Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 02, 2017

European countries dominate global manufacturing rankings in May

Worldwide manufacturing activity continued to rise at a solid pace in May, according to global PMI data, but the regional breakdown of the surveys underscored the recent dominance of European producers and the malaise in Asia.

Welcome news meanwhile came in the form of slower input price increases, which could take pressure off consumer price inflation in many countries.

Global upturn continues

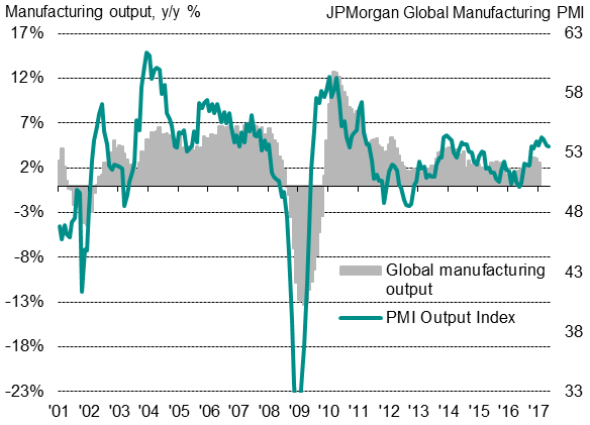

The JPMorgan Global Manufacturing PMI, compiled by IHS Markit from its business surveys in 28 countries, posted 52.6 in May, indicating a sustained steady pace of expansion, albeit down slightly from 52.7 in April. The May index is broadly indicative of global manufacturing output growing at a robust annual rate of 4-5%.

Global production and order book growth rates were largely unchanged on April, and employment growth was also little-changed.

The big changes came in the prices data, with the survey registering a steep slowdown in the rate at which factory input costs were rising on a global scale. Worldwide input prices showed the smallest rise since last September, highlighting how recent easings in many commodity prices have fed through to producers. Prices charged at the factory gate also registered the smallest increase for eight months, suggesting that lower cost pressures could also feed through to consumer prices as retailers see pressure come off wholesale prices.

Much of the easing in cost pressures appears to have come from weaker globally traded commodity prices. However, a further lengthening of global supplier lead-times suggests that some underlying upward pressure on prices persisted in May, as demand often outstripped supply.

Global manufacturing output

European dominance

Regional variations were again very evident. The Eurozone manufacturing PMI continued to run at its highest for six years, and the UK's index likewise remained elevated, albeit dipping slightly from April's three-year peak.

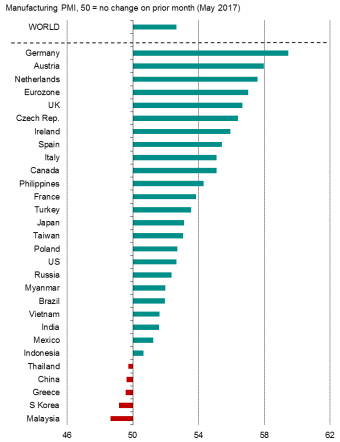

The dominance of European manufacturing was further underscored by the region accounting for all top eight countries in the May worldwide PMI rankings. The fastest growth was recorded in Germany, followed by neighbouring Austria and the Netherlands. The UK was the fourth-fastest growing national manufacturing economy.

Of the 28 countries covered by the PMI surveys, only five saw manufacturing conditions deteriorate in May, four of which were Asian. Although Malaysia reported the steepest downturn, the most significant of the declining manufacturing economies was China. The Caixin PMI fell below 50.0 for the first time in 11 months in May, indicating a renewed deterioration and a marked contrast to the marked improvement in the pace of expansion seen at the turn of the year.

The US and Japanese manufacturing economies meanwhile continued to expand, though the former saw the weakest rate of growth since the presidential election, hampered in part by the strong dollar. Japan, in contrast, recorded one of the strongest upturns seen over the past three years to enjoy the second-fastest rate of expansion of the Asian economies, trailing behind the Philippines.

The varied national performances could in part be attributable to currencies, according to anecdotal evidence, boosting export performance in eurozone countries in particular. The top eight performers in terms of export growth were all euro currency members.

Worldwide manufacturing PMI rankings

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062017-Economics-European-countries-dominate-global-manufacturing-rankings-in-May.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062017-Economics-European-countries-dominate-global-manufacturing-rankings-in-May.html&text=European+countries+dominate+global+manufacturing+rankings+in+May","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062017-Economics-European-countries-dominate-global-manufacturing-rankings-in-May.html","enabled":true},{"name":"email","url":"?subject=European countries dominate global manufacturing rankings in May&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062017-Economics-European-countries-dominate-global-manufacturing-rankings-in-May.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=European+countries+dominate+global+manufacturing+rankings+in+May http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062017-Economics-European-countries-dominate-global-manufacturing-rankings-in-May.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}