Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2020

UK Flash PMI signals economic rebound as uncertainty lifts

- Flash composite PMI™ rebounds from election and Brexit-related malaise to reach 16-month high

- Business sentiment about the outlook rises to highest since June 2015

- Signs of improvement will likely stave off mooted interest rate cut

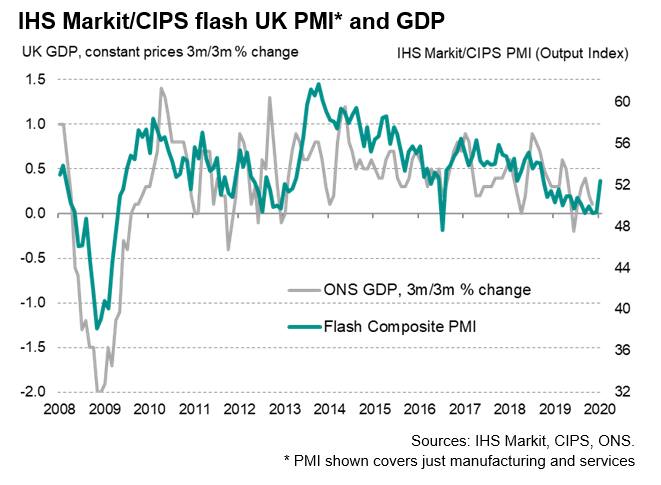

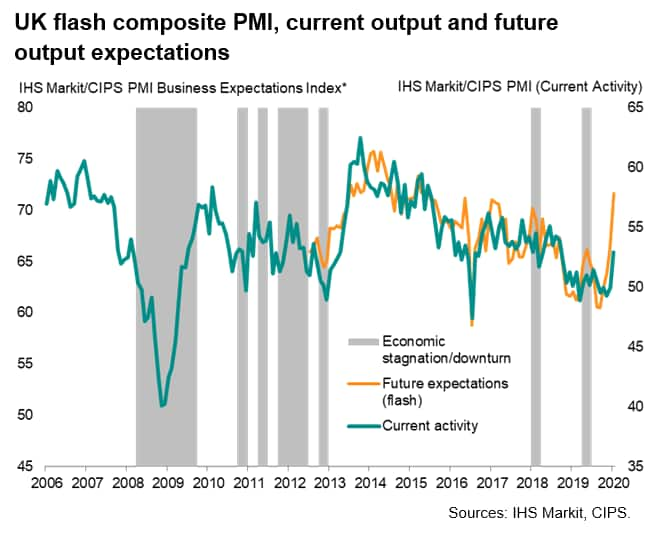

Flash PMI survey data indicate an encouraging start to 2020 for the UK economy. Output grew at the fastest rate for sixteen months amid rising demand for both manufactured goods and services, suggesting business is rebounding after declines seen late last year. Intensifying political and economic uncertainty ahead of the general election has started to ease, encouraging more spending and helping push business expectations of future growth to its highest since mid-2015.

At 52.4, up from 49.3 in November and December, the composite

output index from the survey has rebounded to a level indicative of

GDP rising at a quarterly rate of approximately 0.2% in January,

representing a welcome revival of growth after the malaise seen in

the closing months of 2019.

