Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 04, 2014

German all-sector PMI drops to ten-month low as manufacturing loses momentum

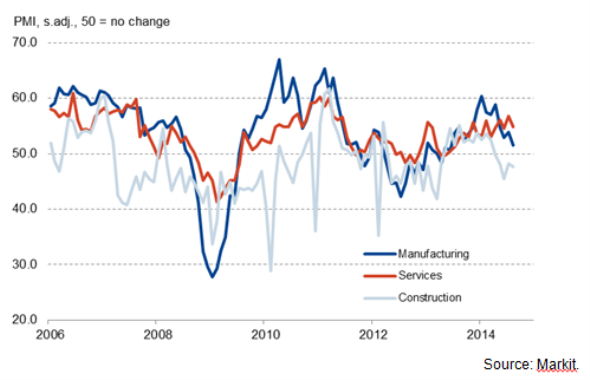

Economic growth in Germany's private sector slowed in August, according to latest PMI results. Growth in the internationally-focused manufacturing sector eased and construction activity continued to decline. The service sector showed further signs of a healthy recovery, despite the pace of expansion having slowed from July's three-year high.

Private sector expansion slows in August

The all-sector PMI, which measures the combined output of the manufacturing, construction and service sectors, fell from July's 37-month high of 55.3 to a 10-month low of 53.4, signalling weaker growth in Germany's private sector. The average PMI reading for the third quarter so far is the lowest since the fourth quarter of 2013.

Despite weakening in August, the survey data suggest that the economy should at least show a rebound from the contraction in GDP seen in the second quarter, a contraction which the PMI indicates understated the underlying health of the economy. This weakness of the official data in the spring relative to the PMI looks likely to have been caused by the former being affected by a greater than usual number of holidays being taken around public holidays.

Strong service sector expansion contrasts with weakening manufacturing growth

The big concern in the data is the divergent trends within the economy, and the fact that Germany's economic recovery has become increasingly dependent on the service sector. Despite falling from 56.7 to 54.9, the index measuring output (business activity) in the service sector posted one of the highest readings for the past three years and was indicative of solid growth in the sector.

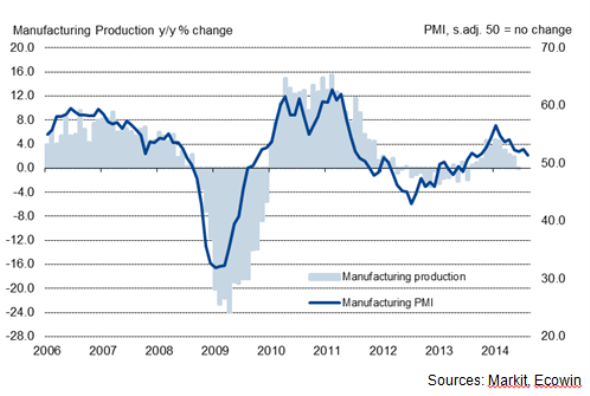

Manufacturing, however, suffered a slide in the pace of growth in August, with the index measuring factory output dropping from 53.8 in July to a 14-month low of 51.5, in part reflecting a weakening economic environment. New orders from both domestic and foreign markets increased at much weaker rates than at the start of the year. Some survey respondents linked weaker export growth to the Russian sanctions. Official data had signalled no growth in manufacturing output in June, with industrial production increasing only a mere 0.3% and failing to rebound from May's substantial decline of -1.7%.

An even gloomier picture was painted by the latest construction data. Activity in the sector contracted again in August, with the index measuring total construction output remaining below the 50.0 threshold for a fifth month running.

Output/ activity across the sectors

Manufacturing production and the PMI

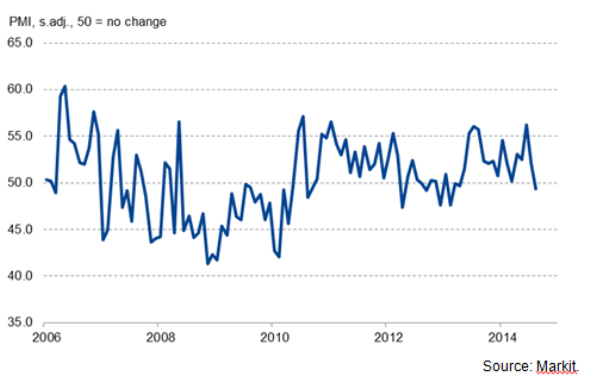

Retail sales fall for first time in 16 months

The weakness of Germany's economy also affected the retail sector in August. The headline PMI - which measures month-on-month sales on a like-for-like basis - fell below the no-change mark of 50.0 for the first time since April last year, in part reflective of a weakening economic environment. The rate of contraction was, however, only marginal, with the index posting 49.4.

Decline in retail sales in August

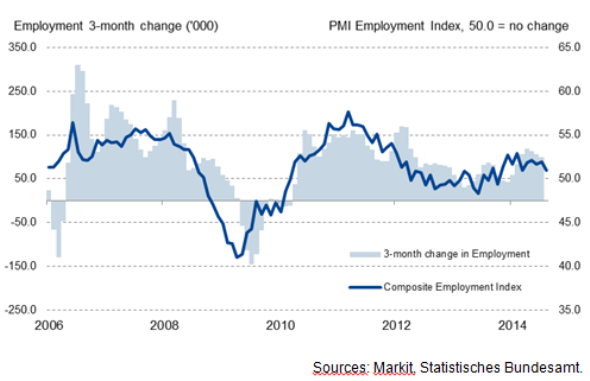

Employment growth maintained, but rate of job creation slows

The slower growth of activity has also brought about a weakened rate of job creation. Survey data pointed to further employment gains in Germany's private sector, but the rate of job creation was the weakest in five months. Negative contributions came again from manufacturing and construction, where jobs were cut at marginal rates. Service providers hired additional workers in August, albeit at the slowest pace in five months.

Official data showed that the labour market was relatively immune to the surprise contraction in German GDP in the second quarter, with the unemployment rate holding steady at 6.7%. Germany's jobless rate compares with a eurozone average of 11.5%.

Change in employment and the PMI

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014German-all-sector-PMI-drops-to-ten-month-low-as-manufacturing-loses-momentum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014German-all-sector-PMI-drops-to-ten-month-low-as-manufacturing-loses-momentum.html&text=German+all-sector+PMI+drops+to+ten-month+low+as+manufacturing+loses+momentum","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014German-all-sector-PMI-drops-to-ten-month-low-as-manufacturing-loses-momentum.html","enabled":true},{"name":"email","url":"?subject=German all-sector PMI drops to ten-month low as manufacturing loses momentum&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014German-all-sector-PMI-drops-to-ten-month-low-as-manufacturing-loses-momentum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+all-sector+PMI+drops+to+ten-month+low+as+manufacturing+loses+momentum http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092014German-all-sector-PMI-drops-to-ten-month-low-as-manufacturing-loses-momentum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}