Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2015

Asian manufacturing remains mired in stagnation in November

Manufacturing in Asia more or less stagnated for a second successive month in November, though the steady picture represents an improvement on the steeper declines seen in prior months.

Output, orders and employment were all little-changed across the region during the month.

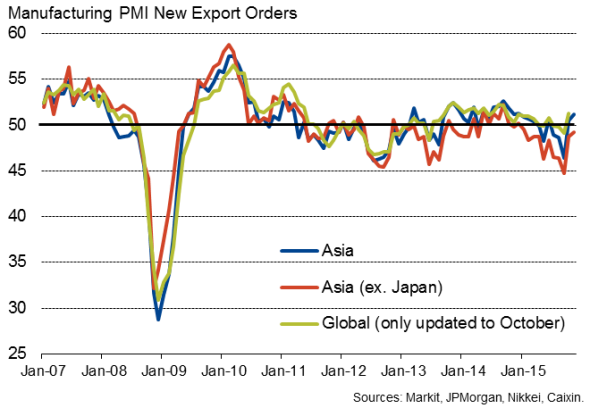

Japan bucked the trend as it registered its best growth for over a year-and-a-half, suggesting Asia ex-Japan continued to act as a drag on global growth. However, exports grew at the fastest rate for almost a year, highlighting a tentative welcome uplift to trade flows.

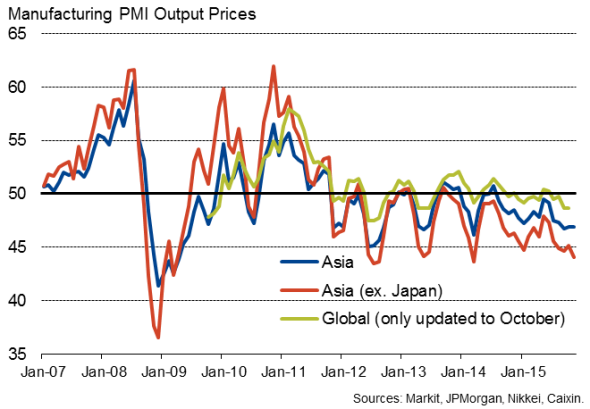

Falling commodity prices and the need to offer discounts to win sales amid weak global demand meanwhile led to average selling prices once again showing one of the steepest drops seen over the past three-and-a-half years, indicating persistent deflationary pressures.

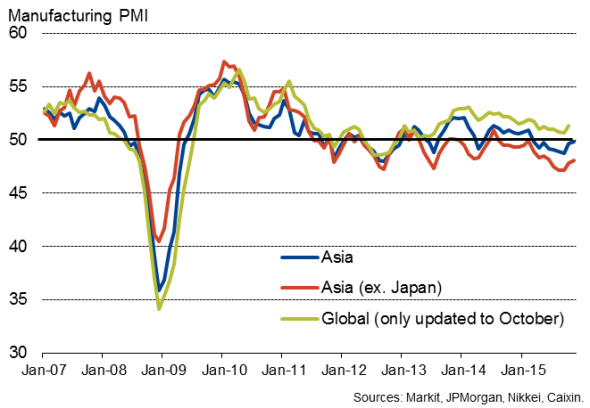

No growth since February

The manufacturing PMI for Asia, compiled by Markit using survey data from around 4,000 companies across eight countries, continued to signal a marginal deterioration of manufacturers' business conditions in November. At 49.8 compared to 49.7 in October, the PMI remained in negative territory for a ninth straight month. Any reading below 50 indicates a worsening of business conditions compared to the prior month.

Asian manufacturing

While an improvement on the steeper rates of decline seen in the four months to September, the latest survey data highlight how Asian manufacturing has failed to register any growth since February and, as such, looks set to continue to act as a drag on global economic growth.

