Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jul 01, 2016

Loan ETFs see best quarterly inflow in two years

Leveraged loans have managed to steer clear of Brexit jitters, posting another quarter of solid returns.

- Markit iBoxx USD Liquid Leveraged Loans Index returned 2.13% in Q2

- The best performing sectors during the quarter were Technology and Financials

- Leveraged loans ETFs saw $614m of inflows in Q2, the largest since Q1 2014

View the full quarterly loan market data report..

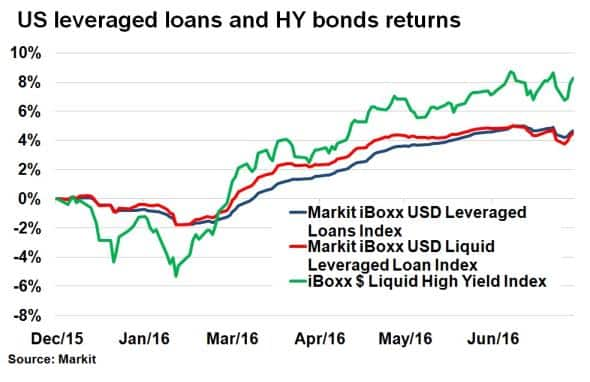

Investor demand for leveraged loans picked up in Q2 as positive risk sentiment prevailed over post-Brexit fears. The Markit iBoxx USD Liquid Leveraged Loans Index ended the quarter up 2.13% on a total return basis, taking it to a total of 4.48% for the year so far.

Brexit waved

After witnessing a dramatic turnaround in Q1 this year, leveraged loans continued to post strong returns into Q2. With Brexit so far showing a minimal impact on returns, factors for the asset class such as stable commodity prices, looser monetary conditions in the US, and falling risk free yields all contributed to positive investor risk sentiment.

It's been quite a turnaround for the leveraged loans this year. The Markit iBoxx USD Liquid Leveraged Loans Index had experienced four consecutive months of negative returns (November 2015 through to February 2016), before rallying in relief in the following three months. At one point in February, leveraged loans were down nearly 2% on a total return basis, but have since erased those losses to end the first half of this year up 4.48%.

While last quarter was the best in three years in terms of returns, Q2 was more subdued but still managed to return 2.13% according to Markit's iBoxx indices. The broader Markit iBoxx USD Leveraged Loan Index ended the quarter up 3.12%, and is now outperforming liquid leveraged loans for the year so far. US high yields bonds however have stolen a march over leveraged loans, and have now returned over 8% so far this year.

Financials and Technology lead

According to Markit's Loan pricing service, the Technology and Financial sectors led spread compression among leveraged loans in Q2. The laggard sector was Energy, although the riskiest names, rated CCC+, saw spread tighten across the board. In terms of regions, North American leveraged loans saw risk fall more than European counterparts in Q2.

Investors dip into ETFs

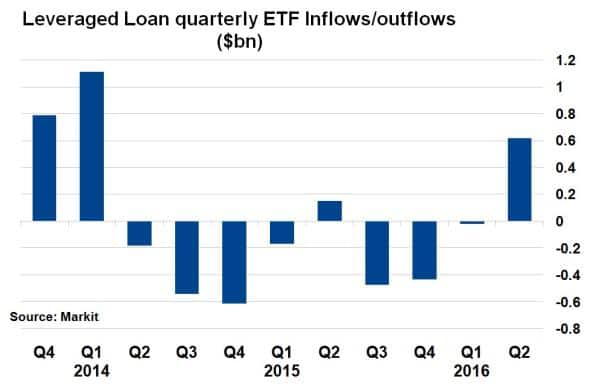

Following on from an impressive March, ETFs tracking US leveraged loans saw their best quarterly inflow in two years. According to Markit's ETP analytics service, ETFs tracking leveraged loans indices saw $614m of inflows in Q2, the highest since Q1 2014 when over $1bn was poured into the asset class. Leveraged loans ETFs now have $6.3bn of AUM.

Settlement volumes pick up

These buoyant trading conditions are also reflected in trading volumes processed by Markit Loans Settlement. Total volumes for the year so far are $ 322bn which is on track to break last year's near record activity. Settlement days have also been falling with the average trade closing in Q2 taking 17.7 days to settle, more than a full day faster than in Q2 last year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Credit-Loan-ETFs-see-best-quarterly-inflow-in-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Credit-Loan-ETFs-see-best-quarterly-inflow-in-two-years.html&text=Loan+ETFs+see+best+quarterly+inflow+in+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Credit-Loan-ETFs-see-best-quarterly-inflow-in-two-years.html","enabled":true},{"name":"email","url":"?subject=Loan ETFs see best quarterly inflow in two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Credit-Loan-ETFs-see-best-quarterly-inflow-in-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Loan+ETFs+see+best+quarterly+inflow+in+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072016-Credit-Loan-ETFs-see-best-quarterly-inflow-in-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}