Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 20, 2018

Upswing in eurozone construction activity continues at start of 2018

- Headline PMI signals one of the fastest rates of growth since before the financial crisis in February

- Rate of job creation among the sharpest since 2007

- Input price inflation joint-highest since March 2012

The eurozone construction sector is enjoying one of its best spells for over a decade, with growth remaining buoyant in February, according to the latest IHS Markit PMI data. The expansion was driven by another strong rise in new contract wins, which in turn encouraged firms to hire additional workers. On the downside, the sector again reported an elevated rate of input price inflation, which was among the sharpest since the global financial crisis.

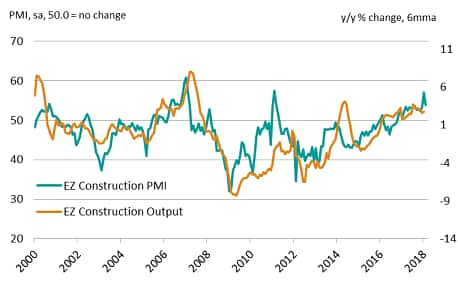

The headline IHS Markit Eurozone Construction PMI® registered 53.9 in February, to signal the second-sharpest rate of growth since March 2011, beaten only by January’s reading of 57.0. The latest increase in total industry activity extends the current period of expansion to 16 months. The uptrend in the headline figure can be traced back to early-2015, coinciding with the ECB’s policy of quantitative easing.

Total activity growth softens but remains marked

The PMI has signalled stronger growth than official data at the start of the year. Given the history of the PMI as an accurate and often leading indicator of hard data, we may see the official numbers improve in the coming months.

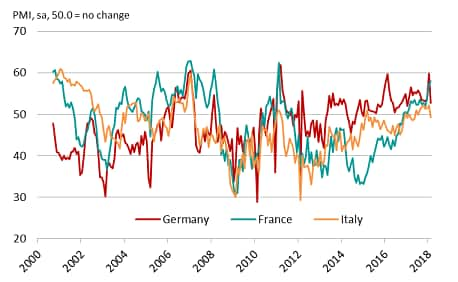

The upturn over the last three years has been driven by Germany, where the rate of growth has consistently outstripped those seen in both France and Italy, though recent months have seen growth become more balanced. While construction output in these latter two countries has spent much of this period in decline, the rate of expansion in France moved above that seen in Germany for the second time in three months during February.

Upturn generally driven by Germany

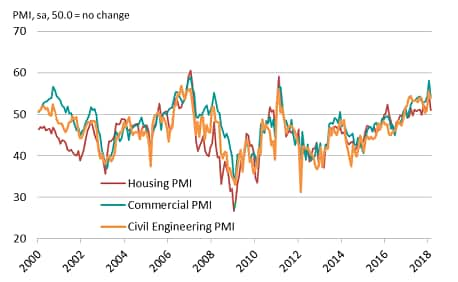

Encouragingly, the expansion in overall construction activity remained broad-based by sub-sector. Commercial and civil engineering construction have generally outperformed house building over the last year, though growth in all three sectors remained elevated relative to historical trends.

Activity growth broad-based across sub-sectors

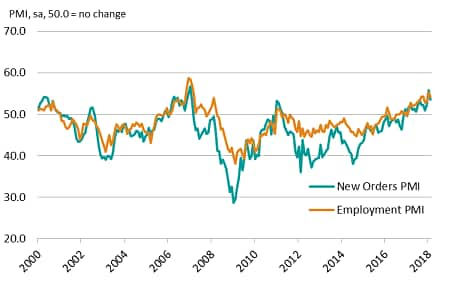

Activity growth has been supported by a rise in new contract wins, which itself can be linked to monetary policy easing and a cyclical upturn in global demand. The inflow of new work in turn encouraged firms to take on additional workers for a thirteenth successive month in February.

Rising new orders boost employment

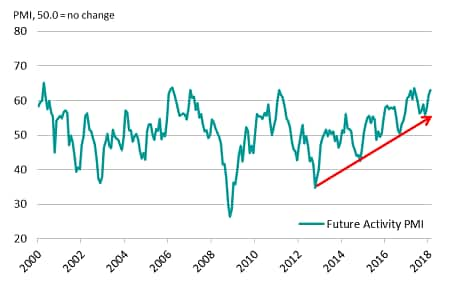

The survey responses also indicate that firms expect growth to continue in the near-term. Indeed, the degree of business confidence as measured by the survey’s Future Output Index was among the highest in over 18 years of data collection during February, and has been trending upwards for the past five years.

Business confidence continues to improve

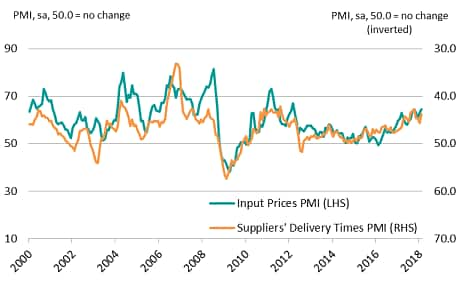

The main area of concern rests with rising costs. The last couple of years have seen a steady acceleration in the rate of input price inflation, which reached its joint-highest since March 2012 during February. The increase can be partially linked to higher oil prices and an upswing in global demand over this period. In turn, strong demand for building materials has put pressure on company supply chains, leading to longer average delivery times.

Inflationary pressures strengthen further

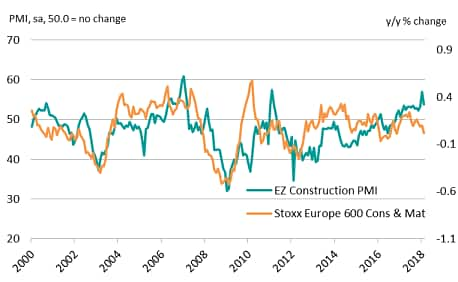

The improving performance of the eurozone construction sector as signalled by the PMI has been reflected in equity markets in recent years. While the Stoxx 600 Construction and Materials Index has pulled back in recent months, PMI data suggest that operating conditions remain robust.

Strong PMI bodes well for equities

Alex Gill, Economist, IHS Markit

Tel: 01491 461 015

alex.gill@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupswing-eurozone-construction.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupswing-eurozone-construction.html&text=Upswing+in+eurozone+construction+activity+continues+at+start+of+2018","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupswing-eurozone-construction.html","enabled":true},{"name":"email","url":"?subject=Upswing in eurozone construction activity continues at start of 2018&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupswing-eurozone-construction.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Upswing+in+eurozone+construction+activity+continues+at+start+of+2018 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fupswing-eurozone-construction.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}