Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2017

China Composite PMI signals firmer start to third quarter but still no signs of jobs growth

The Chinese economy started the third quarter on a firm footing, led by a pickup in manufacturing activity which was in turn supported by stronger foreign demand. However, despite signs of recent improvements, a rise in overall employment remained elusive.

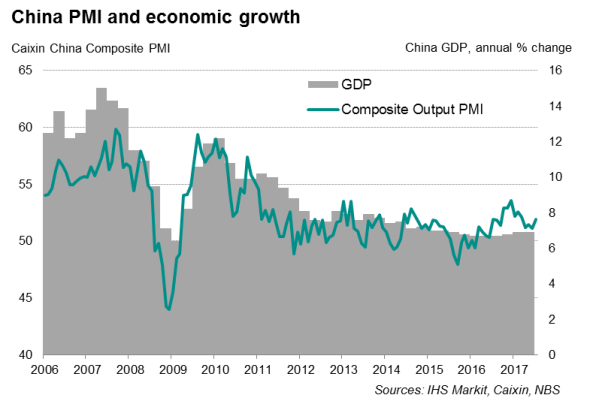

The Caixin China Composite PMI Output Index rose to 51.9 in July " a four-month high " from 51.1 in June, reflecting an upturn in demand. Growth in new business accelerated from the previous month, reaching a five-month record in July.

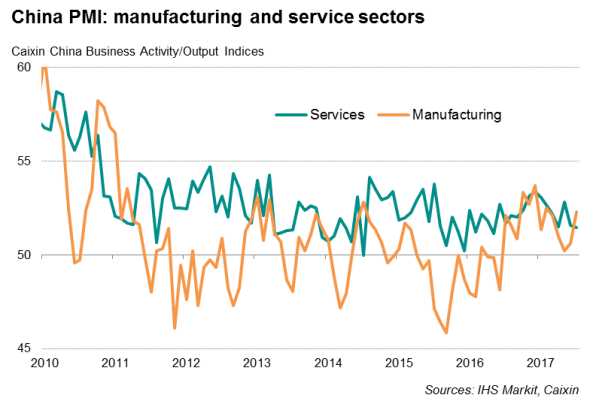

Manufacturing-led upturn

A key driver for the upturn was the manufacturing sector. A notable pickup in new orders, especially export sales, led manufacturing output to increase at a rate not seen since February.

Forward-looking indicators point towards further growth in the goods-producing sector over the coming months. Chinese factories, preparing for higher output, ramped up purchasing activity for a second consecutive month, which in turn led to a further increase in pre-production inventories. At the same time, firms reported a depletion of their stocks of finished goods amid stronger than anticipated client demand, suggesting that future output needs to be raised to replenish inventories.

The Chinese economy is widely anticipated to slow in the third quarter after the strength of China's performance in the first half of the year took analysts by surprise. GDP growth is expected to cool to an annual rate of 6.6% in 2017, according to a Reuters poll and IHS Markit's forecasts. However, the upturn in manufacturing at the start of the third quarter could pose an upside risk to current GDP growth projections.

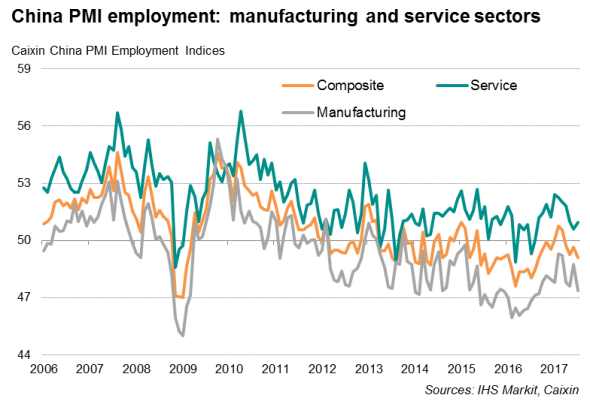

Employment

While the Chinese economy continued to report increased business activity and higher backlogs of work, the labour market remained sluggish. Total employment fell for a fourth straight month in July and at the steepest rate since last August. The increase in service sector jobs was insufficient to offset the persistent decline in manufacturing employment.

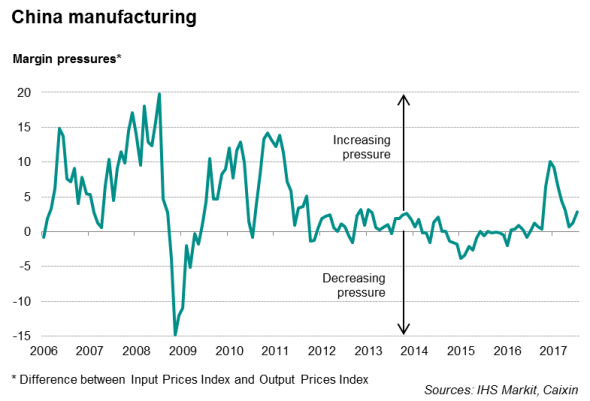

But digging into the details of the PMI surveys reveals that Chinese manufacturers often reported difficulties in keeping and hiring staff. Anecdotal evidence suggested that worker retention suffered because of low salaries and staff retirements. Nevertheless, the manufacturing sector may be hard-pressed to raise wages given the ongoing squeeze on profit margins " adding to the problem of staff retention and hiring.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-China-Composite-PMI-signals-firmer-start-to-third-quarter-but-still-no-signs-of-jobs-growth.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-China-Composite-PMI-signals-firmer-start-to-third-quarter-but-still-no-signs-of-jobs-growth.html&text=China+Composite+PMI+signals+firmer+start+to+third+quarter+but+still+no+signs+of+jobs+growth","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-China-Composite-PMI-signals-firmer-start-to-third-quarter-but-still-no-signs-of-jobs-growth.html","enabled":true},{"name":"email","url":"?subject=China Composite PMI signals firmer start to third quarter but still no signs of jobs growth&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-China-Composite-PMI-signals-firmer-start-to-third-quarter-but-still-no-signs-of-jobs-growth.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+Composite+PMI+signals+firmer+start+to+third+quarter+but+still+no+signs+of+jobs+growth http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082017-Economics-China-Composite-PMI-signals-firmer-start-to-third-quarter-but-still-no-signs-of-jobs-growth.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}