Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 03, 2016

UK all-sector PMI at lowest since April 2009 after record fall

The UK saw a broad-based and severe slowing in its economy in July as Brexit-related uncertainty took its toll on business activity.

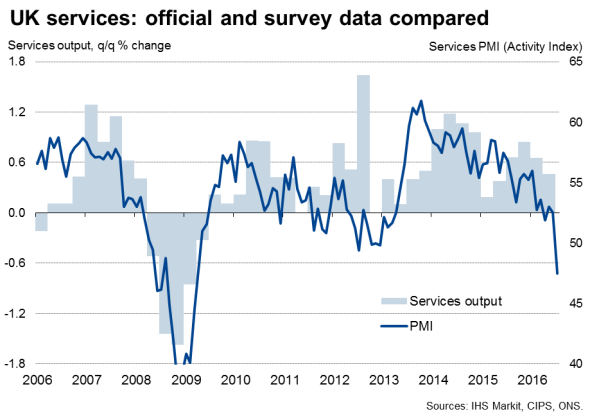

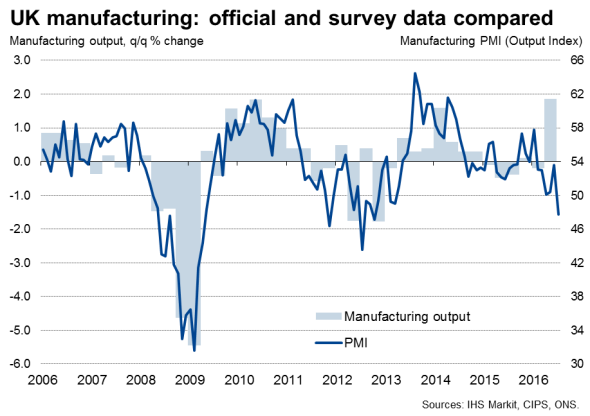

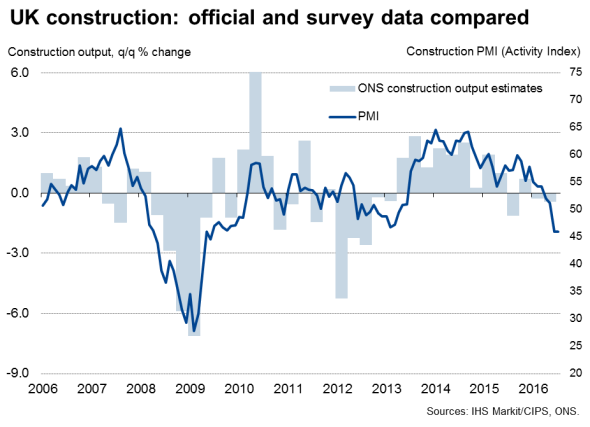

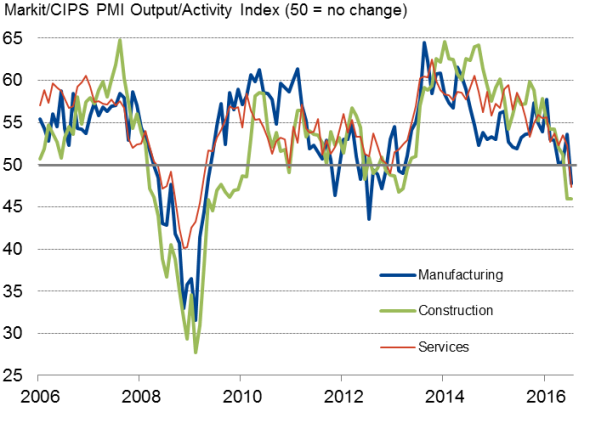

A marked service sector downturn follows news from sister PMI surveys showing the construction sector suffering its steepest downturn since 2009 and manufacturing contracting at the fastest rate since early 2013.

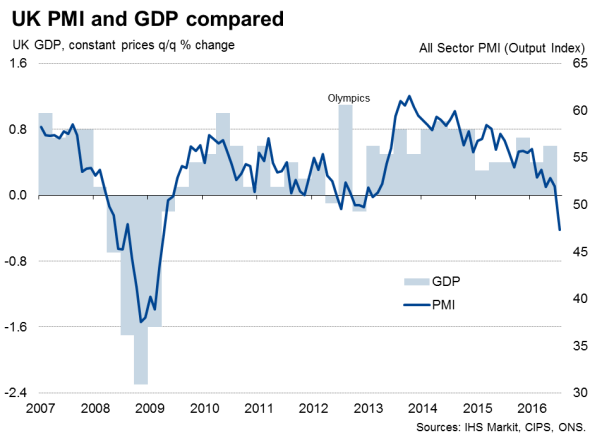

At 47.4, the final Markit/CIPS PMI for services was unchanged on the earlier flash estimate, though when combined with the further weakening in the manufacturing numbers, the surveys point to a slightly steeper downturn than first estimated (a final composite PMI reading of 47.5 compared to a flash estimate of 47.7).

Once the construction sector is also included, the 'all-sector' PMI fell from 51.9 in June to 47.3, its biggest one-month fall in the near 20-year history of the survey and taking the all-sector PMI down to its lowest since April 2009.

At this level, the PMI signals a 0.4% quarterly rate of decline of GDP.

New orders fell in all three sectors, dropping collectively at the fastest rate since March 2009 as demand fell for goods, services and construction projects.

The downturn in demand led to the first, albeit only modest, drop in employment across the three sectors since December 2012, as firms sought to reduce capacity in the uncertain environment. Manufacturing saw the largest drop in staff numbers, followed by construction. Services headcounts were left unchanged, failing to grow for the first time in over three-and-a-half years.

