Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 23, 2026

Week Ahead Economic Preview: Week of 26 January 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

FOMC meets to set US interest rates while Europe awaits GDP data

Rate setters meet at the US Federal Reserve amid a slew of fresh economic indicators and alongside other central bank policy meetings in Canada, Sweden and Brazil. The eurozone, Mexico, Taiwan and the Philippines meanwhile all report GDP numbers, leading up to China's mainland PMI data the following weekend.

No change is expected as the Federal Open Markets Committee meets to set US interest rates. Having already cut three times late last year, there's a widespread expectation that policymakers will err toward caution and hold rates steady at 3.5-3.75% as they assess the outlooks for growth, inflation and employment.

US economic growth has proven resilient in recent months, albeit with signs of some momentum being lost at the turn of the year according to flash PMI numbers. And, while official inflation data have been encouragingly muted compared to the hawkish expectations of some policymakers, the survey data point to tariff-related price pressures persisting down supply chains. However, the job market remains a key concern, with low job creation evident despite the ongoing economic expansion, likely resulting in a bias toward further rate cuts. Hence the rhetoric from the Fed will be closely monitored to weigh up the outlook for rates. Our experts in fact expect the Fed to hold rates steady through the first half of 2026 before reaching a neutral range of 3.00% to 3.25% by the end of 2026.

US economic data on durable goods orders, factors orders, consumer sentiment, the housing market and producer prices, as well as several regional manufacturing surveys, will also provide insights into US economic trends.

Meanwhile, eurozone GDP growth is released for the fourth quarter, which flash PMI survey data hint at showing a modest expansion of approximately 0.3%. While a slightly more sluggish pace was indicated for January by the flash eurozone PMI, the survey has signalled a welcome resurgence in business optimism about the year ahead.

In Asia, fourth quarter GDP data are released for both Taiwan and Indonesia, and government-compiled PMI data will also be released for mainland China. The latter will be monitored for clues as to whether the economy shows signs of rebalancing away from trade toward domestic consumption. Japan's central bank minutes and industrial production data also come under the spotlight as survey data hint at a growing likelihood of further rate hikes.

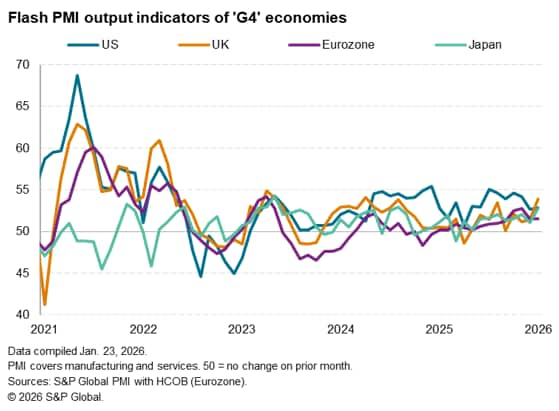

Flash PMIs show UK leading G4 economies in terms of business growth in January

As US business output growth remained stuck in a lower gear in January, an acceleration of growth reported by UK firms meant the UK knocked the US off the top of the G4 growth rankings.

Having led the developed world expansion over much of the past two years, US businesses have reported weaker demand growth and subdued confidence around the turn of the year, as well as higher prices, in contrast to accelerating growth and rising confidence in the UK and Japan. While the eurozone's expansion remained subdued, it nevertheless reported a surge in business confidence about the year ahead, adding further to signs that the US's outperformance may be waning.

Key diary events

Monday 26 Jan

Americas

- US Durable Goods Orders (Nov)

- US Chicago Fed National Activity Index (Dec)

- US Dallas Fed Manufacturing Index (Jan)

EMEA

- Germany Ifo Business Climate (Jan)

APAC

Australia, India Market Holiday

- Singapore Industrial Production (Dec)

Tuesday 27 Jan

Americas

- Mexico Balance of Trade (Dec)

- US ADP Weekly Employment Change

- US S&P/Case-Shiller Home Price (Nov)

- US CB Consumer Confidence (Jan)

- US New Home Sales (Dec)

- US Richmond Fed Manufacturing Index (Jan)

EMEA

- France Consumer Confidence (Jan)

- Spain Unemployment Rate (Q4)

APAC

- Australia NAB Business Confidence (Dec)

- Philippines Trade (Dec)

- China (Mainland) Industrial Profits (Dec)

- Hong Kong SAR Balance of Trade (Dec)

Wednesday 28 Jan

Americas

- US Durable Goods Orders (Dec)

- Canada BoC Interest Rate Decision

- US EIA Crude Oil Stocks Change

- US Fed FOMC Interest Rate Decision

- Brazil BCB Interest Rate Decision

EMEA

- Austria Manufacturing PMI* (Jan)

- Germany GfK Consumer Confidence (Feb)

- Italy Business Confidence (Jan)

APAC

Malaysia Market Holiday

- Japan BoJ Monetary Policy Meeting Minutes (Dec)

- Australia Inflation (Dec)

- India Industrial Production (Dec)

Thursday 29 Jan

Americas

- Canada Balance of Trade (Nov)

- US Balance of Trade (Nov)

- US Factory Orders (Nov)

EMEA

- Sweden GDP (Q4, flash)

- Switzerland Balance of Trade (Dec)

- Türkiye Unemployment Rate (Dec)

- Sweden Riksbank Rate Decision

- Eurozone Economic Sentiment (Jan)

- Eurozone Consumer Confidence (Jan, final)

- Italy Industrial Sales (Nov)

- Spain Business Confidence (Jan)

- South Africa SARB Interest Rate Decision

APAC

Malaysia Market Holiday

- New Zealand Balance of Trade (Dec)

- Philippines GDP (Q4)

- Japan Consumer Confidence (Jan)

Friday 30 Jan

Americas

- Mexico GDP (Q4, prelim)

- Canada GDP (Dec, prelim)

- US PPI (Dec)

- US Chicago PMI (Jan)

EMEA

- France GDP (Q4, prelim)

- UK Nationwide Housing Prices (Jan)

- Spain GDP (Q4, flash)

- Spain Inflation (Jan, prelim)

- Germany GDP (Q4, flash)

- Italy GDP (Q4, adv)

- UK Mortgage Lending and Approval (Dec)

- Eurozone GDP (Q4, flash)

- Germany Inflation (Jan, prelim)

APAC

- South Korea Industrial Production (Dec)

- Japan Unemployment Rate (Dec)

- Japan Industrial Production (Dec, prelim)

- Australia PPI (Q4)

- Taiwan GDP (Q4, adv)

Saturday 31 Jan

APAC

- China (Mainland) NBS PMI (Jan)

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-january-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-january-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+26+January+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-january-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 26 January 2026 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-january-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+26+January+2026+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-january-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}