Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 03, 2018

UK manufacturing sector growth slows amid steepest export decline since 2014

- PMI at lowest level since July 2016

- Output growth slows further as new order inflows hit by sharp drop in exports

- Business optimism at 22-month low

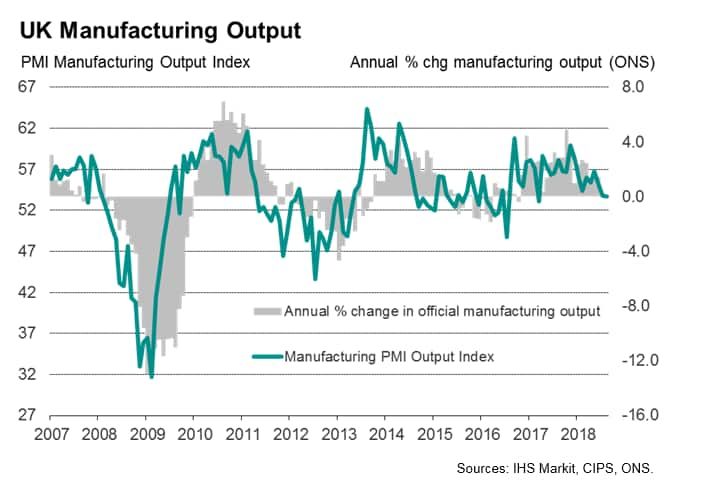

UK manufacturing output growth waned in August to its lowest since March 2017, due mainly to a sharp downturn in exports. Optimism about the future also dipped lower to suggest conditions could deteriorate further in coming months.

Production growth slowdown

The seasonally adjusted IHS Markit/CIPS Manufacturing PMI fell to 52.8 in August, its lowest since the immediate aftermath of the EU referendum. The lower August reading represents a continuation of a general slowing trend that has been evident since growth peaked in November of last year.

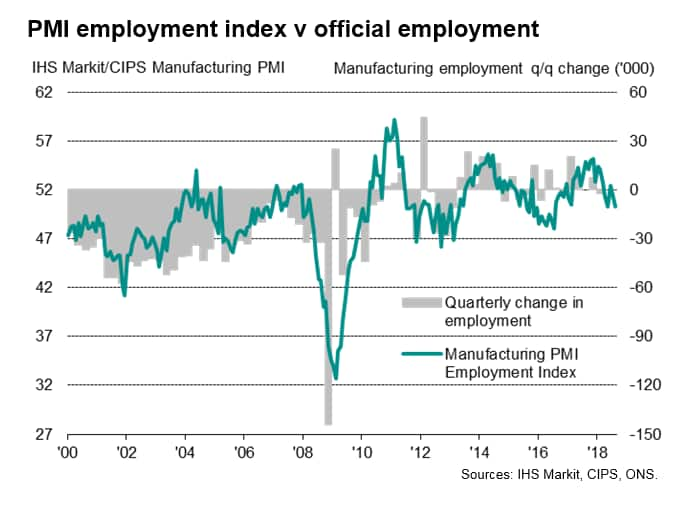

Output and new orders expanded at the weakest rates for 17- and 25-months, respectively, as exports fell at the steepest pace since October 2014. Employment meanwhile barely rose as producers grew more cautious in terms of hiring, registering the joint-weakest jobs gain for over two years.

A comparison of the survey's output index with official manufacturing data from the Office for National Statistics indicates that the survey is indicative of the official gauge of output stagnating (measured on a three-month-on-three-month basis). [*]

Subdued outlook

In seeking to assess the production trend in coming months, the survey data suggest downside risks to the outlook. Companies themselves grew less optimistic in August, with sentiment about production in the year ahead dipping to a 22-month low. Anxiety about the disruptive impact of Brexit remained highest on the list of concerns.

