Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 03, 2015

Russian investors enjoy peace dividend

Although the situation is far from normalised, the relative calm since the latest Ukraine ceasefire has seen Russian corporate credit tighten significantly.

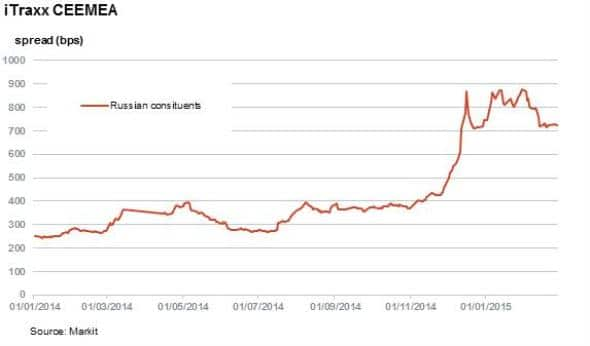

- CDS spreads among Russian constituents of the iTraxx CEEMEA have tightened

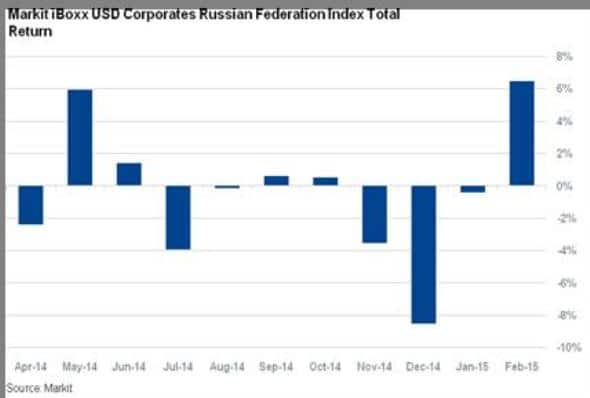

- The iBoxx Russia Index, which tracks debt issued by Russian companies offshore, has returned 6.7% over February

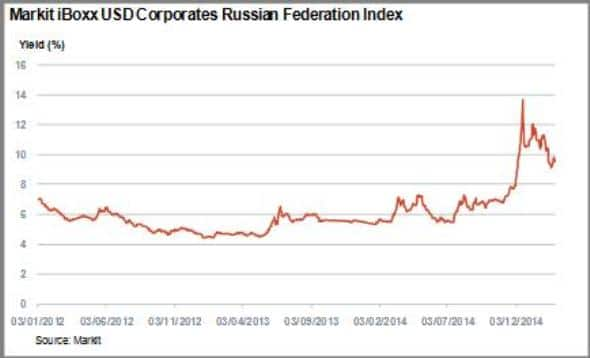

- Despite the recent credit tightening, Russian dollar denominated bonds still yield 9.5%

Russia's on going troubles have given investors a wild ride, as falling oil prices and international sanctions saw the country's credit rating cut to junk status while its currency hit new lows against the dollar. While Russia is still off limits to many investors, the recent relative calm in Ukraine and stabilising oil prices have seen Russian corporate credit rebound from its recent lows at the start of February.

CDS investors less worried

A closer look at the Russian constituents of iTraxx CEEMEA index, which make up 36% of the index, reveals tightening across the board. The nine Russian constituents of the index have seen their average CDS spreads tighten by 144bps over February, after a recent high in January which saw the average number top out at 875bps, over three times higher than this time last year.

The falling Ruble and slowing economy have put banks at the centre of the recent negative credit sentiment, owing to the prospect of depositor flight to safety and refinancing risk. Alpha bank, Russia's largest private commercial bank and lender, has seen its 5-Year CDS spreads tighten 94bps in February. It is, however, still the riskiest out of its peer group at 902bps.

State owned lenders Sberbank and VTB Bank have fared better, with CDS spreads standing at 634bps and 798bps respectively. VTB Bank has been one of the biggest winners having shed 182bps off its all time high on January 30th.

Current CDS spreads also reflect the declining price of oil, with Gazprom and Rosnef both seeing CDS spreads over three times wider than a year ago. But these firms have also seen this trend reverse in the last month, tightening 145bps and 130bps respectively.

Bonds perform well

The Markit iBoxx USD Corporates Russian Federation Index, which tracks dollar denominated debt issued by Russian companies, has returned 6.7% in February alone and was the best performing corporate bond country index in February according to iBoxx. This rebound comes after three months of successive negative returns of

-0.4% in January, -8.5% in December and -3.5% in November.

More room for return

From 2012 to 2014, Russian corporates yielded between 4%-6% during this period of relative stability. The falling oil price last which started last August, coincided with political turmoil and subsequent Western sanctions, had a crippling effect on Russian bond markets. Yields on the Markit iBoxx USD Corporates Russian Federation Index reached as high as 13.5% last December, but have since receded. The gains seen in February have left corporates averaging 9.5% at latest reading, still far off the long term average.

Whether any further value can be extracted out of the Russian bond market is largely dependent on the price of oil, which is unlikely to return back to $100 in the short term. However, a thawing of sanctions could provide some continuing momentum to the recent trend.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Credit-Russian-investors-enjoy-peace-dividend.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Credit-Russian-investors-enjoy-peace-dividend.html&text=Russian+investors+enjoy+peace+dividend","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Credit-Russian-investors-enjoy-peace-dividend.html","enabled":true},{"name":"email","url":"?subject=Russian investors enjoy peace dividend&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Credit-Russian-investors-enjoy-peace-dividend.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Russian+investors+enjoy+peace+dividend http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03032015-Credit-Russian-investors-enjoy-peace-dividend.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}