Output by sector

Input costs meanwhile rose at the fastest rate for two-and-a-half years, linked in many cases to higher import prices resulting from the weakened exchange rate. Manufacturing saw the steepest rise.

Average prices charged for goods and services rose only modestly, however, at a rate unchanged on June, as firms often chose to soak up higher costs in order to offer competitive prices to customers.

Outlook

It's too early to say if the surveys will remain in such weak territory in coming months, leaving substantial uncertainty over the extent of any potential downturn. However, the unprecedented month-on-month drop in the all-sector index has undoubtedly increased the chances of the UK sliding into at least a mild recession.

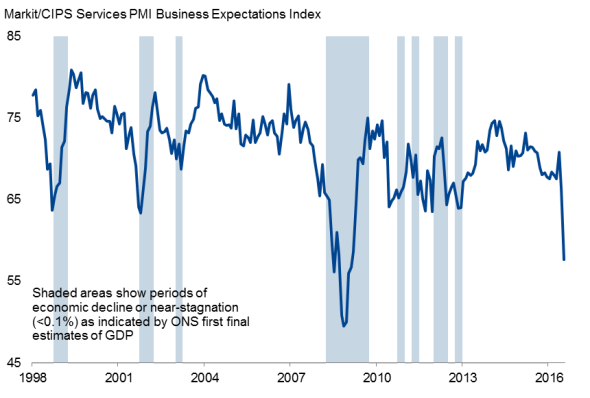

Service providers are certainly bracing themselves for worse to come, with a record drop in business confidence about the year-ahead leaving optimism at its lowest ebb since February 2009.

Business confidence

Our forecast is for the economy to slip into a mild recession in late-2016 and to barely grow in 2017, with GDP rising by a mere 0.2%.

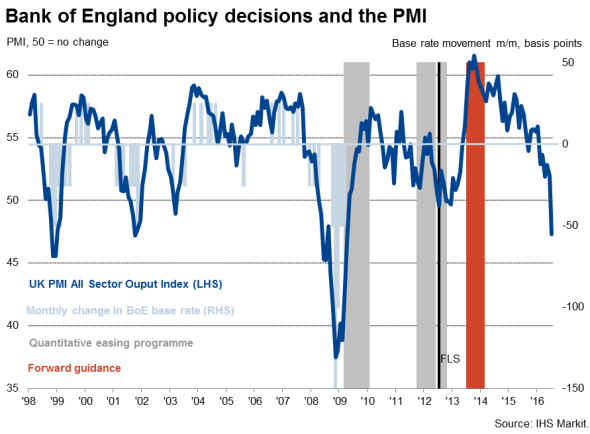

However, the extent of any downturn clearly depends to some degree on the policy response. The PMI is already deep into territory which would normally spur the Bank of England into taking action to stimulate the economy. A quarter point cut in interest rates therefore seems to be a foregone conclusion at tomorrow's Monetary Policy Committee meeting, though the extent and nature of other non-standard stimulus measures - and their effectiveness - remains a far greater source of uncertainty and the subject of intense speculation.

Broad-based weakness

The final services PMI numbers confirm the signal from the earlier flash estimate that the sector saw business activity fall to the greatest extent since March 2009 in July. The switch from steady growth in June was the most severe seen since data were first collected in 1996.

The downturn in new business in the service sector was even more dramatic. However, in both cases, the rates of decline remained well off those seen at the height of the global financial crisis in late-2008 and early-2009.

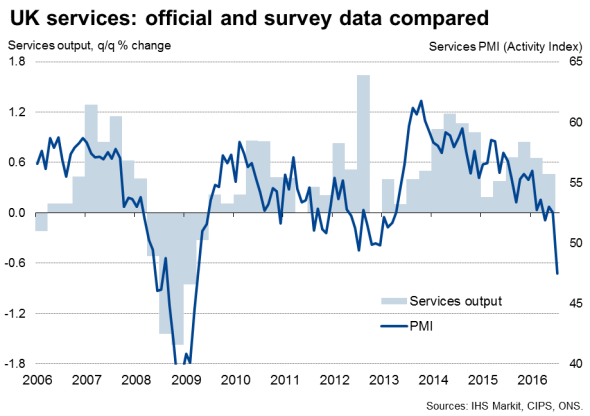

Cracks appear in official data

The deterioration in the PMI paints a far bleaker assessment of the economy than the latest official data, though cracks are also appearing in the latter.

The first estimate of gross domestic product in the second quarter from the Office for National Statistics indicated that the economy grew 0.6%, accelerating from 0.4% in the first three months of the year. But the robust number masked a less rosy picture that appears when the details are examined.

The second quarter official data showed that construction has slipped into recession and the services economy grew at the slowest pace in a year. The main source of stronger growth was a surge in the pace of expansion in the manufacturing economy, in turn linked to jumps in output of the autos and pharmaceutical sectors - both of which tend to show high production volatility and are often unrepresentative of the wider industrial sector.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-Economics-UK-all-sector-PMI-at-lowest-since-April-2009-after-record-fall.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-Economics-UK-all-sector-PMI-at-lowest-since-April-2009-after-record-fall.html&text=UK+all-sector+PMI+at+lowest+since+April+2009+after+record+fall","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-Economics-UK-all-sector-PMI-at-lowest-since-April-2009-after-record-fall.html","enabled":true},{"name":"email","url":"?subject=UK all-sector PMI at lowest since April 2009 after record fall&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-Economics-UK-all-sector-PMI-at-lowest-since-April-2009-after-record-fall.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+all-sector+PMI+at+lowest+since+April+2009+after+record+fall http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03082016-Economics-UK-all-sector-PMI-at-lowest-since-April-2009-after-record-fall.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}