Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 03, 2020

WTO leadership race

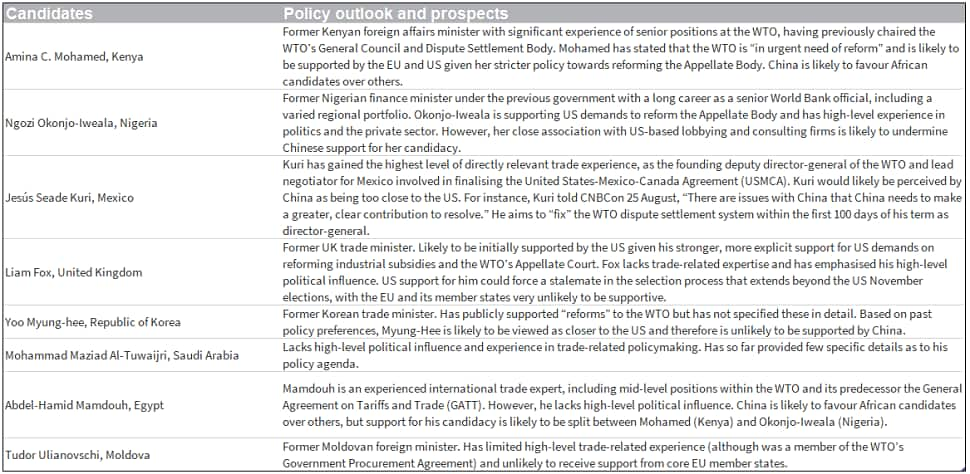

The current director-general of the World Trade Organization (WTO), Ricardo Azevêdo, will leave his post on 31 August, one year before his mandate officially expires. Eight candidates have been nominated to be his successor. The 164 members of the WTO's General Council must select a shortlist of five candidates over 7-16 September, before coming to a consensus on the appointment of a new director-general before 7 November 2020 or otherwise conduct a vote as a last resort.

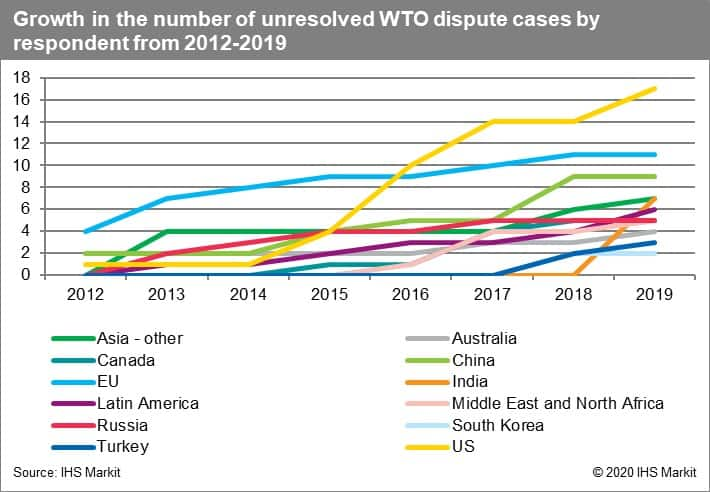

- The Trump administration will almost certainly back a candidate for director-general who supports reforms to the WTO that create a more level playing field (given US claims that China undertakes unfair trade practices) and that limits the remit of the Appellate Body (AB); these reforms will remain priorities regardless of the US election outcome. President Donald Trump's administration has advanced numerous grievances regarding the WTO's role and function. The independence and remit of the AB was criticised during the term of former president Barack Obama, resulting in his administration opposing the appointment of two judges to the AB in 2011 and 2016 respectively. Since 2017, the Trump administration has escalated the US's push for reforms to the WTO by blocking all appointments to the WTO's AB, which has prevented it from hearing new appeals through the WTO's dispute settlement system. US Trade Representative Robert Lighthizer on 21 August 2020 in TheWall Street Journal outlined a five-point plan for reforming the WTO. Notably, he reiterated that new rules should be established that "stop the economic distortions that flow from China's state capitalism", better enforcement of the most-favoured-nation principle, mandating "baseline tariff rates that apply to all", and that WTO dispute resolution should be "akin to commercial arbitration" by establishing "ad hoc tribunals". The WTO is viewed by the Trump administration as facilitating weaker domestic industry and employment offshoring in contradiction to President Trump's "America First" programme. Regardless of the outcome of the US presidential election in November, the US probably will continue seeking reforms to the WTO in multiple areas, most immediately the dispute settlement process, use of industrial subsidies, and anti-dumping rules.

- The Chinese government would most likely favour as WTO director-general candidates less exposed to US influence, favouring neutral candidates from Egypt, Kenya, or Nigeria over others. The Chinese leadership has yet to provide a clear indication on its preferred candidate. However, the content of any candidate's reform agenda is likely to be less important than whether the candidate maintains friendly ties amid an increasingly competitive US-China relationship and is less exposed to political influence from the US. Favourable candidates are, therefore, likely to include ones from Egypt, Kenya, and Nigeria. This rationale is reflected in China having achieved greater representation in multilateral affairs with support from African countries, such as the election of Qu Dongyu as the head of the UN Food and Agricultural Organization (FAO), which Foreign Minister Wang Yi attributed to "staunch support" from Africa. China will likely follow the African Union's decision if it announces support for a candidate. So far, the AU has not publicly stated its preference.

- The European Union has similar trade and investment objectives to those of the US, likely aligning with Washington on intellectual property rights, state subsidies, and human rights and labour rights issues. The EU is a WTO member but it has not fielded a candidate, after European Trade Commissioner Phil Hogan dropped out of the race in June 2020 because of insufficient support from EU member states. For the EU, which has exclusive competence over its member states in trade matters, holding the director-general's position is likely less important than unblocking the AB's ability to deliver dispute resolutions. The EU supports reforms that strengthen monitoring and compliance rules, also in the context of China's insufficient compliance with the rules, and potentially incorporate environmental and labour rights considerations into WTO standards.

- A pathway for achieving a consensus under any new WTO director-general is indicated by the EU, Japan, and the US having already in January 2020 proposed the application of stricter regulations on heavily subsidising countries. The EU, Japan, and the US agreed in January 2020 to limit industrial subsidies among WTO members and discussed ways to address forced technology transfers. The three countries also agreed that WTO members using excessively large subsidies will need to demonstrate that they have no adverse impact on trade and that the subsidies applied are transparent. The proposals are more likely to satisfy US concerns over the EU not distinguishing between market and non-market economies when calculating dumping margins, which it perceives to benefit Chinese trade. Crucially, China is likely to support these proposals because this would help it continue to build alliances within the WTO.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwto-leadership-race.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwto-leadership-race.html&text=WTO+leadership+race+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwto-leadership-race.html","enabled":true},{"name":"email","url":"?subject=WTO leadership race | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwto-leadership-race.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=WTO+leadership+race+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwto-leadership-race.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}