Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 14, 2020

Corporate Bond Pricing Data - June 2020 Recap

US Treasury Movement

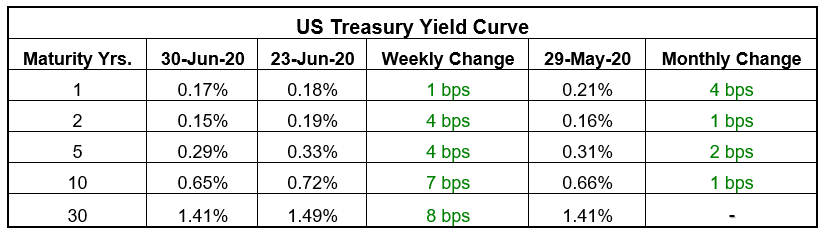

Over the month of June, the US Treasury curve tightened. The table below summarizes weekly and monthly performance across the curve, followed by a snapshot of the 30 year's performance in more detail, sourced from our Price Viewer portal.

The 30-year yield started the month at 1.41%, it widened to

1.67% in early June, then tightened shortly after, finishing the

month unchanged.

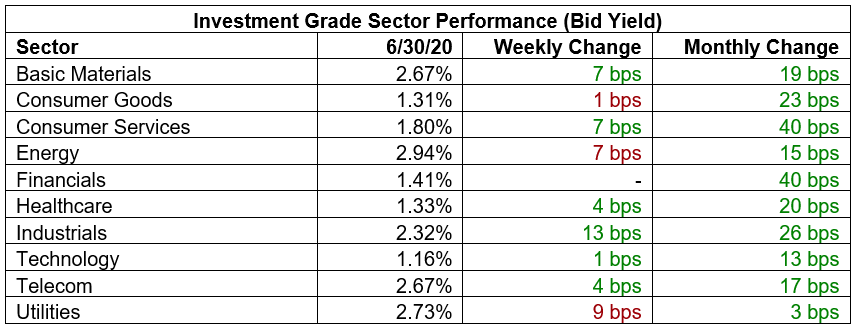

Investment Grade Market Review

The table below summarizes weekly and monthly sector performance

across the iShares iBoxx $ Investment Grade Corporate Bond

ETF.

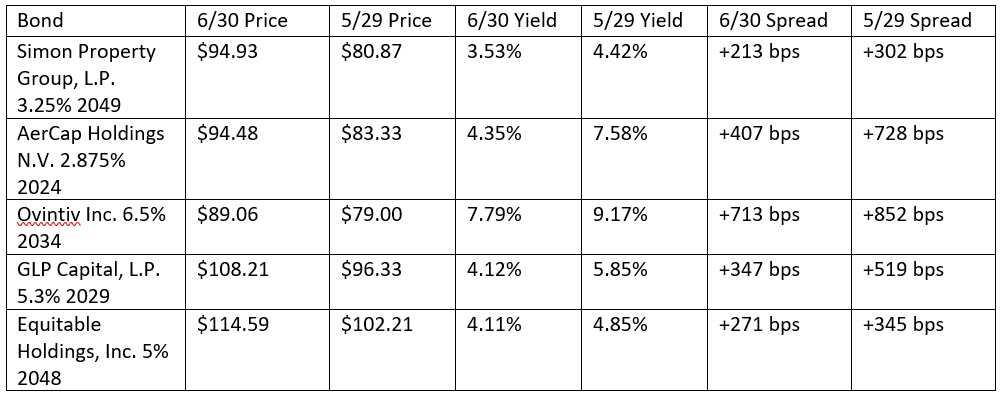

Best performing bonds within the Investment Grade Market

The best performing iShares iBoxx $ Investment Grade Corporate Bond ETF bonds in June are show in the table below.

These best performing bonds show the rebound in sectors heavily hit by the Corona Virus, including REITs, airlines, and energy.

The screenshot below shows yield fluctuations of the Simon

Property Group, L.P. bond over the last 3 months.

Worst Performing bonds within the Investment Grade Market

Below are the worst preforming iShares iBoxx $ Investment Grade Corporate Bond ETF bonds of June.

