Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 03, 2015

Are energy investors heading into a yield trap?

February saw shares which offer an attractive dividend yield compared to long term average perform well. But investors need to be wary of falling into yield traps, as many oil and gas which offer attractive trailing dividend yields have announced or are forecasted to cut dividends.

- Firms with the most attractive dividend yields compared to their five year averages outperformed the market by 2% last month

- Energy shares are disproportionately represented among the companies offering an attractive dividend yield compared to long term average

- But several of the energy firms which offer attractive yields are expected to cut payments, according to Markit's dividend forecasts

The oil market settled last month, which provided some relief to the embattled energy sector. This relative stability saw energy shares outperform the rest of the market, as evident by the 1.5% outperformance posted by the Vanguard Energy ETF over the S&P 500 index. This risk rally was most likely driven by dividend investors, as the energy sector has a long track record of offering attractive dividend yields; something which was made stronger as trailing dividend yield across the sector reflect the recent energy headwinds.

But the sector's attractive trailing dividend yield compared to long term averages could be a dividend trap, as many of the names currently trading with the best yields are forecast to cut payments in the near term.

Yield seekers push up market

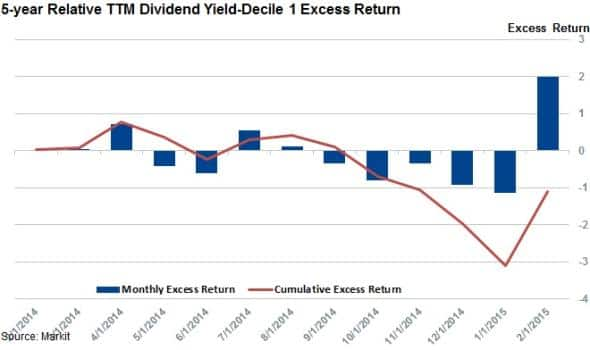

February saw constituents of the US Total cap universe whose shares offered the most attractive trailing twelve month dividend yield compared to five year averages post their best month in over 18 months.

Shares among the best ranked 10% of shares in the 5-year Trailing 12-Month Dividend Yield factor, which ranks firms by their current trailing 12 month dividend yield compared to the five year trend, outperform the rest of the US total cap universe by 2% in February. This strong performance snapped a five month losing streak which saw deep value dividend names lag the market by over 5%.

This strong desire to hold good dividend names made energy names the best performing group across the ten 5-year Trailing 12-Month Dividend Yield decile groups in February.

Energy shares driving the trend

The resurgent energy sector was a key driver of the recent strong performance. Energy firms made up a quarter of the names which traded at the most attractive dividend yields at the start of February. This makes the sector the best represented ahead of technology shares which make up 14.3% of the top scoring decile.

In contrast, energy names only comprised one tenth of the names among the best ranked relative dividend yield decile last August. The recent tumble in oil prices saw this proportion more than double as falling shares prices pushed trailing 12 month dividend yields up

"Yield moths" beware

One potential pitfall for dividend investors is that the ongoing turbulence in the energy sector has forced many of the firms whose shares currently trade at the most attractive dividend yield to long term average to cut their dividend payments.

Of the 31 energy shares which offer the best trailing dividend yield to long term averages, Markit forecasts four suspensions, nine cuts and six flat payments.

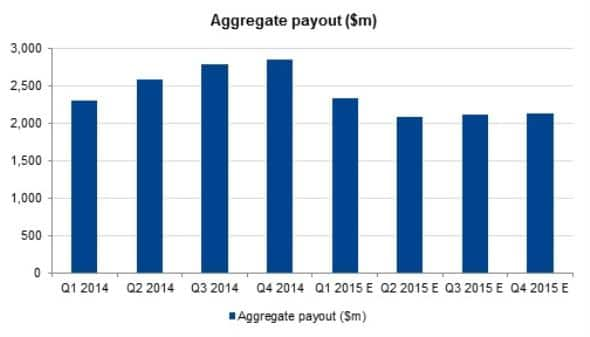

aggregate quarterly payments made by these 31 firms to $2.05bn in Q2, compared to $2.9bn paid in Q4 of last year just prior to oil's unexpected drop.

These recent developments take the average forecast 12 month forward dividend yield for the sector to 4.5%; much lower than the trailing yield which now stands at 7.4%.

Despite the recent cuts in payments, deep value dividend energy stocks are still trading at a better forward yield than at the start of 2014 when this figure stood at 3.6%.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Equities-Are-energy-investors-heading-into-a-yield-trap.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Equities-Are-energy-investors-heading-into-a-yield-trap.html&text=Are+energy+investors+heading+into+a+yield+trap%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Equities-Are-energy-investors-heading-into-a-yield-trap.html","enabled":true},{"name":"email","url":"?subject=Are energy investors heading into a yield trap?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Equities-Are-energy-investors-heading-into-a-yield-trap.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Are+energy+investors+heading+into+a+yield+trap%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Equities-Are-energy-investors-heading-into-a-yield-trap.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}