Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2015

Chinese production stabilises as export wins help offset weakening domestic demand

China's manufacturing economy contracted for the eleventh time in the past 12 months in November, according to the Markit-compiled Caixin PMI survey, but the rate of decline eased to the weakest since June.

The Caixin China General Manufacturing PMI rose further from September's six-and-a-half year low, up from 48.3 in October to 48.6. Although the index remained below the 50.0 neutral level, signalling an ongoing deterioration of business conditions which was again led by larger firms, the survey found factory output to have stabilised amid the largest rise in new export orders for just over a year. However, the survey also indicated a further weakening of domestic demand and ongoing job losses in the manufacturing sector. Prices charged also fell at the steepest rate for 20 months, suggesting the deflationary trend continued to intensify.

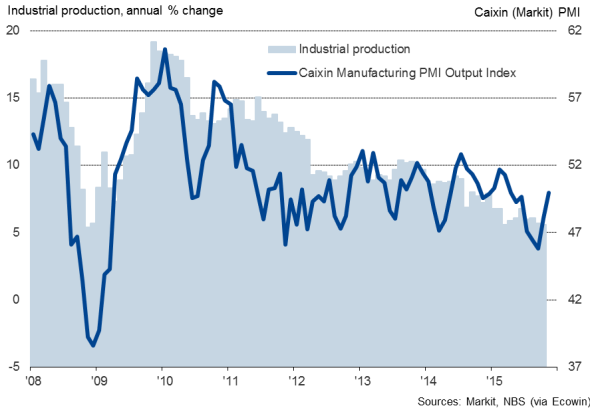

1.Production stabilises

Factory output was unchanged in November, halting a six-month period of continual decline. The survey data indicate that the rate of decline was at its fastest in September but that the trend has improved so far in the fourth quarter. However, the survey has not registered an increase in production since March.

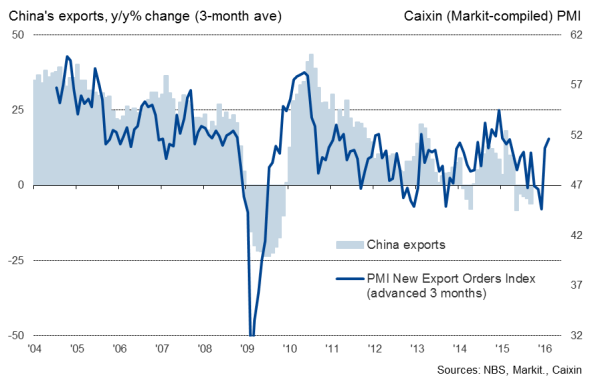

2.Orders fall at increased rate despite export rise

The survey signalled the largest monthly rise in new export orders since October of last year, the second consecutive monthly improvement. The data therefore suggest that the downturn in foreign trade seen throughout much of 2015 is starting to reverse, albeit only modestly.

Despite the upturn in export sales, total orders inflows fell at a slightly increased rate in November, highlighting a further deterioration in demand for manufactured goods from domestic customers.

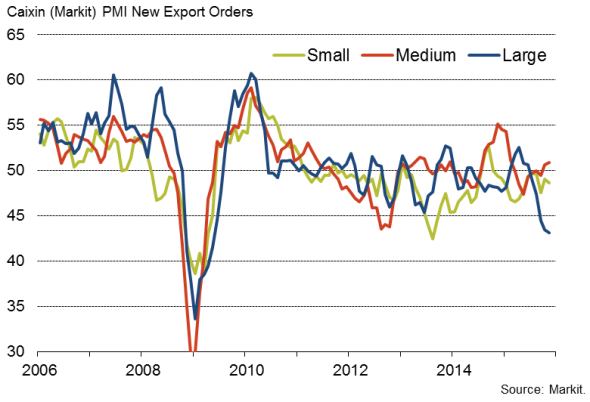

3.Large firms suffer in global markets

Large firms are seeing a steeper drop in order books compared to small and medium sized firms, linked to an ongoing deterioration in export performance at these larger firms. Large firms have seen exports slump in recent months at a rate not seen since the first half of 2009, at the height of the global financial crisis.

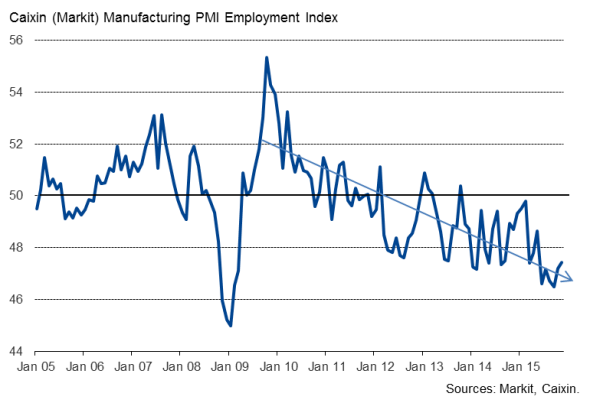

4.Employment maintains strong downward trend

The rate of factory job losses eased slightly in November but remained severe and close to the post-global financial crisis record seen in September. The decline largely reflected ongoing efforts by manufacturers to boost productivity and cut excess capacity, and marks the continuation of a job-cutting trend that has been evident in most months since the start of 2012.

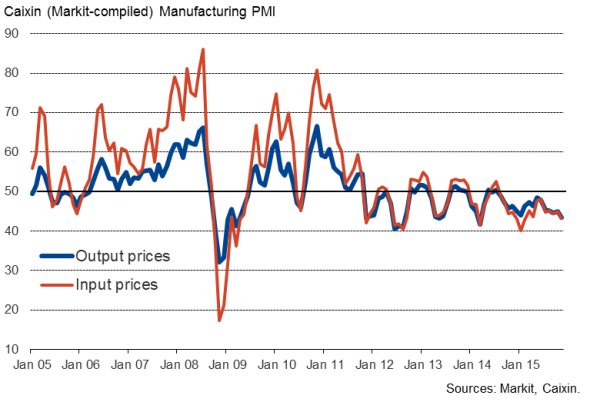

5.Deflationary pressures intensify as supply glut continues

Average producer selling prices meanwhile fell at the steepest rate for 20 months, indicating that the deflationary trend intensified in November. Input prices also dropped at an increased rate, the steepest seen for nine months. With suppliers' delivery times improving in November, pointing to a healthy supply of inputs, the survey suggests there is an ongoing lack of inflationary pressures in supply chains.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Chinese-production-stabilises-as-export-wins-help-offset-weakening-domestic-demand.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Chinese-production-stabilises-as-export-wins-help-offset-weakening-domestic-demand.html&text=Chinese+production+stabilises+as+export+wins+help+offset+weakening+domestic+demand","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Chinese-production-stabilises-as-export-wins-help-offset-weakening-domestic-demand.html","enabled":true},{"name":"email","url":"?subject=Chinese production stabilises as export wins help offset weakening domestic demand&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Chinese-production-stabilises-as-export-wins-help-offset-weakening-domestic-demand.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Chinese+production+stabilises+as+export+wins+help+offset+weakening+domestic+demand http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Chinese-production-stabilises-as-export-wins-help-offset-weakening-domestic-demand.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}