Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 18, 2018

Zambian private sector makes solid recovery after recent cholera outbreak

- PMI signals an improvement in business conditions for the third month in succession

- Business activity shows solid growth after a weak start to 2018

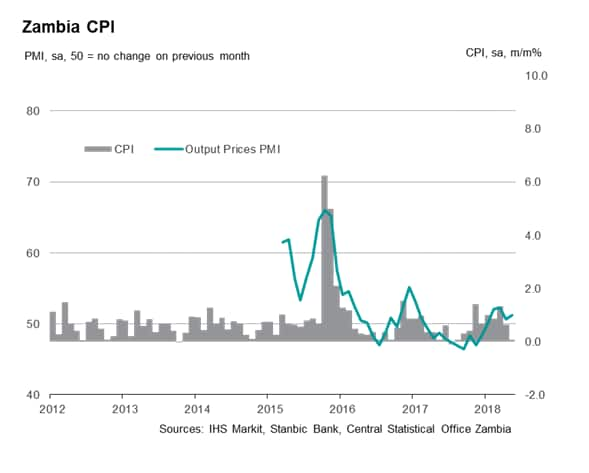

- Modest inflationary pressures evident following interest rate reduction in February

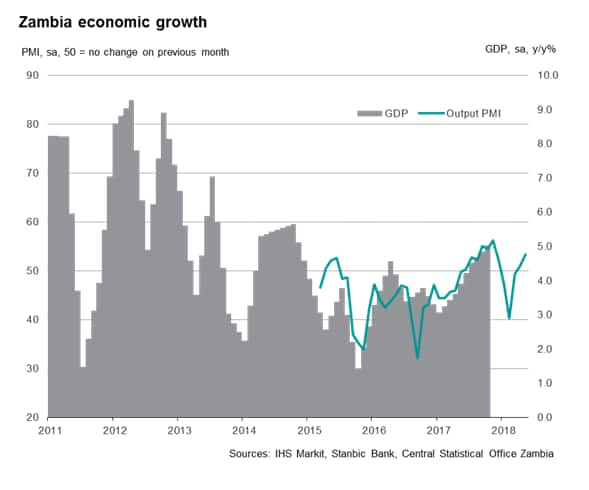

Growth in the Zambian economy has regained momentum during the second quarter so far, indicating that the effects of the recent cholera outbreak have now subsided. The economy should therefore be on course to return to the solid growth rates seen at the end of 2017.

Latest data from the Stanbic Bank PMI survey, compiled by IHS Markit, signalled a third consecutive monthly improvement in business conditions during May. In particular, output rose for the second month in succession following a three-month period of decline. Encouragingly, the May survey data also pointed to a marked increase in order volumes, boding well for strong production in June. As a result, it is likely that the second quarter of 2018 will see GDP growth pick up, following an expected slowdown in the first three months of the year.

Economy overcomes cholera outbreak

Zambia was hit by a widespread cholera outbreak over the first quarter of 2018. Output in particular was affected, as a number of businesses were forced to close in order to prevent the spread of the disease. In fact, the survey data highlight how business activity contracted sharply in February, dropping at the fastest pace observed since declining copper prices hit the economy in late-2016.

More recently, business activity has rebounded, with the PMI averaging 51.8 in the second quarter so far against an average of 49.5 in the first quarter. Moreover, new orders have risen solidly as demand strengthened. May saw the largest monthly rise in new orders since the survey began in March 2015.

However, employment remained a weak point. Despite the recent uptick in output and new business, workforce numbers fell in May, and have failed to rise in each of the past three months. The drop in employment likely reflects on-going difficulties filling vacancies, though also hints at the possibility of some weakening of underlying growth since last year.

Price pressures

PMI data have meanwhile also signalled a sustained, albeit modest, increase in average selling prices since the last interest rate reduction to 9.75% in February. Anecdotal evidence suggested prices were hiked due to the need to increase margins as costs rose. However, despite accelerating mid-quarter, the latest selling price index reading remained below the series average, providing another suggestion that demand may have cooled slightly compared to late last year and thus raising the possibility of further interest rate reductions as the year progresses. IHS Markit expects the policy rate to fall to around 9.25% by the end of 2018.

Recovery set to continue

Despite potentially dampened growth figures over the first quarter of 2018, IHS Markit is predicting a solid overall GDP growth rate of 3.8% in 2018 following a 4.1% rise in 2017. An expected continuation of higher copper prices combined with lower interest rates and weaker inflation are likely to fuel growth over the year, with the PMI providing timely updates on how the economy is progressing.

However, the outcome of the continuing talks with the International Monetary Fund regarding a long-awaited aid package will play an important role going forward. Ongoing delays have caused investors to take a more cautious approach as highlighted by increasing yields for the country's Eurobond's mid-quarter.

Gabriella Dickens, Economist, IHS Markit

Tel: +44 1491 461 008

gabriella.dickens@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

Learn how to access and receive PMI data

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fzambian-private-sector-makes-solid-recovery-after-recent-cholera-outbreak.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fzambian-private-sector-makes-solid-recovery-after-recent-cholera-outbreak.html&text=Zambian+private+sector+makes+solid+recovery+after+recent+cholera+outbreak+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fzambian-private-sector-makes-solid-recovery-after-recent-cholera-outbreak.html","enabled":true},{"name":"email","url":"?subject=Zambian private sector makes solid recovery after recent cholera outbreak | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fzambian-private-sector-makes-solid-recovery-after-recent-cholera-outbreak.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Zambian+private+sector+makes+solid+recovery+after+recent+cholera+outbreak+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fzambian-private-sector-makes-solid-recovery-after-recent-cholera-outbreak.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}