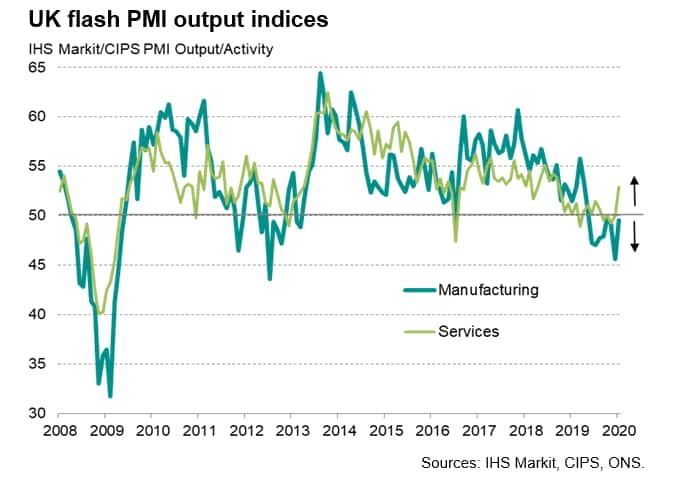

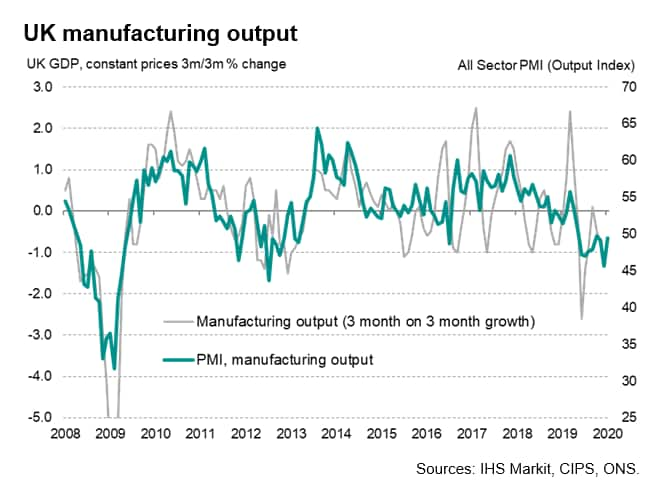

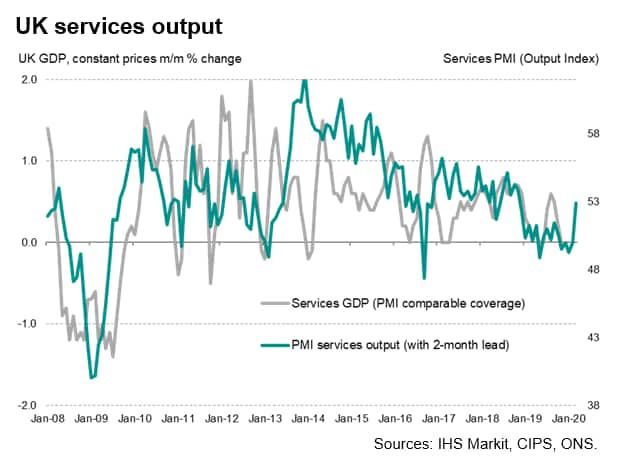

The weak PMI data in the closing months of 2019 pointed to one of the worst spells for the economy seen over the past decade, commensurate with GDP stagnating at best in the fourth quarter. Anecdotal evidence collected via the surveys revealed how companies blamed heightened Brexit-related uncertainty, exacerbated by political worries in the lead up to the December 12th general election, as having dampened spending by households and businesses alike. The January survey hints strongly that some of this uncertainty has lifted with the decisive general election result, with companies often reporting that demand has improved in the short term at least. New orders for services showed the strongest monthly gain for nearly one-and-a-half years, while manufacturers reported the first increase in new orders since last April.

Hiring has also picked up in January, according to the preliminary PMI data, which reflects responses from approximately 80-85% of the final survey results for manufacturing and services. The flash composite employment index rose for a fourth month running, pointing to the quickest rate of job creation since last July, buoyed by stronger job gains in services and the first net rise in factory staffing levels since last March.

Improving outlook

An uplift in sentiment about the outlook hints that the January upturn has legs. Business confidence regarding the year ahead rose sharply to reach the highest since mid-2015. Manufacturers expectations remained relatively muted, albeit improving to the highest since last May, while service sector confidence hit the highest for nearly five years.

The difference in business sentiment levels was largely a

function of manufacturers being concerned about their greater

exposure to weak international demand, potential tariff hikes and

uncertainty with respect to the post-Brexit overseas trading

environment. Service sector companies in contrast are typically

more domestically focused, and are therefore less reliant on

exports and the external environment.

Does the rebound have legs?

A key question is whether the January upturn represents the start of a more sustained economic upturn now that some of the economic and political uncertainty has lifted following the general election, or whether we are merely seeing a short-lived upturn in sentiment that could quickly ebb away. Notable risks include a possible absence of positive developments relating to Brexit in coming months and an intensification of US trade war attentions on Europe.

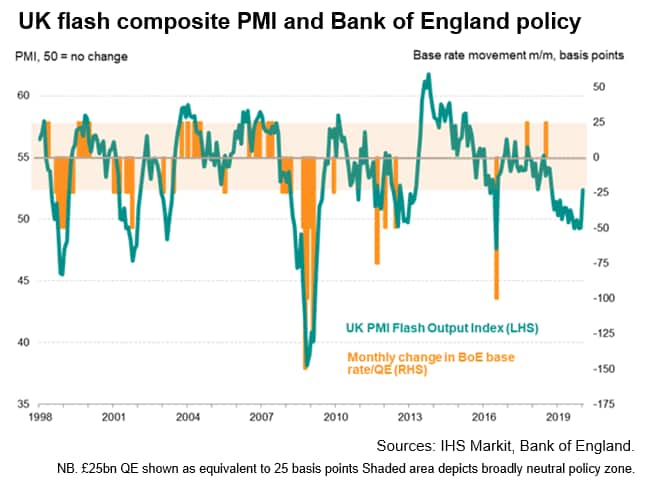

Rate cuts off the table, for now

Business confidence could also be dampened due to changing

interest rate expectations. The January uplift in sentiment

coincided with

growing expectations that the next change in policy by the Bank

of England will be an interest rate cut. However, it seems likely

that the rise in the PMI is sufficiently strong to kill off the

prospect of an imminent rate cut by the Bank of England, with

policymakers taking a wait and see approach as they assess the

performance of the economy in the post-Brexit environment. Four of

the Bank's Monetary Policy Committee had flagged their appetite for

a cut to interest rates earlier in the month, but cited the flash

PMI as being an important input into this decision. However,

gauging by historical comparisons of MPC decisions with the PMI,

the current flash reading pushed the survey closer to what we

consider neutral policy territory.

For more information contact economics@ihsmarkit.com.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

© 2019, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-rebound-as-uncertainty-lifts-Jan.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-rebound-as-uncertainty-lifts-Jan.html&text=UK+Flash+PMI+signals+economic+rebound+as+uncertainty+lifts+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-rebound-as-uncertainty-lifts-Jan.html","enabled":true},{"name":"email","url":"?subject=UK Flash PMI signals economic rebound as uncertainty lifts | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-rebound-as-uncertainty-lifts-Jan.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+Flash+PMI+signals+economic+rebound+as+uncertainty+lifts+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-economic-rebound-as-uncertainty-lifts-Jan.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}