Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 19, 2018

Swedish doves still outnumber hawks

- September's monetary policy meeting included no change in the forward guidance. The first Swedish interest rate rise, in nearly a decade, is still scheduled for the December meeting.

- However, an increased dovishness in the language, contradicting July's firming, is leading to heightened speculation that the first rate rise will be pushed back. A decision we would expect to be signaled by a firm change in the forward guidance at the October meeting.

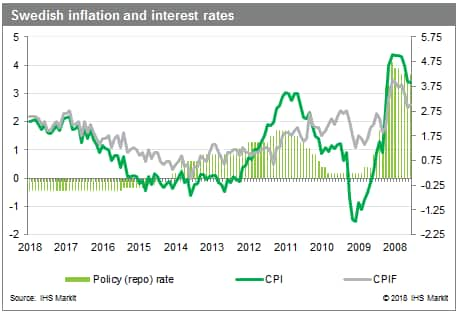

- This speculation is manifesting in renewed turbulence in FX markets. The krona saw a 0.7% slide against the euro on Friday, following a fractional (0.1%) undershooting of CPI inflation. Despite CPIF, the inflation rate targeted by the central bank, remaining steady in excess of the 2.0% target.

- In our opinion a decision to delay a rate hike would have serious negative implications for the Swedish economy.

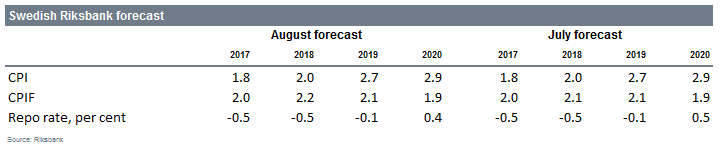

The Riksbank voted to maintain the repo rate at -0.5% at the September meeting. Despite an as expected shift in the voting, from 5:1 in favor of maintaining to 4:2, and an expansion of the 2018 CPIF forecast, the market perception is that the meeting was more dovish than expected. The monetary policy report emphasized and highlighted the board's concerns that the recent recovery in inflation is the result of higher energy prices and that underlying inflation momentum remains muted, saying that underlying inflation has averaged 1.5% y/y in 2018. However, the current upswing in inflation is not only energy, food inflation has averaged 2.6% in 2018 so far, and given the extreme weather of recent months we, and the Riksbank, expect that food prices will remain high through to the end of the year. However, the extreme weather has also led to very low levels in the domestic hydroelectric reservoirs, a key energy source for Sweden, which will likely put upward pressure on energy prices in the latter half of the year. Continuing the narrative that inflation is being skewed by energy prices- but supporting our expectation that interest rates will remain close to target.

The perceived heightened dovish language did not immediately impact markets. But last week's FX reaction to August's 0.1% easing for CPI inflation, back to 2.0% y/y, from 2.1% y/y in June-July, shows that observers are very concerned that any underperformance could be used as a rationale for delaying a rate rise. The market perception seems therefore, to be that it would take very little to push the Riksbank back into "wait and see" mode. Given the recent renewed weakness of the krona, it reached a new high against the euro in mid-August, it is a dangerous time for unclear monetary policy.

In our opinion, the October meeting of the Riksbank will be decisive. If the board plans to push back the first rate rise, they will have to signal that decision, more firmly to markets at the October meeting. As the meeting is scheduled for the 23 October, after the publication of September's inflation rate, the outcome of that meeting will likely hang on that set of data. If we have a more mixed set of inflation data, which is entirely possible as some of the energy related base effects could start to unwind in September, we will probably see a retreat from the Riksbank. In these circumstances we do not expect the first rate revision until the February 2019 meeting. However, because of when the October meeting falls in our forecast calendar, unless the next inflation release falls significantly below expectations, we will not integrate a new policy rate forecast until the November round.

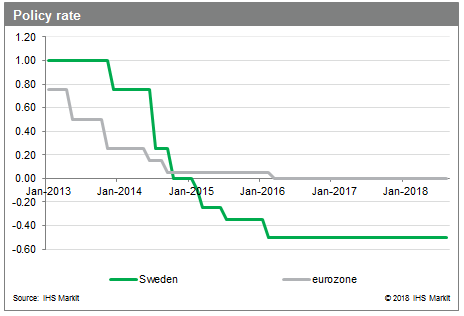

We continue to believe that a decision to delay the first rate rise would be very ill advised. At -0.5% Sweden has the second lowest rate globally - topped only by Switzerland. IHS Markit believes that Swedish monetary policy is too loose, leading to mounting risks and asymmetries: volatility of the krona, rising house prices, very high household debt. Rather than supporting economic stability, current monetary policy is increasing the probability of a bumping landing for Swedish economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fswedish-doves-still-outnumber-hawks.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fswedish-doves-still-outnumber-hawks.html&text=Swedish+doves+still+outnumber+hawks+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fswedish-doves-still-outnumber-hawks.html","enabled":true},{"name":"email","url":"?subject=Swedish doves still outnumber hawks | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fswedish-doves-still-outnumber-hawks.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Swedish+doves+still+outnumber+hawks+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fswedish-doves-still-outnumber-hawks.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}