobless claims figures are out in the US.

Friday 11 November

The Reuters Tankan Index is released in Japan.

Industrial output numbers are updated in India.

Russia sees the publication of foreign trade data.

In Germany, Destatis issues updated inflation figures.

The Office for National Statistics releases construction output numbers for the UK.

The Reuters/Michigan Consumer Sentiment Index is published in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}