Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 01, 2016

China manufacturing PMI shows steepest job losses for seven years

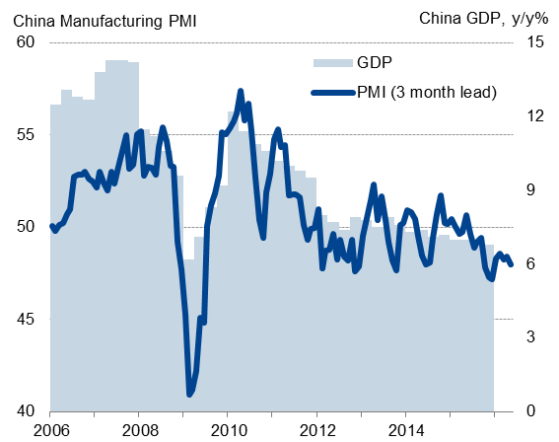

The Caixin China General Manufacturing PMI" survey, compiled by Markit, showed business conditions deteriorating at the fastest rate for five months in February. The PMI dropped from 48.4 in January to 48.0.

Production fell at the steepest rate since last September as new order inflows fell for the eleventh time in the past 12 months. Exports led the decline in new order books.

Caixin Manufacturing PMI

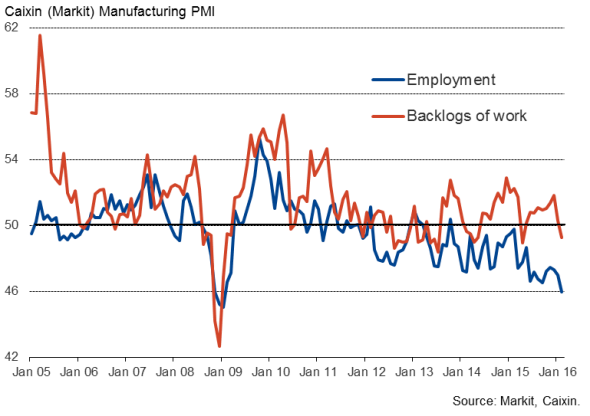

Backlogs of work - which measures firms' pipelines of orders received but not yet completed - showed the first fall in ten months. Reduced backlogs of work are an indication of firms having excess capacity relative to demand.

Stocks of finished goods fell at the fastest rate for over four years as many firms deliberately wound-down inventories in the face of weak demand, focusing on cost-cutting.

Capacity reduction continues

Perhaps most worrying of all, however, was the accelerating pace of job looses signalled by the survey. Factory employment suffered the largest monthly fall since January 2009, when jobs were being culled at the height of the global financial crisis.

The steepening decline in employment indicates that the process of reducing excess capacity in the manufacturing sector is still very much ongoing. We note that larger firms have seen particularly steep job cutting, with a more modest rate of job losses seen in smaller firms.

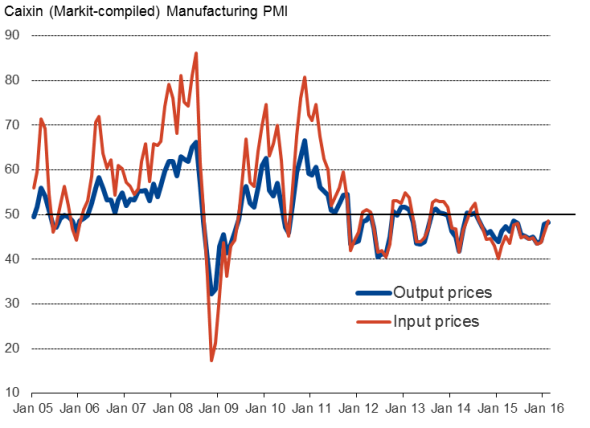

Deflationary pressures showed some signs of moderating, though both input prices and manufacturers' selling prices continued to fall. Rates of decline were nevertheless the slowest for 18 and nine months respectively.

Deflationary pressures ease

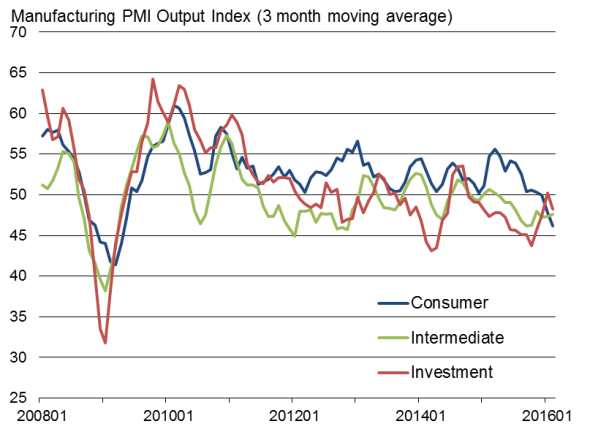

Consumer facing businesses are suffering the worst conditions, reporting the steepest downturns in production and exports since the global financial crisis in recent months, raising concerns about the extent to which global consumer spending is being buoyed by lower oil prices.

Demand, including exports sales, of investment goods such as plant and machinery, has been somewhat more stable in prior months, though declined sharply again in February.

Consumer sector hardest hit

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01032016-Economics-China-manufacturing-PMI-shows-steepest-job-losses-for-seven-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01032016-Economics-China-manufacturing-PMI-shows-steepest-job-losses-for-seven-years.html&text=China+manufacturing+PMI+shows+steepest+job+losses+for+seven+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01032016-Economics-China-manufacturing-PMI-shows-steepest-job-losses-for-seven-years.html","enabled":true},{"name":"email","url":"?subject=China manufacturing PMI shows steepest job losses for seven years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01032016-Economics-China-manufacturing-PMI-shows-steepest-job-losses-for-seven-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+manufacturing+PMI+shows+steepest+job+losses+for+seven+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01032016-Economics-China-manufacturing-PMI-shows-steepest-job-losses-for-seven-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}