Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2017

Philippines manufacturing PMI signals strengthening growth in Q2

The Philippines manufacturing economy showed further signs of shifting up a gear in the second quarter. Output grew at its faster rate so far this year during May, according to the Nikkei PMI. There's also a strong likelihood that the upturn will gain greater momentum in June, amid strong order book growth and buoyant business sentiment.

The survey's headline index moved up from 53.3 in April to 54.3 in May, its highest in the year to date.

Slower expansion in Q1

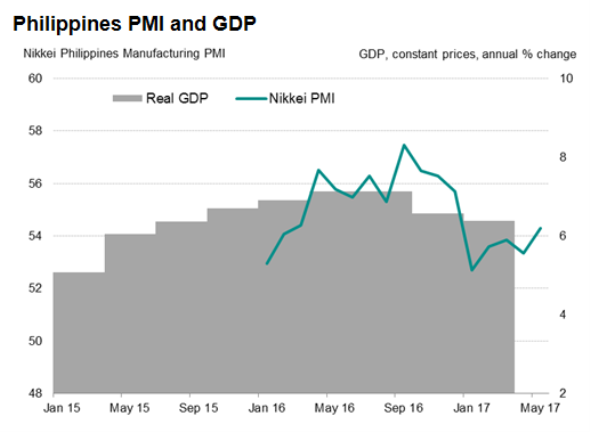

The upturn in the PMI comes as welcome news after a disappointing first quarter. Data from the Philippine Statistics Authority showed gross domestic product rising 6.4% year-on-year in the opening quarter. Though the growth rate remained the envy of many economies, it fell short of the official target range of 6.5-7.5% and was the smallest gain since the final quarter of 2015.

Slower expansion in the services and industry sectors was primarily responsible for the slowdown in first-quarter growth. By expenditure, domestic demand growth, which has been the mainstay of the recent expansion, eased from 8.1% in the fourth quarter of 2016 to 5.8%. The data also showed a sharp post-election pullback in government spending.

Stronger growth expected ahead

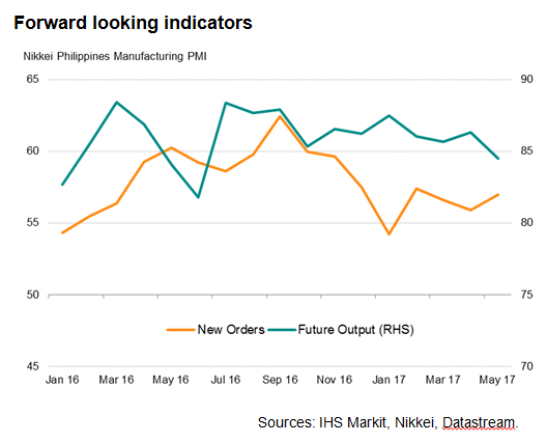

However, PMI survey data indicate that the pace of manufacturing growth has continued to lift higher into the second quarter. Although expansion of total new business remained below the 2016 average, inflows of new work increased to the greatest extent for three months and remained solid overall in May.

Firms continued to feel positive with regards to future economic growth. Even though May saw a moderation in the degree of business confidence across the Philippine manufacturing sector, the level of optimism remained elevated in May.

According to anecdotal evidence, optimism was linked to expectations of further improvements in the domestic and global economies, as well as increased construction activity.

Furthermore, the rollout of the government's infrastructure projects points towards a likely pick-up in construction activities and public spending in the coming months. All of these bode well for the manufacturing sector, helping fuel expectations that economic growth will strengthen in the second quarter.

Slowing inflation

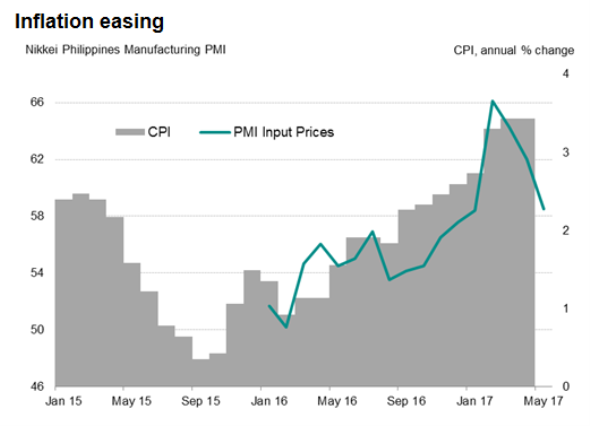

Further welcome news came from signs of a moderation in inflationary pressures. Average input costs grew at the weakest pace in four months, albeit one that was still strong overall, according to the latest Nikkei PMI survey. The signs of slowing inflation will be welcomed by the Bangko Sentral Ng Pilipinas (BSP). The central bank left interest rates unchanged at the last monetary policy meeting, but noted that upside risks to the inflation outlook remain. Official data showed consumer price inflation remained at 3.4% in April, the joint-highest in nearly two-and-a-half years.

Slower increases in input prices, as signalled by survey data, could feed through to an easing in consumer prices. That should allay, to some extent, the BSP's concerns and stave off expectations of an interest rate hike.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-Economics-Philippines-manufacturing-PMI-signals-strengthening-growth-in-Q2.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-Economics-Philippines-manufacturing-PMI-signals-strengthening-growth-in-Q2.html&text=Philippines+manufacturing+PMI+signals+strengthening+growth+in+Q2","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-Economics-Philippines-manufacturing-PMI-signals-strengthening-growth-in-Q2.html","enabled":true},{"name":"email","url":"?subject=Philippines manufacturing PMI signals strengthening growth in Q2&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-Economics-Philippines-manufacturing-PMI-signals-strengthening-growth-in-Q2.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+manufacturing+PMI+signals+strengthening+growth+in+Q2 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01062017-Economics-Philippines-manufacturing-PMI-signals-strengthening-growth-in-Q2.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}