May 20, 2016 - Weekly Pricing Pulse

The MPI decline marks stronger global headwinds as we move to late spring and early summer. Buying opportunities may arise.

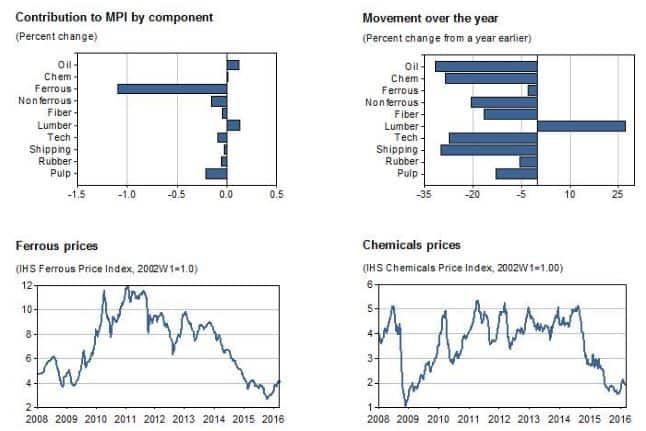

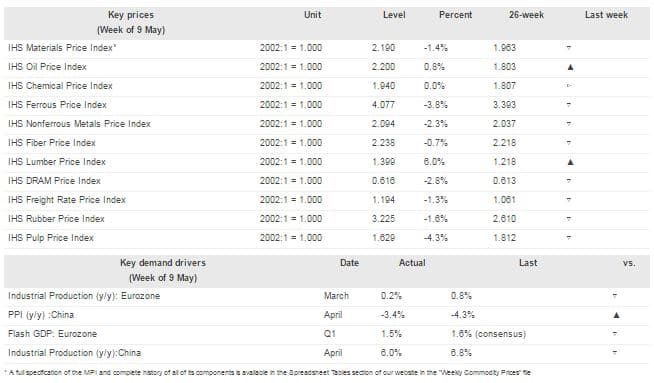

Growing global economic anxiety finally took its toll on the IHS Materials Prices Index (MPI) last week. The overall index declined 1.4%, breaking a four-week run of consecutive increases. Nonetheless, oil prices continued to hold up in light of a tightening global market and concerns about Canadian production. For perspective, oil-price benchmarks are up some 80% since mid-January. However, declining metal prices ended up dragging the MPI down. The ferrous subindex, in particular, fell 3.8% with iron ore prices pulling back from $60/metric ton. This ended a four-week expansion as concerns grew about the sustainability of Chinese consumption. The nonferrous subindex also dropped 2.3%.

Declines in metals also occurred alongside disappointing industrial production growth in China—April showed year-over-year growth of 6.0% compared with 6.8% in March while Eurozone GDP growth in the first quarter was revised down slightly.

An MPI decline was not unexpected given the relatively soft global fundamentals that we have been highlighting over recent weeks. While the recent rally in commodities may have reflected, in part, the fact that prices undershot fundamentals in the fourth quarter, their continued rise needs to be linked to improving physical markets. In this regard seasonal and structural factors will pose more headwinds as we move to early summer and overall liquidity decreases. Oil markets may provide some support if supply-side bottlenecks continue to flare up, but the broader commodity complex needs to see global manufacturing activity faring better.