Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 01, 2015

Languishing UK manufacturing sector sees costs fall at fastest rate since 1999

UK manufacturing continued to languish at the end of the third quarter amid near-stagnant exports, weak business investment and waning consumer demand. Firms started to scale back employment levels for the first time in almost two-and-a-half years in September as a result. Some relief came in the form of the steepest drop in input prices for 16-and-a-half years.

The ongoing stagnation of the manufacturing sector will add to growth worries and helps dovish calls for UK interest rate hikes to be delayed until the sector regains momentum.

1. Slower order growth pushes PMI down to 51.5

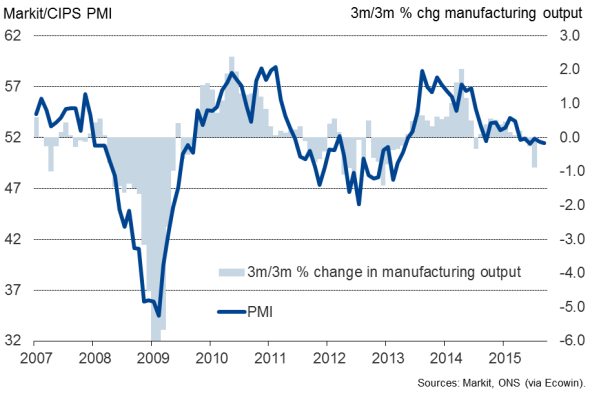

Lower output prices failed to deliver a much-needed boost to sales, with slower new order growth contributing to a further fall in the Markit/CIPS Manufacturing PMI to 51.5 from 51.6 in August, the second-weakest reading seen over the past two-and-a-half years. The survey is broadly consistent with a stagnation of the manufacturing economy when compared with official data.

At 51.7, the third quarter average PMI reading was unchanged on that seen in the second quarter.

2. Consumer boost fades

Key to the weaker PMI reading was a deterioration in business conditions among producers of consumer goods, where the PMI fell below 50.0 for the first time since February 2013. The first drop in orders for consumer goods for two-and-a-half years contrasted markedly with the surge in demand for such goods seen earlier in the year, and indicates that the goods-producing sector has lost a major source of growth.

Orders for investment goods such as plant and machinery picked up slightly but continued to signal only weak demand, pointing to ongoing subdued business investment.

3. Smaller firms hit hardest by global growth jitters

Larger firms are weathering the global economic storm better than smaller companies. While large manufacturers continued to report some, albeit slower, growth of exports, small firms saw overseas sales drop to the greatest extent for just over three years.

Overall export orders rose marginally, improving on the declines seen in prior months but still in stark contrast to the strong overseas sales growth recorded in late-2013 and early-2014.

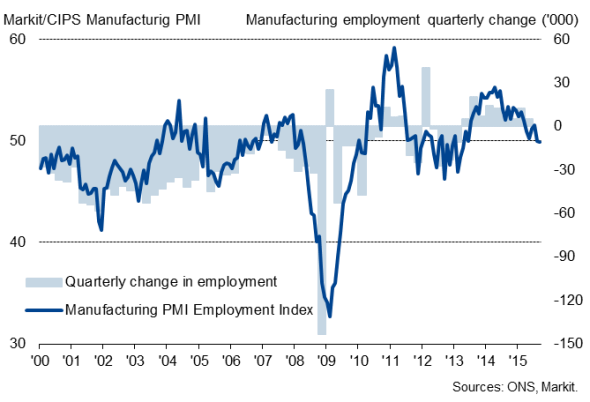

4. Employment dips for first time in 2" years

Worries about future production meanwhile led factory owners to cut staffing levels (albeit only fractionally) for the first time in nearly two-and-a-half years. Although only minor, the drop in headcounts sends a signal that firms are cautious about the business outlook and increasing numbers are starting to consider scaling back production.

5. Input prices fall at fastest rate since 1999

UK manufacturers enjoyed the steepest fall in input prices for 16-and-a-half years in September, highlighting the downturn in inflationary pressures that is resulting from the recent rout in global commodity prices. Average prices charged by producers dropped at the fastest rate for five months as lower costs were often passed on to customers.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Languishing-UK-manufacturing-sector-sees-costs-fall-at-fastest-rate-since-1999.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Languishing-UK-manufacturing-sector-sees-costs-fall-at-fastest-rate-since-1999.html&text=Languishing+UK+manufacturing+sector+sees+costs+fall+at+fastest+rate+since+1999","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Languishing-UK-manufacturing-sector-sees-costs-fall-at-fastest-rate-since-1999.html","enabled":true},{"name":"email","url":"?subject=Languishing UK manufacturing sector sees costs fall at fastest rate since 1999&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Languishing-UK-manufacturing-sector-sees-costs-fall-at-fastest-rate-since-1999.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Languishing+UK+manufacturing+sector+sees+costs+fall+at+fastest+rate+since+1999 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102015-Economics-Languishing-UK-manufacturing-sector-sees-costs-fall-at-fastest-rate-since-1999.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}