Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 20, 2019

The Value of Fair Value beyond Compliance

Fair value is the pricing of foreign assets, post-closure of their native markets. Because markets are intercorrelated, breaking news from one part of the world can impact all markets globally. Fair value prices serve to capture fluctuations in the valuation of foreign equity and fixed income assets. Using these prices, portfolio and asset managers with international exposure can accurately estimate the net asset value of their funds, ensuring that the subscriptions and redemptions take place at appropriate levels; preventing short-term stakeholders from exploiting arbitrage opportunities caused by inter-market correlation, thus protecting passive long-term stakeholders' returns.

In 1940, the SEC and congress passed the Investment Company Act of 1940, requiring mutual funds to use fair value prices for any securities that do not have readily available prices for valuation. If any fund has exposure to an international asset that is not trading at the time of valuation, they would need fair value prices to value it.

The need for fair value becomes even more pronounced during significant market events. For example: a financial crisis resulting in the closure of a stock market exchange, such as the Athens's stock exchange closing for five weeks in 2015. Or perhaps a natural disaster, like the 2011 earthquake in Fukushima Japan, which led to nuclear disaster.

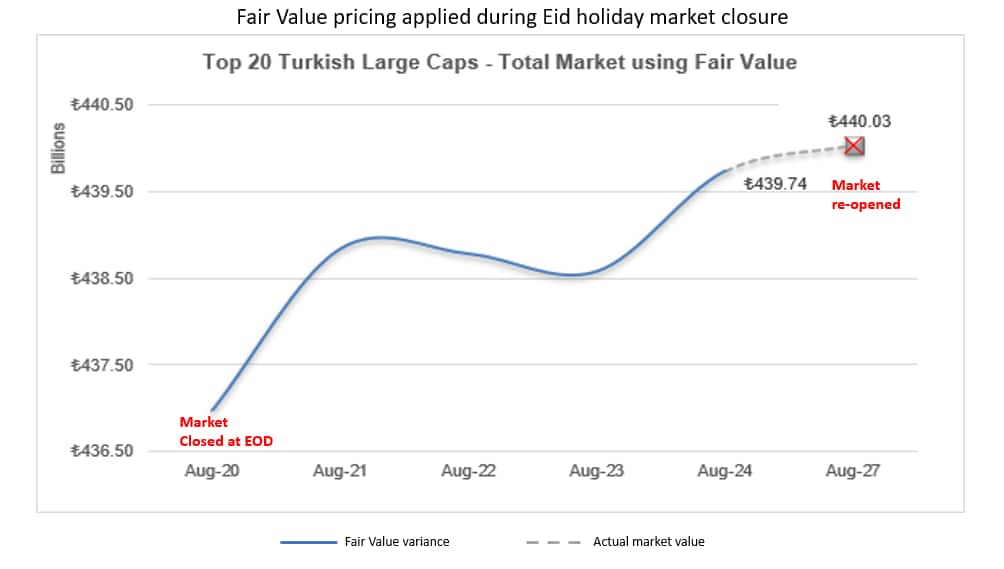

The chart below demonstrates a recent use case for fair value: In August 2018, the Istanbul stock exchange closed for a week for the Eid holiday Festival, resulting in a significant downfall for the Turkish lira. During this week, portfolio managers relied on Fair Value prices to gauge real-time fluctuations for securities or other assets.

This chart tracks the change in aggregate market cap for the 20 largest Turkish securities (market cap > ₺10B) with respect to market cap through the market closure. By the end of Friday, Aug. 24, IHS Markit added ₺2.76 billion to the total market cap, capturing 90% of the total movement.

Similar to other forms of regulation, such as liquidity or MiFID II, fair value is enforced locally yet impacts markets globally. Uncertainty and volatility within markets have been increasing over the past couple of years due to multiple major market events, such as Brexit and the unpredictable results of US elections, as well as the recent trade tensions between the US and China. To make sure that their valuations account for increased volatility, portfolio managers from the EMEA and APAC regions have been migrating toward the use of fair value as an approach to best practice.

The use case of fair value has expanded beyond the regulatory needs, as previously mentioned, to encompass hedge funds as well. Hedge funds that hold securities that don't trade for extended periods of time, either due to suspension or halts, have been reaching out to us for fair values, as they do not have readily available prices for these securities.

IHS Markit has been in this space since 2012, implementing its own statistical approach: employing 70+ global factors, such as global index futures, S&Ps, the NIKKEI, the DAX futures, sector ETFs, regional ETFs, FX rates, and more than 3,000+ entity-specific factors - such as CDS prices, depository receipts, pink sheets - to accurately estimate out-of-hours prices for foreign assets. Fair Value clients include mutual funds, asset managers, fund administrators, auditors, and hedge funds. IHS Markit, being the data warehouse that we are, has exposure to a large supply of deep historical datasets, which puts us in a unique position and powers our capability to accurately estimate fair value prices for these assets around the clock.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-value-of-fair-value-beyond-compliance.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-value-of-fair-value-beyond-compliance.html&text=The+Value+of+Fair+Value+beyond+Compliance+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-value-of-fair-value-beyond-compliance.html","enabled":true},{"name":"email","url":"?subject=The Value of Fair Value beyond Compliance | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-value-of-fair-value-beyond-compliance.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+Value+of+Fair+Value+beyond+Compliance+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-value-of-fair-value-beyond-compliance.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}