Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 03, 2016

Brexit-exposed Irish sectors suffer in months following referendum vote

Irish firms operating in sectors deemed to be most at risk from the UK's decision to leave the EU have already suffered in the months following the referendum, according to PMI data from IHS Markit.

With the UK yet to even invoke Article 50 of the Lisbon Treaty to start the negotiations to leave the EU, it appears that some areas of the Irish economy face a long and challenging road ahead.

Most Exposed Sectors

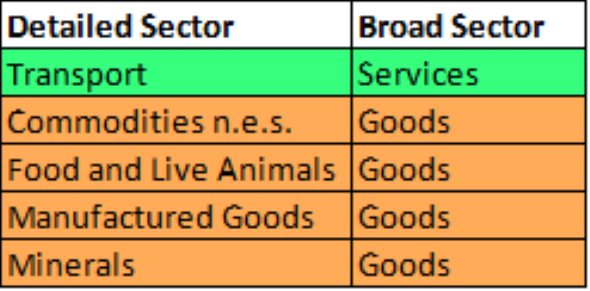

Alongside the announcement of the 2017 budget in October, the Irish government outlined an analysis of which sectors of the economy are most exposed to the departure of the UK from the EU*.

Using the 'Exposure Index' devised by the Irish Department of Finance, the five most exposed sectors are listed below in order of exposure:

One of the features of PMI surveys is that they provide the opportunity to drill down to see the responses for specific types of companies, such as firms in particular sectors or of particular sizes. We can therefore aim to isolate the PMI responses for those sectors outlined in the Irish government's analysis. For the purpose of this note we group together the five sectors with greatest exposure to Brexit and label them as the 'Most Exposed', with the remaining sectors grouped together as the 'Less Exposed'. The detailed sectors we include in the 'Most Exposed' group can be found in the Appendix to this note.

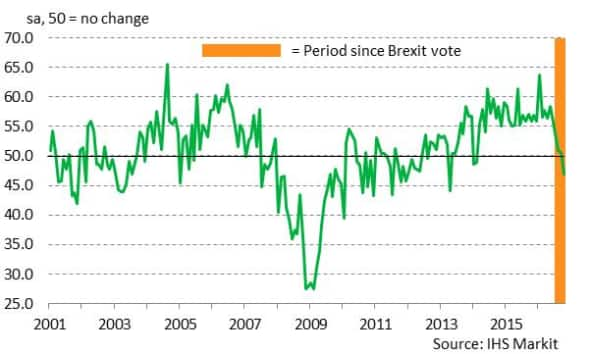

'Most Exposed' sectors see output decline

Prior to the UK's referendum at the end of June, output in the 'Most Exposed' sectors had been growing strongly on a monthly basis. However, in the months following the 'leave' vote the rate of expansion eased in three successive months before giving way to an outright decline in business activity during October. This was the first monthly fall in output in more than two-and-a-half years and the strongest downturn since April 2013. This suggests that the Brexit impact on the 'Most Exposed' sectors has already been both immediate and significant.

'Most Exposed' PMI Output Index

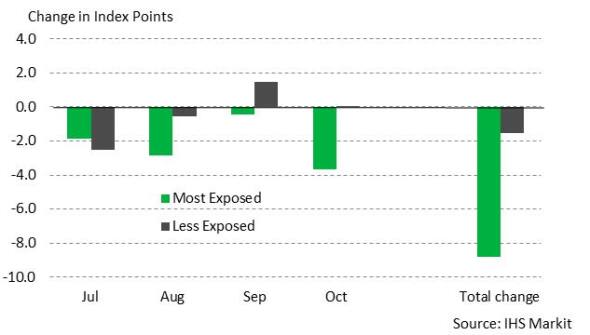

While the Output Index for the 'Most Exposed' sectors has seen a fall of 8.8 index points since June, the equivalent drop in the 'Less Exposed' index has been much smaller (1.5 index points), with September and October actually seeing growth accelerate slightly in these less exposed parts of the economy.

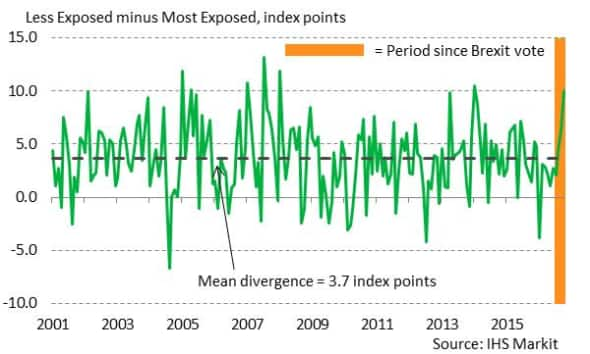

Moreover, the divergence between the two groups in October was 10.0 index points, the largest since January 2014 and one of the biggest since January 2001.

Changes in Output Indices since June

Divergence between 'Most Exposed' and 'Less Exposed' sectors

The trend in output in the 'Most Exposed' sectors reflected a similar picture regarding new business. In fact, new orders have now decreased for two successive months, with the reduction in October the sharpest since August 2012. New export orders also fell into contraction territory in the latest survey period for these most vulnerable companies. By way of comparison, the 'Less Exposed' sectors saw a sharp rise in total new orders in October, the fastest since June. They also posted an increase in new export orders, although the rate of expansion was only modest.

Job creation has also taken a hit following the UK's decision to leave the EU. Although employment in the 'Most Exposed' sectors rose during October, this followed a fall in the previous month. Also, the rate of jobs growth was weaker than seen in the months leading up to the vote. Meanwhile, 'Less Exposed' sectors raised employment at a marked and accelerated pace during the month.

Less of a divergence between the two groups has been evident with regards to the two PMI price indices. Input costs rose sharply during October, while firms increased their output prices at a solid pace.

Slower growth across Ireland as a whole

Looking at the combined manufacturing and services PMI data for Ireland as a whole, a slowdown in the rate of growth has also been evident. October saw the slowest increase in business activity since June 2013, with rates of expansion in new orders and employment also below those seen pre-referendum, continuing the trends highlighted last month.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112016-economics-brexit-exposed-irish-sectors-suffer-in-months-following-referendum-vote.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112016-economics-brexit-exposed-irish-sectors-suffer-in-months-following-referendum-vote.html&text=Brexit-exposed+Irish+sectors+suffer+in+months+following+referendum+vote","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112016-economics-brexit-exposed-irish-sectors-suffer-in-months-following-referendum-vote.html","enabled":true},{"name":"email","url":"?subject=Brexit-exposed Irish sectors suffer in months following referendum vote&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112016-economics-brexit-exposed-irish-sectors-suffer-in-months-following-referendum-vote.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit-exposed+Irish+sectors+suffer+in+months+following+referendum+vote http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03112016-economics-brexit-exposed-irish-sectors-suffer-in-months-following-referendum-vote.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}