Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 02, 2014

Week Ahead Economic Overview

Policy decisions at the Bank of England and the Bank of Japan plus industrial production numbers for a number of European countries are the highlights of a busy week for economy watchers. Other important releases include the HSBC China Services PMI" and UK trade data.

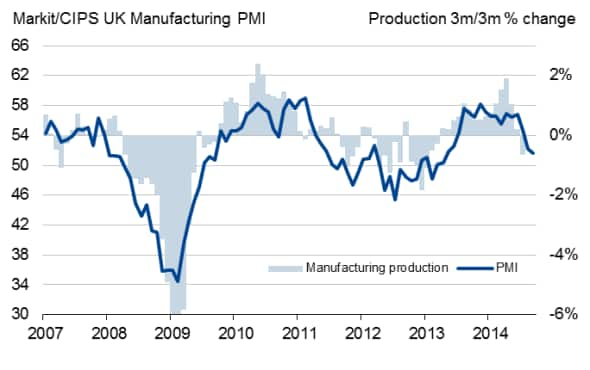

The Bank of England announces its latest monetary policy decision for the UK on Thursday, at which no change is expected. Since the last meeting, GDP has been revised higher, meaning the UK economy is now 2.7% larger than its pre-crisis peak, but the Bank had already pencilled-in faster growth in the second quarter. September's disappointing manufacturing PMI reading will add to the air of caution as to whether the economy is ready for higher interest rates and wage growth remains stuck at an all-time low.

UK manufacturing output and the PMI

Updates from the ONS on UK industrial production, trade and construction will add to the policy debate and also give further hints as to how the economy was performing in the third quarter. In July, industrial output rose 0.5%, but the underlying rate of growth eased from the strong pace of expansion seen earlier in the year, in line with the signals sent by survey data.

The Bank of Japan will announce its latest monetary policy decision on Tuesday. Official data showed the Japanese economy shrinking 1.7% in the second quarter, as spending was hit by a rise in the sales tax. If growth fails to revive, pressure will be felt by policymakers to reinvigorate the economy with more stimulus. Survey data showing a slowing in manufacturing in September will add to policymakers' worries, and is one of several factors likely to cause a downgrading of the Bank's view of the economic situation.

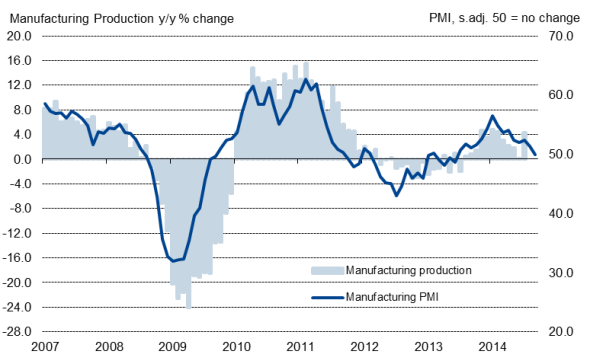

In the eurozone, industrial production numbers are released for a number of countries. In Germany, industrial output rebounded in July, with production rising 1.9%, following a mere 0.3% increase in June. Any positive readings for August will add to the likelihood of third quarter GDP edging back into growth territory, after the German economy shrank 0.2% in the second quarter. Survey data signalled a slowing in manufacturing growth in recent months, with September's data pointing to stagnation in the sector. Industrial production data are also released in France, Spain, Italy and Greece.

German manufacturing output and the PMI

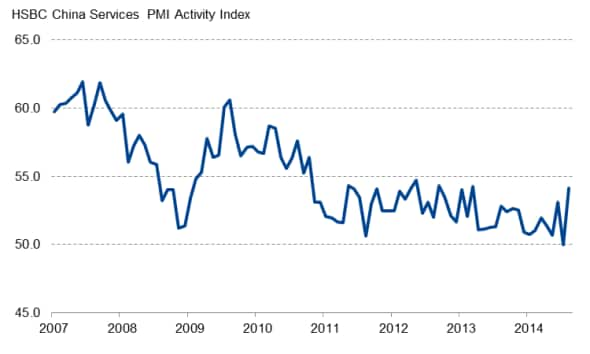

he HSBC China Services PMI is released later than usual this month, due to Chinese National Day on October 2. The survey will provide further insights into how the world's second-largest economy is performing at the end of the third quarter, after manufacturing continued to rise at only a marginal rate. The data will also give more clues as to whether the economy is on track to meet its growth target of 7.5% for the year. In August, survey data signalled solid service sector growth, with the index measuring business activity the highest in nearly one-and-a-half years.

HSBC China Services PMI Activity Index

Monday 6 October

The University of Melbourne issues its latest inflation estimate for Australia, while the National Australia Bank publishes business confidence data.

The Markit Eurozone Retail PMI, the latest Sentix Investor Confidence Index and industrial import price data are released in the currency union.

Markit's construction PMI and factory orders numbers are meanwhile published for Germany.

Employment trends data are issued in the US.

Tuesday 7 October

A number of whole economy PMI reports, sector PMI data and the UK & English Regions Report on Jobs are released by Markit.

The Reserve Bank of Australia and the Bank of Japan announce their latest interest rate decisions, with Japan also seeing the release of its Leading Economic Index.

Industrial production data are out in the UK, followed by the latest GDP estimate from the National Institute of Economic and Social research.

Industrial production numbers are also published in Germany.

France sees the release of its budget balance.

In Canada, building permits are issued.

The IBD/TIPP Economic Optimism Index is released in the US.

Wednesday 8 October

The HSBC China Services PMI is released by Markit.

Current account data and machinery orders numbers are out in Japan.

In Spain, industrial output numbers are released.

Housing starts data are meanwhile published in Canada.

The OECD publishes a statistics release on composite leading indicators.

Thursday 9 October

Australia sees an update on labour market data.

Trade data are meanwhile out in Germany and France.

The European Central Bank releases its latest Monthly Report, which contains a detailed analysis of the region's economic situation, while Eurostat publishes house price data.

The Bank of England announces its latest monetary policy decision, while the Royal Institution of Chartered Surveyors releases an update on the housing market.

Inflation figures and unemployment data are published in Greece.

The New Housing Price Index is out in Canada.

Initial jobless claims and wholesale inventories numbers are published in the US.

The OECD publishes a statistics release on harmonised unemployment rates.

Friday 10 October

The UK Commercial Development Activity Report is released by Markit and Savills.

Industrial production numbers are released in France, Greece and Italy.

Construction output figures and trade data are released in the UK.

Canada sees an update on its labour market data.

Import and export prices are meanwhile published in the US.

Oliver Kolodseike | Economist, Markit

Tel: +44 14 9146 1003

oliver.kolodseike@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102014-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}