Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2015

UK manufacturing PMI slides to weakest in over two years

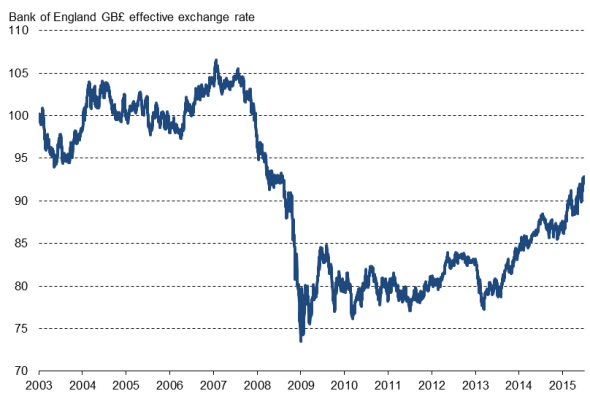

A sharper than expected manufacturing slowdown adds to signs that UK economic growth could disappoint in 2015. The disappointment caused sterling to slide as the weak numbers pushed back expectations of when the Bank of England is likely to start hiking interest rates.

The Markit/CIPS Manufacturing PMI fell to 51.4 in June, its lowest since April 2013. The average PMI reading in the second quarter was the lowest for two years.

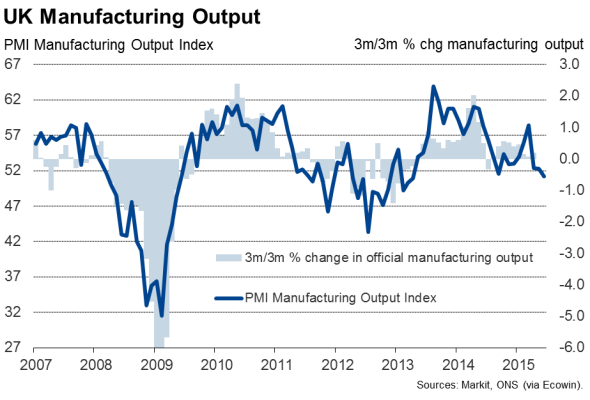

The survey found factory output to have grown at the slowest rate since April 2013, with firms adjusting to slower order book growth. June saw one of the smallest increases in new business recorded over the past two years.

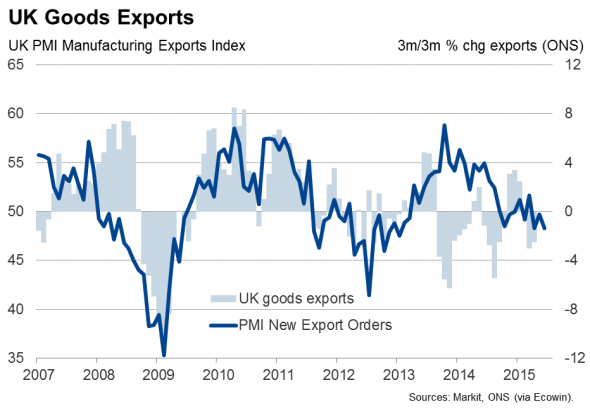

A third consecutive monthly drop in export sales drove the order book weakness. New export orders fell at the joint-fastest rate seen since the start of 2013. The drop in exports was itself commonly linked by companies to the exchange rate. The pound has risen to its highest since 2008 on a trade-weighted basis.

The modest growth in output seen in June was underpinned once again by rising production for consumer goods, reflecting the consumer-spending driven growth seen both at home and in many overseas countries in recent months. Production of intermediate goods (inputs supplied to other companies) more or less stagnated and output of capital goods fell.

Economy underperforming

The weakening production trend suggests that manufacturing could even act as a drag on the economy in the second quarter, raising doubts about the economy's ability to meet what are looking like optimistic official growth forecasts.

The Bank of England and Office for Budget Responsibility are forecasting growth of 2.5% in 2015, but given the weak start to the year, with GDP rising by just 0.4% in the first quarter, this requires an average expansion of 0.6% in each of the remaining three quarters.

The PMI data available so far for the second quarter, including today's manufacturing data, are consistent with GDP rising by only 0.5%. Manufacturing looks set to contract by 0.2%, according to the PMI.

Costs start rising again

There was mixed news on inflation. Input costs rose for the first time since August of last year, largely reflecting the lifting of oil prices from their recent lows earlier in the year. Although dipping in June from May's recent highs, oil prices remained almost a third higher than their low earlier in the year on average in June. However, there's little sign of rising costs being passed on to customers. Average selling prices in fact fell marginally, due mainly to companies competing on price in an increasingly tough market to win sales. The combination of rising costs and falling output prices points to a squeeze on profits.

Employment rose modestly, but the rate of growth has slowed markedly since earlier in the year, reflecting slower order book growth. Headcounts also look set to come under increasing pressure in coming months as manufacturers reported the steepest drop in unfinished orders for over two years. With less work-in-hand, firms will soon seek to reduce capacity.

UK Manufacturing Employment

Concern at the Bank

The slower than expected growth of the economy so far this year, alongside weak inflationary pressures (albeit with wage growth finally showing signs of lifting higher), is likely to cause policymakers to push back their views on when the economy may be sufficiently robust to withstand higher interest rates. Much will, however, depend on the performance of the service sector, data for which are published on Friday.

Exchange rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-uk-manufacturing-pmi-slides-to-weakest-in-over-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-uk-manufacturing-pmi-slides-to-weakest-in-over-two-years.html&text=UK+manufacturing+PMI+slides+to+weakest+in+over+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-uk-manufacturing-pmi-slides-to-weakest-in-over-two-years.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing PMI slides to weakest in over two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-uk-manufacturing-pmi-slides-to-weakest-in-over-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+PMI+slides+to+weakest+in+over+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01072015-economics-uk-manufacturing-pmi-slides-to-weakest-in-over-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}