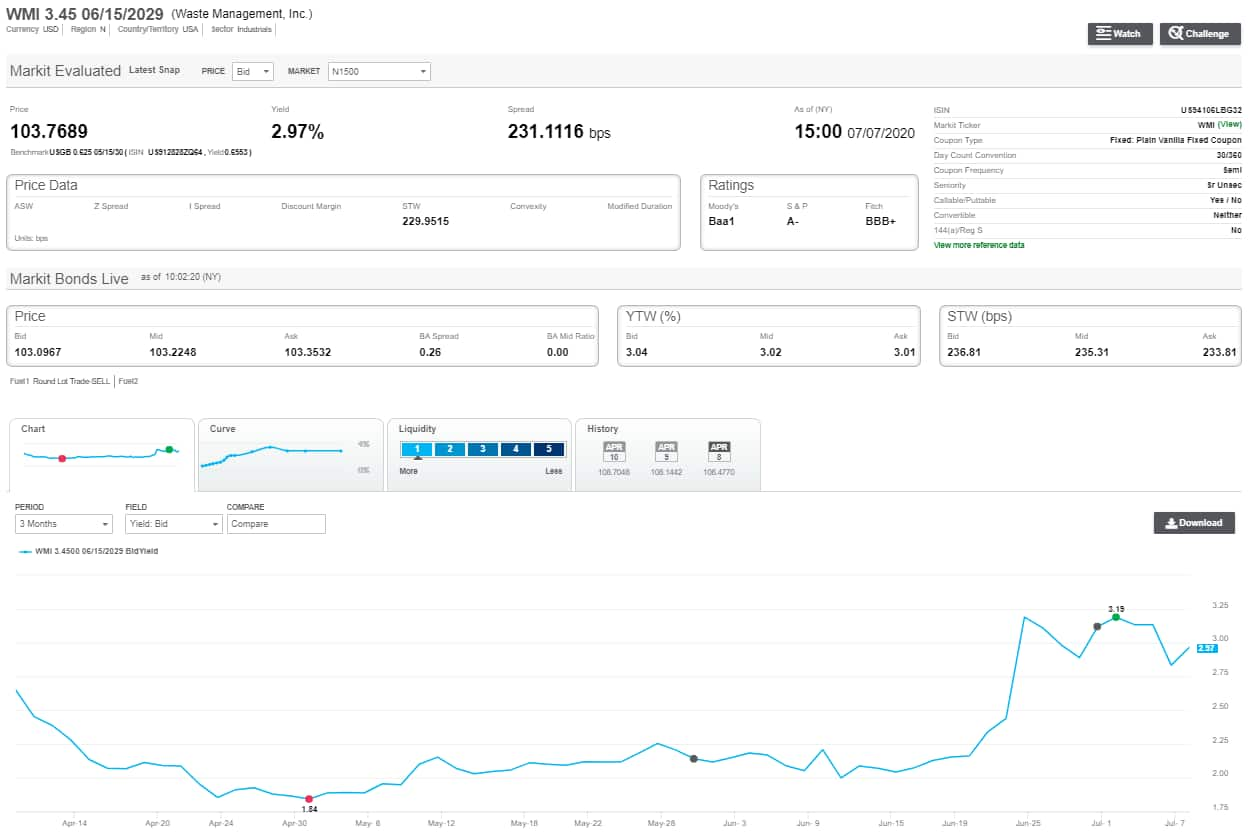

3 of the 5 bonds on this list are Waste Management, Inc. bonds issued to fund the $4.9 Billion acquisition of Advanced Disposal announced in April 2019. These bonds dropped in late June due to Waste Management's revised terms of acquisition. The merger was pushed back due to the Corona Virus and the special mandatory redemption provision of the bond requires the deal to close on or prior to July 14, 2020, redemption price is equal to 101% of the aggregate principle amount.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-treasury-movement-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-treasury-movement-june-2020.html&text=Corporate+Bond+Pricing+Data+-+June+2020+Recap+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-treasury-movement-june-2020.html","enabled":true},{"name":"email","url":"?subject=Corporate Bond Pricing Data - June 2020 Recap | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-treasury-movement-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Corporate+Bond+Pricing+Data+-+June+2020+Recap+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-treasury-movement-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}