Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 30, 2026

Week Ahead Economic Preview: Week of 2 February 2026

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

PMIs, payrolls and policy meetings

Highlights from the coming week's data diary include the US employment report, global PMI surveys and eurozone inflation, while central bank decisions are scheduled for the UK, the euro area and Australia.

PMI surveys of both manufacturing and service sector business conditions are published during the week and will provide insights into growth, trade, inflation and job market trends around the world at the start of 2026. Prior data showed global growth having cooled to a six-month low in December, in part linked to a slowing US economy. This softer pace of US growth likely persisted into January, according to the flash PMIs, contrasting with some more encouraging signals from Europe and Japan. PMI updates from mainland China and ASEAN economies will also be eagerly awaited, especially after the latter showed signs of reviving despite the uncertain global trade environment.

The PMIs build the scene ahead of Friday's non-farm payroll report, which will provide guidance on a key area of concern to US policymakers. With inflation having so far proven more benign that many hawks had feared, the focus has been on the need to cut rates in response to the recent softness of the labor market. December's report showed just 50k jobs created after a similarly subdued 56k rise in November, with the unemployment rate running at 4.4%, one of the highest rates for four years. But there is a growing belief that a more serious downturn in the labor market might be necessary to prompt any further loosening from the Fed, meaning Friday's report could prove material in guiding rate expectations.

No change in policy is meanwhile expected when ECB rate setters meet on Thursday, with the central bank seeing itself as being in a "good place". Eurozone inflation has been hovering around the ECB's target in recent months, and the economy is showing modest signs of improvement.

While Bank of England officials have also become more relaxed about the inflation outlook, and there are signs that UK business activity has picked up since last year's Budget, there are worries about the growth outlook amid a slumping labour market. Although no change in policy is priced in by many for the coming week's Bank of England meeting, a rate cut is seen as a possibility in March.

In APAC, market anticipation has built for a February hike by the Reserve Bank of Australia following recent upside CPI surprises, though the latest flash PMI data suggest that price pressures could moderate again in the coming months.

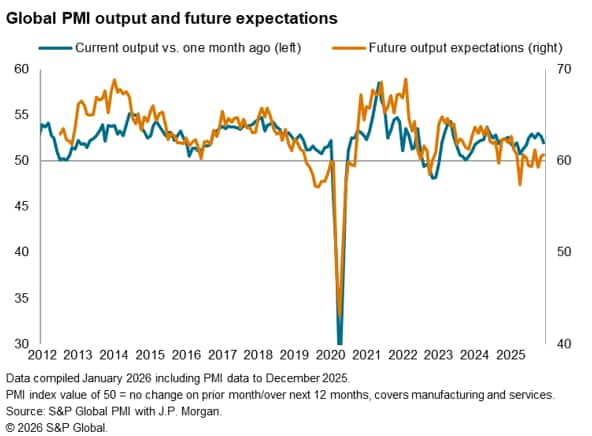

How long can business output growth diverge from expectations?

Over much of 2025 the worldwide PMI surveys tracked an unusual divergence whereby robust, resilient global business output growth (and GDP) contrasted with historically subdued levels of business confidence (as measured by firms' expectations of growth over the coming year). Doubts over whether this resilience can be sustained into 2026 were raised by output growth succumbing to a six-month low in December. January's PMI data, due in the coming week, will therefore provide new insights into these output and sentiment trends, and likely set the scene for the global economic outlook over 2026.

We will be looking to see whether resilience has persisted with December being a temporary slowdown, or whether output growth has continued to moderate in the face of low business optimism. More worryingly, have business confidence and growth cooled further amid heightened geopolitical concerns?

Key diary events

Monday 2 Feb

Worldwide Manufacturing PMIs, incl. global PMI* (Jan)

Americas

Mexico Market Holiday

- US ISM Manufacturing PMI (Jan)

EMEA

- Germany Retail Sales (Dec)

- Switzerland Retail Sales (Dec)

APAC

Malaysia Market Holiday

- Indonesia Balance of Trade (Dec)

- Indonesia Inflation (Jan)

Tuesday 3 Feb

Americas

- Brazil Industrial Production (Dec)

- Mexico Business Confidence (Jan)

- Mexico Manufacturing PMI* (Jan)

- US JOLTs Job Openings (Dec)

EMEA

- Türkiye Inflation (Jan)

- France Inflation (Jan, prelim)

- Spain Unemployment Change (Jan)

APAC

- South Korea Inflation (Jan)

- Australia Building Permits (Dec, prelim)

- Taiwan Consumer Confidence (Jan)

- Australia RBA Interest Rate Decision

- Hong Kong SAR GDP (Q4, adv)

- Pakistan Inflation (Jan)

Wednesday 4 Feb

Worldwide Services, Composite PMIs, inc. global PMI* (Jan)

Global Sector PMI* (Jan)

Americas

- US ADP Employment Change (Jan)

- US ISM Services PMI (Jan)

EMEA

- Eurozone Inflation (Jan, flash)

- Italy Inflation (Jan, prelim)

APAC

- New Zealand Employment Change (Q4)

Thursday 5 Feb

Americas

- US Initial Jobless Claims

- US Balance of Trade (Dec)

- Brazil Balance of Trade (Jan)

- Mexico Banxico Interest Rate Decision

EMEA

- Germany Factory Orders (Dec)

- France Industrial Production (Dec)

- Eurozone HCOB Construction PMI* (Jan)

- Italy Retail Sales (Dec)

- UK S&P Global Construction PMI* (Jan)

- Eurozone Retail Sales (Dec)

- UK BoE Interest Rate Decision

- Eurozone ECB Interest Rate Decision

APAC

Pakistan Market Holiday

- Australia Balance of Trade (Dec)

- Philippines Inflation (Jan)

- Thailand Inflation (Jan)

- Indonesia GDP (Q4)

- Taiwan Inflation (Jan)

Friday 6 Feb

Americas

- Canada Employment Change (Jan)

- US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings

(Jan)

- US UoM Sentiment (Feb, prelim)

EMEA

- Germany Balance of Trade (Dec)

- Germany Industrial Production (Dec)

- Sweden Inflation (Jan, prelim)

- France Balance of Trade (Dec)

- Spain Industrial Production (Dec)

- Switzerland Unemployment Rate (Jan)

- UK Halifax House Price Index* (Jan)

APAC

New Zealand Market Holiday

- Japan Household Spending (Dec)

- Philippines Industrial Production (Dec)

- India RBI Interest Rate Decision

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-february-2026.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-february-2026.html&text=Week+Ahead+Economic+Preview%3a+Week+of+2+February+2026+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-february-2026.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 2 February 2026 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-february-2026.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+2+February+2026+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-february-2026.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}