Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 01, 2015

Short sellers get taste for chocolate producers

Rising cocoa prices have seen short sellers circle in on Swiss listed chocolate manufacturers in recent weeks.

- Barry Callebaut has seen short interest nearly double to 3.6% of shares

- But American firms have not seen the same levels of short selling as their Swiss peers

- Cocoa ETFs have seen their first quarterly inflow in over 12 months

Cocoa has been one of the few good performers in the commodities space so far this year, climbing by over 10% since January according to the Dow Jones UBS Commodity index. Unlike many commodities globally which have suffered in the wake of falling growth in China and other resource-hungry economies, cocoa prices have been surging after Ghana, the second largest production, cut its production forecast for the year by a quarter from the previous year's level.

Although analysts are expecting Ghana's production to bounce back, the current shortfall could see confectioners scramble to find enough cocoa to meet demand. A number of confectioners are trying to limit their consumption by taking steps such as lowering the chocolate content in recipes and making bars smaller. But some are questioning whether the industry will be able to weather the shortfall without passing on price increases to customers. This has in turn seen short sellers hone in on chocolate producers.

Shorts get taste for chocolate

At the centre of the recent increase in short selling are Swiss firms Barry Callebaut and Lindt.

Barry has seen demand to borrow its shares climb from less than 2% of shares outstanding in January to 3.6% as of latest count. Note that the increase in demand to borrow also looks to be linked to the decision by the Swiss government to remove the Swiss franc float freely against the euro. While the rising Swiss franc could help offset the rising cost of cocoa, it may also make it harder for Barry to compete against non-Swiss rivals.

The other firm to see an increase in demand to borrow in recent months is Chocoladefabriken Lindt which has seen demand to borrow climb past the 1.4% mark for the first time since last year; now at twice the level seen at the start of the year.

But it hasn't all been sweetness for short sellers in the sector, as UK firm Thornton's had over 3.5% of its free float out on loan when it announced that it was selling itself to at a 40% premium to where its shares were trading.

Interestingly, American firms Hershey and Mondelez International have not seen the same level of short interest with both firms seeing less than average short interest.

ETF investors scramble

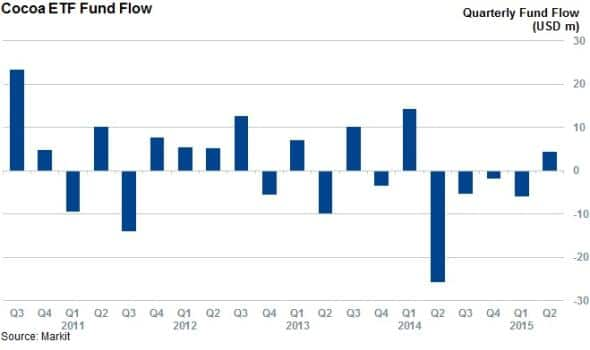

These buoyant cocoa prices have seen cocoa ETFs snap a four quarter string of outflows in Q2 after investors poured over $4.4m into the 22 cocoa tracking funds.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-equities-short-sellers-get-taste-for-chocolate-producers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-equities-short-sellers-get-taste-for-chocolate-producers.html&text=Short+sellers+get+taste+for+chocolate+producers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-equities-short-sellers-get-taste-for-chocolate-producers.html","enabled":true},{"name":"email","url":"?subject=Short sellers get taste for chocolate producers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-equities-short-sellers-get-taste-for-chocolate-producers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Short+sellers+get+taste+for+chocolate+producers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-equities-short-sellers-get-taste-for-chocolate-producers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}