Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 20, 2019

Thailand 2020 outlook

Opposition Future Forward Party (FWP) leader Thanathorn Juangroongruangkit resigned from the House of Representatives' budget bill extraordinary committee on 30 November after the constitutional court's ruling to disqualify him as a member of parliament.

The Thai government is likely to continue efforts to disqualify opposition lawmakers, which will lead to an increasingly confrontational parliament with growing difficulties in passing major policies. Recent policies, such as the first reading of the budget bill in October, were passed with very slim margins and encountered frequent defections from both political camps' members of parliament. A 27 November vote to investigate the use of special powers by the former junta was won by only four votes, which led to the Parliament Speaker to call for a revote and a subsequent mass walkout by opposition party members. The pro-establishment political camp has increasingly perceived the opposition camp as an alleged threat to state stability. Army chief Apirat Kongsompong has warned of alleged "communist threats" and alleged "attacks on the monarchy", likely referring to the Future Forward Party (FWP)'s campaign for constitutional amendments. This, as well as at least 28 ongoing court cases against FWP leader Thanathorn Juangroongruangkit and other FWP members, signals the FWP's likely dissolution in the coming months.

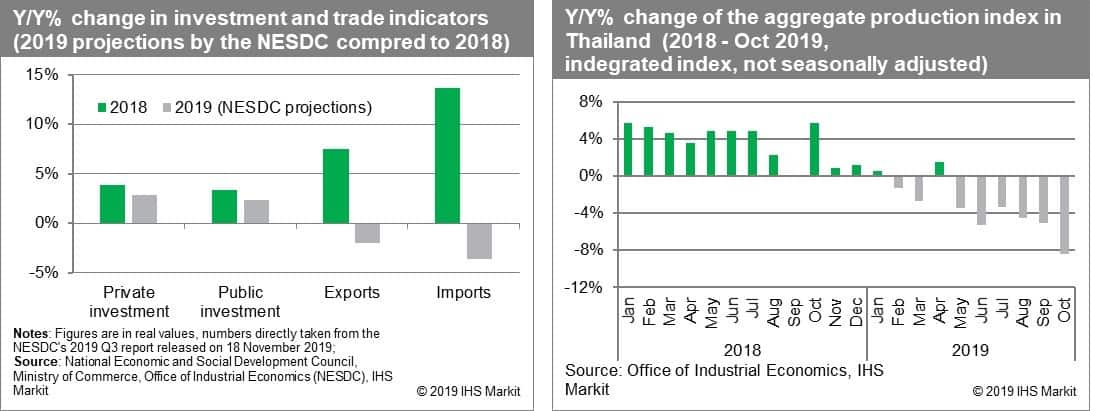

Separately, slowing business activity across all major sectors has intensified criticism of the government's response to livelihood issues. October data on exports, manufacturing, and investment have indicated a slowdown since the beginning of 2019. The National Economic and Social Development Council, a government-led think tank, has revised the 2019 GDP forecast from 2.7-3.2% to 2.6%. IHS Markit economics has also indicated downwards revisions to growth forecasts. The government has launched several stimulus packages, mostly in the form of cash handouts and tax relief targeting farmers and low-income households. In addition, the Bank of Thailand has cut interest rates to support the business environment and an appreciating currency. However, so far results have been limited, with anecdotal evidence pointing towards continued grievances from middle-class and low-income households. An 18 November video on economic hardship and calling for Prime Minister Prayuth Chan-o-cha's resignation attracted about 1.4 million views within days of posting.

Protests in Thailand are likely to remain peaceful and concentrated in government and commercial areas in Bangkok. Since the establishment of the civilian government in June, opposition parties are disinclined to instigate large-scale protests, which can lead to an army intervention. However, the potential dissolution of the FWP, which is likely to involve banning popular opposition party members from political participation, will probably trigger protests in urban areas, particularly in Bangkok. In 2020, frequent protests of tens of thousands of people is likely, but they will be mostly peaceful, with a very low risk of violent escalations, physical harm, or denial of access to roads and major commercial regions beyond a few hours. Hotspots are highly likely to include central business areas and politically symbolic sites such as government areas in Phra Nakhon, Dusit, and Phaya Thai; business districts, in particular Pathum Wan and Lumpini; and Thammasat University and the UN office along Ratchadamnoen Nok Road.

Indicators of changing risk environment

Increasing risk

- A failure to pass the budget bill, currently in its second reading and scheduled for final vote in January 2019, would further indicate government inefficiency and the worsening effectiveness of government policies, including stimulus measures aimed at helping those adversely affected by the economic downturn, and therefore increase protest risks.

- Passage of the budget bill without increasing resources allocated to government ministries will further heighten protest risks as it adversely affects government employees. In its current form, the budget focuses on funding the military and palace. This increases the likelihood of civil servants, public health, and education-sector workers joining the protests to demand better pay and working conditions amid the economic downturn.

- If the Thai economy further deteriorates throughout 2020 in manufacturing, agricultural (rice and rubber plantations in particular), and export-oriented sectors, any procyclical policies such as introducing new taxes or reducing subsidies amid economic hardship would trigger protests - some escalating to rioting and fighting with the police, especially in central Bangkok.

Decreasing risk

- Defection in the FWP, such as members of parliament breaking away from the FWP and Pheu Thai (PT) coalition to join the ruling Palang Pacharath Party (PPRP), would indicate the waning of popular support and reduce protest risks in the one-year outlook. At least three members of parliament from FWP have been consistently voting in favor of PPRP policies.

- Pro-opposition activists are organizing a protest gathering called "Run Against Uncle" (referring to Prayuth) on 12 January 2020. Strong army deployment to the small-scale event will indicate continued heavy-handed approach similar to the former military government, reducing risks of violent escalations.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-2020-outlook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-2020-outlook.html&text=Thailand+2020+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-2020-outlook.html","enabled":true},{"name":"email","url":"?subject=Thailand 2020 outlook | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-2020-outlook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Thailand+2020+outlook+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthailand-2020-outlook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}