Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 03, 2015

Bonds calm before Greece vote; China positive

Bond markets remain flat ahead of Sunday's Greek referendum, while China and Mexico buck bond selloff and return positive for June.

- Greece's 2-yr bond yield has remained elevated but calm ahead of Sunday's referendum

- 10-yr treasuries rallied as a mixed jobs report came in slightly below forecasts

- Chinese and Mexican sovereigns were rare providers of total return in June

Calm before the storm

Credit markets have remained relatively calm over the last few days ahead of Greece's much anticipated referendum this Sunday.

Greece's 2-yr government bond due 2017 yield widened nearly 16% last weekend to 36.5% but has since remained relatively flat. The yield as of yesterday's close stood at 34.7%.

Latest opinion polls suggest the "yes' vote is in the lead, which means the Greek public would accept the reform proposals set forth by its creditors. But the lack of decisive movement in credit markets over the last few days suggests the result and eventual outcome is still up in the air.

The IMF, to whom Greece is now in arrears, weighed in on the debate yesterday by suggesting Greece would need €60bn to kick start their economy after a Syriza led first half to the year.

Treasuries

Treasuries rallied on the back of a mixed jobs report from the US Labor department yesterday. The economy added 223,000 jobs in June, lower than analyst forecasts.

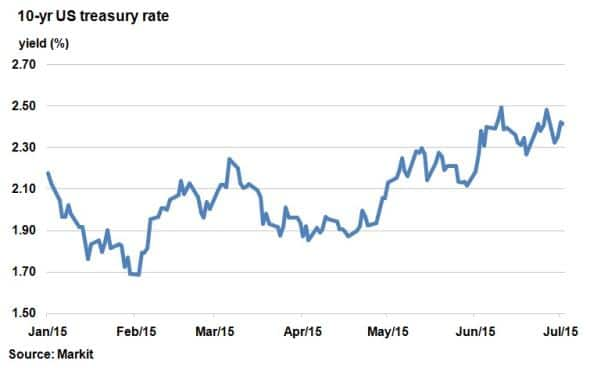

Fearing a delay in interest rate lift, the benchmark 10-yr rate dropped 3bps to 2.38%. So far this year, 10-yr treasuries have been bound between 1.5% as 2.5%, but have creeping towards the higher end as inflation expectations accelerated.

Primary issuance

While larger systemic risks stemming from the Greek crisis have been largely contained, short term market uncertainty has put a stranglehold on the primary bond market.

Total issuance in the US investment grade market has amounted to precisely $0 this week, not helped the shorter Fourth of July week.

China and Mexico

It was a turbulent June for global bond markets with very little in the form of returns for investors.

European sovereigns suffered a particularly bad month with periphery names like Italy and Spain down -2.7% and -2.4% respectively. It was however a core European name - France - that suffered the biggest loss, -2.8% according to Markit's iBoxx indices. Developed sovereigns are now all down year to date (ytd) on a total return basis.

On the corporate bond front, UK investment grade credit suffered losses of -2.8% and is now down overall ytd. High yield was also caught up in the bond market uncertainty with returns down in all three major western currencies. High yield has remained resilient during the recent sovereign bond turmoil but fundamental factors such as Greece and Puerto Rico in recent weeks have scared investors away from the asset class.

There was however some bright spots in bond markets, with Chinese and Mexican government bonds the few areas that yielded a positive return for June.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-credit-bonds-calm-before-greece-vote-china-positive.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-credit-bonds-calm-before-greece-vote-china-positive.html&text=Bonds+calm+before+Greece+vote%3b+China+positive","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-credit-bonds-calm-before-greece-vote-china-positive.html","enabled":true},{"name":"email","url":"?subject=Bonds calm before Greece vote; China positive&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-credit-bonds-calm-before-greece-vote-china-positive.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Bonds+calm+before+Greece+vote%3b+China+positive http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03072015-credit-bonds-calm-before-greece-vote-china-positive.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}