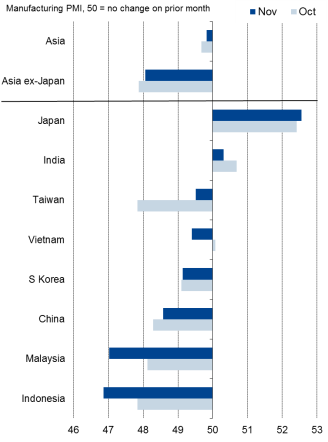

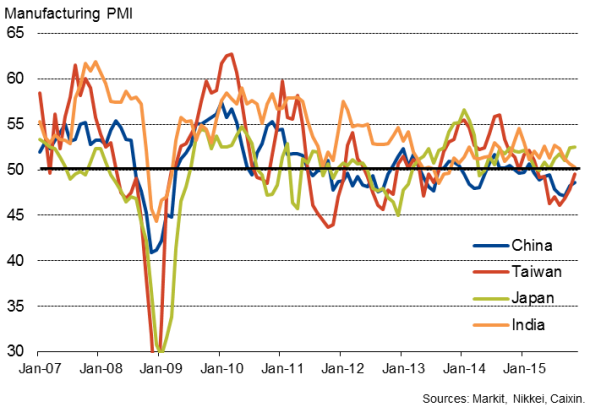

Japan bucks regional trend

The stand-out performer in the region was Japan. At 52.6, the Nikkei PMI for Japan registered the strongest monthly expansion since March of last year, suggesting the Japanese industrial upturn is gaining momentum after having briefly slipped into contraction earlier in the year.

National PMI rankings

Data sourced from national PMI surveys conducted by Markit for Nikkei and Caixin (China).

Japan's upturn is being led by reviving export sales, with overseas orders showing one of the largest gains seen over the past two years. Better export performance was commonly linked to the competitive advantage arising from the weakened yen.

If Japan is excluded, the PMI for the region fell to 48.1. However, rising from 47.9 in October, the Asia-ex Japan PMI signalled the smallest deterioration seen since June, due largely to a slower rate of decline in China. The Caixin PMI for mainland China rose from 48.3 to a five-month high of 48.6.

A rise in the Nikkei PMI for Taiwan, up from 47.8 to 49.5, added further support to the region, registering the smallest contraction seen since Taiwan slipped into decline back in April and a marked turnaround from the steep declines seen in recent months. However, exports continued to fall sharply.

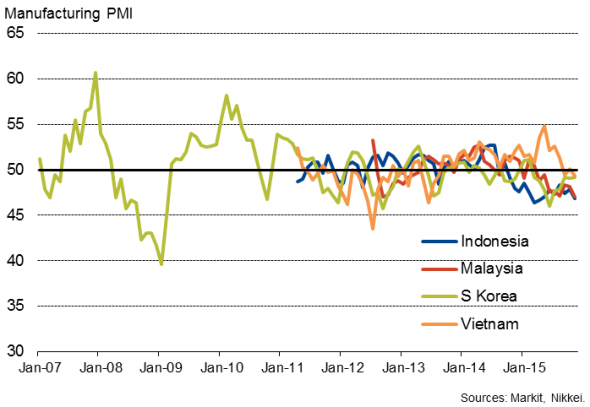

The softening rates of decline in China and Taiwan were offset by steeper downturns in Indonesia and Malaysia, the latter suffering the steepest decline seen since survey data were first collected in mid-2012, with the Nikkei PMI down from 48.1 to 47.0. The weakness of the Nikkei Malaysian PMI appeared to largely be driven by a downturn in domestic demand, though export orders barely rose during the month.

The slump in the Nikkei PMI for Indonesia from 47.8 to 46.9 was the weakest seen since April and the lowest seen across the region in November. Indonesia's underperformance was primarily a function of a steeper drop in export orders than its neighbours, which contributed to one of the largest slumps in overall order books since the survey began in early-2011.

Only moderate downturns were meanwhile seen in South Korea and Vietnam. However, while the former saw an unchanged rate of decline as the Nikkei PMI held steady at 49.1, the decline in Vietnam marked a turnaround from the brief return to (marginal) expansion seen in October. The Nikkei Vietnam PMI dipped from 50.1 to 49.4, signalling only the second monthly downturn in manufacturing activity since August 2013 (though the survey has now indicated falling exports in Vietnam for six successive months).