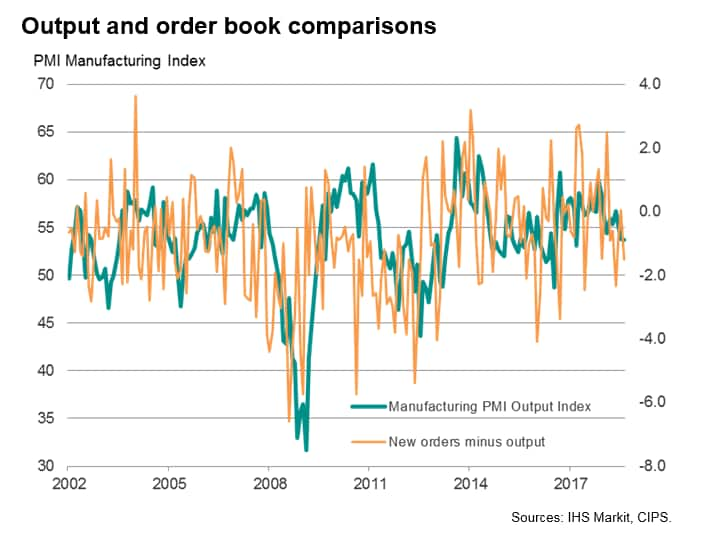

Other sub-indices for the survey also hint at slower future production: growth of output continued to outpace that of new orders, a situation which generally tends to mean production will be scaled back in coming months unless demand revives (see chart).

New orders growth has in fact fallen below that of output in five of the past six months, meaning companies' production levels are only being sustained by clearing backlogs of work. A marked drop in backlogs of uncompleted orders in August underscored how existing production capacity is more than sufficient to cater to current demand growth, boding ill for future output and jobs growth.

Export woes

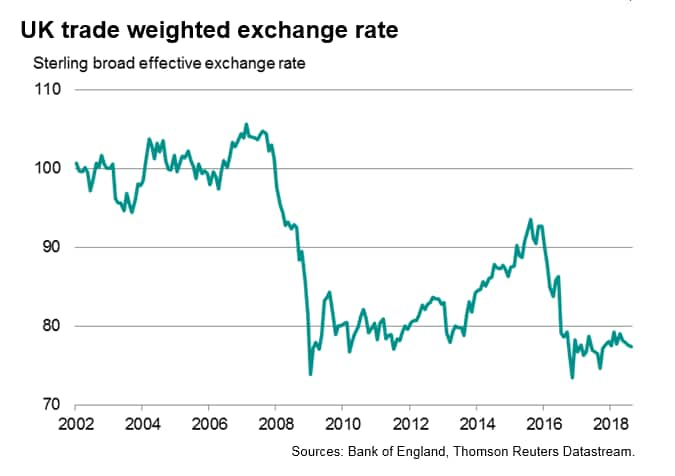

While exports had been an important driver of the manufacturing upturn for much of 2017, the trade picture has worsened in recent months, culminating in a sharp drop in exports in August. The export decline is all the more worrying due to the sustained weakness of sterling during the month, which should be helping to boost the competiveness of UK goods in overseas markets.

Export orders fell for consumer goods, investment goods (such as plant and machinery) as well as intermediary goods. The latter, which are inputs provided to other manufacturers abroad, showed the steepest decline and fell for a second successive month.

Fewer delays and cooling price pressures

Some good news came in the form of fewer supply chain delays, with delivery times showing the smallest (albeit still marked) lengthening for four months. Input cost pressures also continued to run below recent peaks, though the rate of raw material price inflation remained unchanged on July's elevated level.

Output prices likewise continued to rise sharply, though less so than in July, indicating that upward pressure on inflation from the factory sector has eased since earlier in the year but remains significant.

Chris Williamson, Chief Business Economist, IHS

Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2018, IHS Markit Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-sector-growth-slows-030918.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-sector-growth-slows-030918.html&text=UK+manufacturing+sector+growth+slows+amid+steepest+export+decline+since+2014+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-sector-growth-slows-030918.html","enabled":true},{"name":"email","url":"?subject=UK manufacturing sector growth slows amid steepest export decline since 2014 | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-sector-growth-slows-030918.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+manufacturing+sector+growth+slows+amid+steepest+export+decline+since+2014+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-manufacturing-sector-growth-slows-030918.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}