Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 02, 2015

Puerto Rico credit risks largely isolated

Puerto Rico's unsustainable debt problems have intensified this week, but the wider municipal bond market has so far remained resilient.

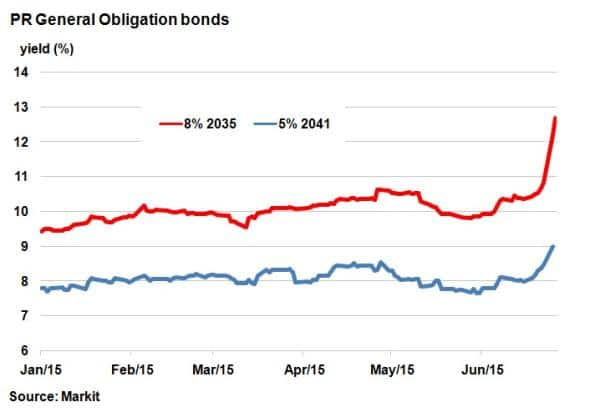

- Puerto Rico's 2035 general obligation bond has seen its price drop from 77 on Friday June 26th to 66.2 on June 30th as default looms

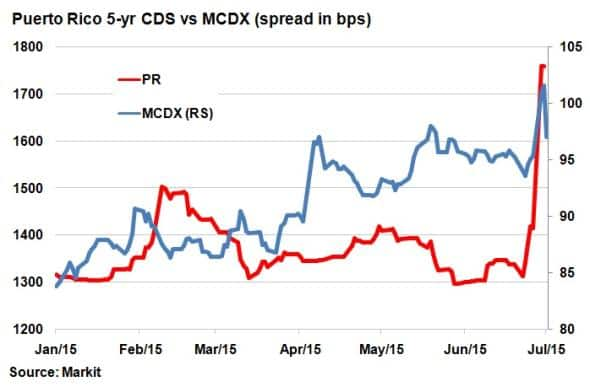

- Credit markets shook off the news as the MCDX widened only 2bps since last Fridays close

- MBIA has seen it's 5-yr CDS spread widen 112bps since last Fridays close

Puerto Rico's long standing debt problems took a turn for the worse last weekend when its governor stated that the US territory was unable to repay its upcoming debts.

Puerto Rico currently has $72bn in debt outstanding and the highest debt/GDP ratio of any US municipality, by a wide margin. A default in Puerto Rico would be the largest issuer default in municipal bond history.

Puerto Rico's general obligation bonds sold off sharply on the governor's comments. The 8% coupon bond due 2035 has dropped 11pts (cash basis to par) so far this week, with yields widening to 12.6%, according to Markit's Municipal bond pricing service. Investors recently appeared to be more optimistic of a resolution to the situation, as yields on the 2035 bond had tightened 50bps from this past May to June.

The fact that general obligation bonds exerted such volatility marks a turning point in the crisis. In March, Puerto Rico's sales tax revenue bonds came under pressure after a bill to reform VAT was rejected; a situation that had little effect on the price of its general obligation bonds, which are seen as safer.

Attractive yields and tax free benefits have enticed US investors to the municipal bond market over the last few years. ETFs tracking the US municipal bond market have seen staggering growth over the years, with year to date net inflows amounting to $2.07b. But June saw the first monthly outflow since December 2013, although investors had reduced exposure well before the latest developments in Puerto Rico. In fact, there have been small inflows into muni bond ETFs this week, suggesting the recent events have not put off investors.

Credit markets have also reflected the calm mood in the wider municipal bond market. The Markit MCDX, a credit index referencing municipal single name CDS, widened 6bps on the back of the developments in Puerto Rico; the largest one day move since April. This level has since tightened; with the latest June 1st spread level 97bps, only 2bps wider than last Friday. A comparable long duration bond, California's general obligation bond due 2045 maturity barely budged, with yields actually tightening, although of course worth noting that California is a higher grade issuer.

This was in stark contrast to Puerto Rico's 5-yr CDS spread, which has widened 344bps so far this week to 1759bps. Interestingly, these levels are not too dissimilar to Greece's a month ago, as media draws parallels between the two independent crises. But the situation in Puerto Rico is significantly different as it has not triggered volatility in the muni bond market, which remains relatively flat so far this week. It is also worth noting that munis are held by the general public and not governments like in the case of Greece.

But risk did spread to the bond insurance market. MBIA, a monoline insurer of municipal bonds, saw its 5-yr CDS spread widen 112bps from last Friday's close and was largest credit widener among single name CDS in North America over the past week. The widening was attributed to MBIA's sizeable exposure to Puerto Rican Munis. Its equity price tumbled too. Puerto Rico did however manage to make interest and principle payments due yesterday, calming nerves and the potential to trigger contagion indirectly through insurers, albeit MBIA did indirectly help fund the payment.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Credit-Puerto-Rico-credit-risks-largely-isolated.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Credit-Puerto-Rico-credit-risks-largely-isolated.html&text=Puerto+Rico+credit+risks+largely+isolated","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Credit-Puerto-Rico-credit-risks-largely-isolated.html","enabled":true},{"name":"email","url":"?subject=Puerto Rico credit risks largely isolated&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Credit-Puerto-Rico-credit-risks-largely-isolated.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Puerto+Rico+credit+risks+largely+isolated http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02072015-Credit-Puerto-Rico-credit-risks-largely-isolated.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}