Besides Japan, the only other Asian economy monitored by the surveys to register an improvement in business conditions was India, though at 50.3 the Nikkei PMI indicated a near-stagnation of activity. The reading was the weakest seen since India's goods producing sector fell into decline just over two years ago, reflecting a combination of weak domestic demand and poor export growth.

Asian national manufacturing PMI surveys

Exports

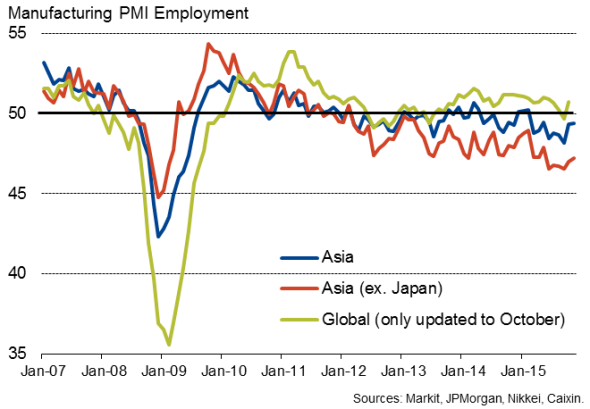

Employment trimmed

Employment fell across Asia for the ninth month running, albeit only modestly as the rate of job losses eased to the lowest since May. It was a steeper rate of decline if a solid rise in Japanese factory employment is excluded, with headcounts in Asia ex-Japan now having fallen for some 45 consecutive months. China and Indonesia saw the most intense rates of job cutting, while renewed headcount trimming was also seen in Malaysia and Vietnam. India, Taiwan and South Korea all saw slight employment gains.

Employment

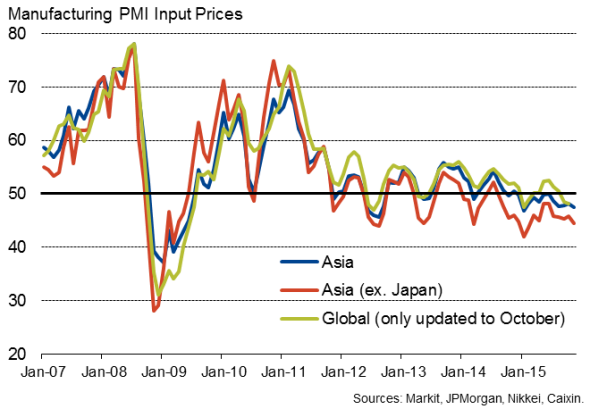

Price fall led by lower oil costs

Input costs fell across Asia at the fastest rate since February, with an even sharper rate of decline seen if Japan is excluded. Firms generally benefitted from falling global commodity prices, notably for oil, but weakened currencies often pushed up import prices. Firms in Malaysia, Indonesia and India consequently saw higher input costs, and rates of decline eased in Taiwan and Vietnam. Producers in China saw the sharpest fall in input costs since August 2012 and prices fell at the steepest rate for two and a half years in South Korea.

Manufacturing input costs

Average selling prices across Asia continued to fall at a rate unchanged on that seen in October, which was in turn the highest for just over one-and-a-half years. Firms in China, Taiwan, South Korea and Vietnam once again cut prices in an effort to boost sales, but prices were hiked in India, Japan, Indonesia and Malaysia, the latter seeing the steepest rate of increase, with selling price inflation hitting a three-and-a-half year survey high.

Manufacturers' selling prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Asian-manufacturing-remains-mired-in-stagnation-in-November.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Asian-manufacturing-remains-mired-in-stagnation-in-November.html&text=Asian+manufacturing+remains+mired+in+stagnation+in+November","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Asian-manufacturing-remains-mired-in-stagnation-in-November.html","enabled":true},{"name":"email","url":"?subject=Asian manufacturing remains mired in stagnation in November&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Asian-manufacturing-remains-mired-in-stagnation-in-November.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Asian+manufacturing+remains+mired+in+stagnation+in+November http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122015-Economics-Asian-manufacturing-remains-mired-in-stagnation-in-November.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}