Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 04, 2016

Chinese ‘circuit break’ sends FTSE, S&P lower

Chinese markets collapsed by 7% on the first day of trading in 2016, sending European stocks sharply lower. Short sellers however look to have had a profitable start to the year with targeted names leading the selloff.

- Short sellers persistence in targeting FTSE 100 firms continues to pay off in the new year

- FTSE 100 in the red as Anglo American and Glencore suffer large falls

- Ocado shares slide as fears of Amazon’s fangs in the UK market drive shares lower

Make way for bears

The Caixin-Markit China Manufacturing PMI released on January 4th 2016 fell to 48.2; a tenth consecutive month of the index remaining below the neutral 50 value. This level indicates that operating conditions faced by Chinese producers continued to deteriorate moderately during December 2015.

The negative PMI data, combined with an end to a six month ban on selling by major investors, sparked a new year equity sell off which triggered a new market circuit breakerintroduced by authorities. The automatic 15min halt to trading when the CSI 300 index falls by 5% looks to have backfired as stocks continued to slide once trading resumed, triggering a full halt to trading once reaching a 7% decline.

The bear runs west

The Shanghai Composite index ended down 6.9% while the Shenzen Composite fell by 8.2%, with negative sentiment quickly spreading to Europe with the DAX falling 4.3% and the Stoxx50 down 3.3%. Close to the end of trade, the FTSE 250 had fallen by 1.9% and FTSE 100 by a significant 2.6%.

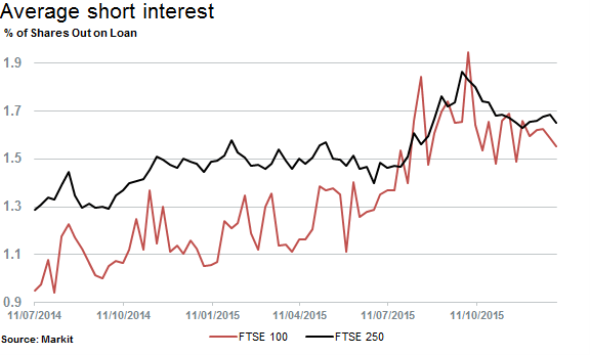

Short sellers have been persistently targeting FTSE 100 names since June 2015, when average short interest increased over 50% from 1.1% to above 1.7%, closing the gap on the FTSE 250 whose average has hovered above 1.5% for some time.

Average short interest for both the FTSE 250, comprised of relatively smaller firms, and the FTSE 100 remained elevated above 1.5% heading into 2016.

Resources pain continues

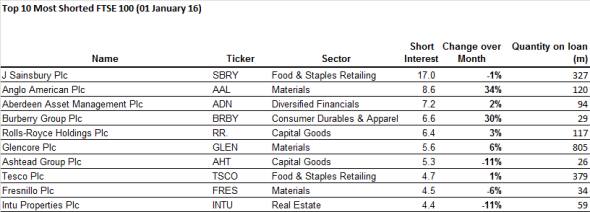

Short sellers were well placed for a sell off on the first day of trading in the UK. Leading the price decreases were Anglo American and Glencore, which both fell by more than 5%, and are both in the top ten most shorted stocks of the FTSE 100 currently.

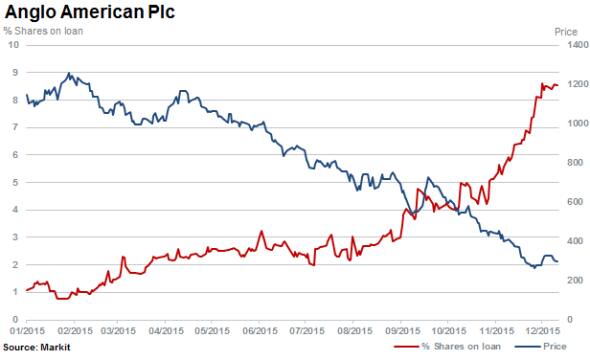

Anglo American with 8.6% of shares outstanding on loan and Glencore with 5.6% have continued to suffer a rout in prices as a weaker demand outlook for commodities has now been compounded by the recent weak Chinese market data points.

Other notable top ten shorts in the FTSE100 proving fertile ground for short sellers on the day were Burberry (-4%), Tesco (-4%) and Aberdeen Asset Management (-3%).

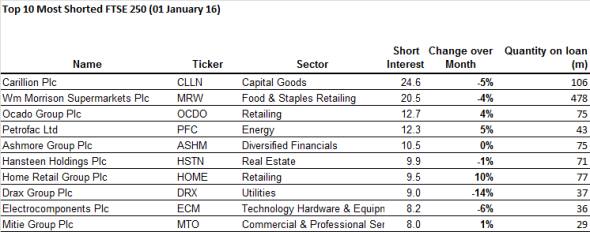

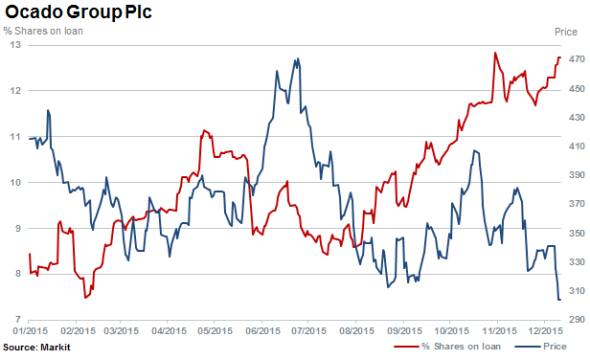

In the FTSE 250, one of the most successful shorts of 2016 so far is Ocado, which fell by 6% with 12.7% of shares outstanding on loan prior to trade opening.

Ocado shares have faltered recently due to news that Amazon plans to target UK grocery delivery market.

Relte Stephen Schutte | Analyst, IHS Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Equities-Chinese-circuit.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Equities-Chinese-circuit.html&text=Chinese+%e2%80%98circuit+break%e2%80%99+sends+FTSE%2c+S%26P+lower","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Equities-Chinese-circuit.html","enabled":true},{"name":"email","url":"?subject=Chinese ‘circuit break’ sends FTSE, S&P lower&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Equities-Chinese-circuit.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+%e2%80%98circuit+break%e2%80%99+sends+FTSE%2c+S%26P+lower http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-Equities-Chinese-circuit.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}