Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 02, 2015

Obamacare squeezes biotech shorts

Biotech shares have soared in the last 12 months which has provided fertile ground for short squeezes, however short sellers have been relatively resilient despite the pain.

- Biotech is the most short sold sector in the US as stocks spike on Obamacare ruling

- 18 short squeezes occurred in June, with stocks popping 12% on average

- Despite squeezes, some short sellers have held on and increased positions

Avoiding the squeeze

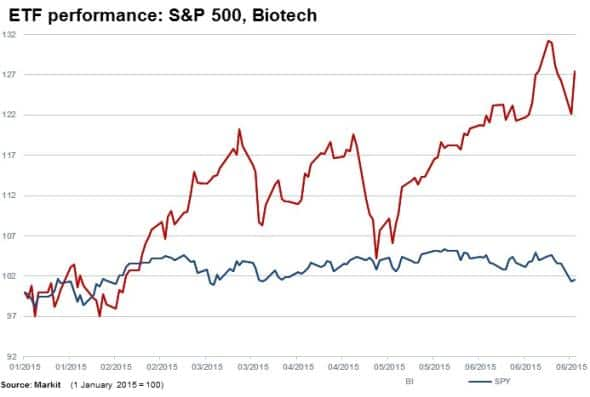

Short sellers have battled against biotech in 2015 with the sector's momentum exemplified by the SPDR S&P Biotech ETF (XBI) which is up by an impressive 78% over the last 12 months and 27% year to date.

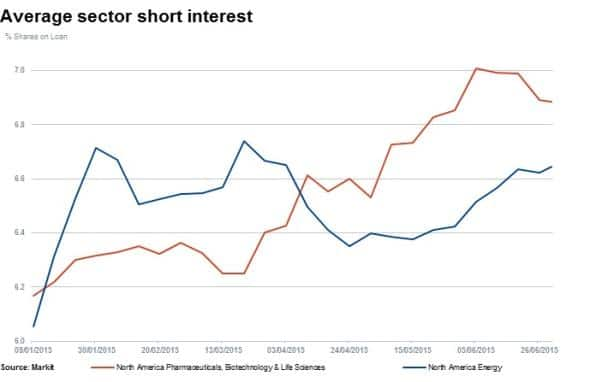

On average the biotech sector is currently the most shorted sector in the US, measured by short interest across shares that make up the Russell 3000 index. The sector's average of 6.8% of shares outstanding on loan is now above that of the energy sectors, at 6.6%.

The impact of the US Supreme Court upholding recent healthcare reforms saw short sellers move to cover positions, as stocks were boosted by the prospect of legislated healthcare coverage extended to another 30mn Americans.

Markit's recently launched Short Squeeze model* identified 18 short squeezes in June 2015. The model combines three main short sentiment factors; out of the money short positions, concentration of short sellers near break-even and abnormal trading volumes which could indicate catalyst events. Companies are then ranked according to their likelihood of being squeezed.

Of the 18 squeezes reported, the majority ranked in the top percentile of companies Markit identified at the beginning of June as expected to squeeze. These included a large proportion of biotech stocks, seeing a rise in share prices and subsequent covering of short positions. However this trend has since reversed with short sellers returning to some single name stocks with conviction.

Examples of top ranked companies according to the Short Squeeze model, prior to squeezing include;

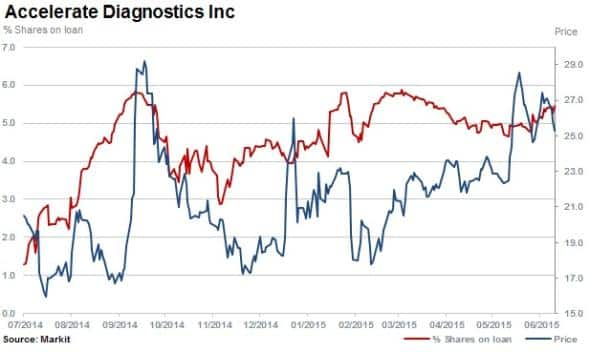

Accelerate Diagnostics witnessed a short squeeze on June 3rd with shares rising 13% and subsequent covering. However some shorts have held on and the stock remains in high demand with a cost to borrow above 15% and 5.4% of shares outstanding on loan.

Bellicum Pharmaceuticals remains an in demand short with a cost to borrow above 10%. Its short squeeze occurred on June 5th with the stock spiking 15%. Resilient shorts were rewarded however as the spike was not long lived and the share price has fallen 28% since the squeeze.

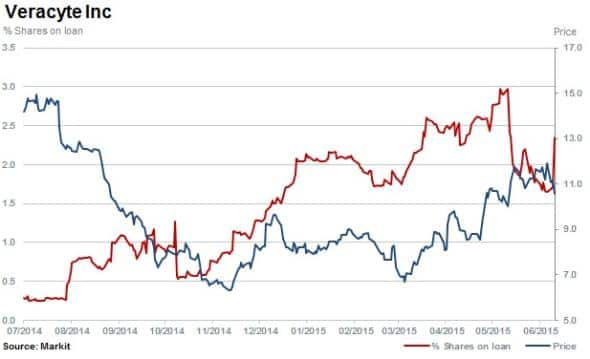

Molecular diagnostics firm Veracyte saw short sellers squeezed on June 4th. Shares rose by 14%with shares outstanding on loan declining by more than 20%, but have subsequently risen to pre-squeeze levels.

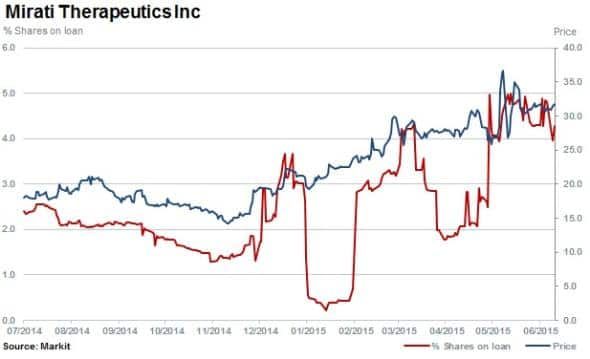

Mirati Therapeutics jumped by 26% in the three days prior to June 5th, shares outstanding on loan has since decreased by 10%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Equities-Obamacare-squeezes-biotech-shorts.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Equities-Obamacare-squeezes-biotech-shorts.html&text=Obamacare+squeezes+biotech+shorts","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Equities-Obamacare-squeezes-biotech-shorts.html","enabled":true},{"name":"email","url":"?subject=Obamacare squeezes biotech shorts&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Equities-Obamacare-squeezes-biotech-shorts.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Obamacare+squeezes+biotech+shorts http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Equities-Obamacare-squeezes-biotech-shorts.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}