Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 01, 2018

Order book and production divergence hints at extended eurozone manufacturing soft patch

- Manufacturing PMI still in robust expansion territory but drops to lowest since February 2017

- Exports exert biggest drag on order book growth since July 2010

- Future growth likely to weaken as order book growth is outstripped by recent production gains

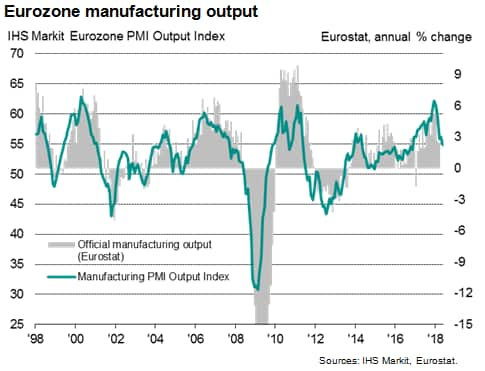

The eurozone manufacturing sector reported its slowest expansion for 15 months in May, according to the final PMI data. The details of the survey, especially the divergence between changes in output and order books, suggest growth is likely to remain subdued or even weaken further in coming months.

All key indices lower in May

The IHS Markit Eurozone Manufacturing PMI fell for a fifth successive month in May, down from a peak of 60.6 in December and 56.2 in April to 55.5. Output grew at the slowest rate for 18 months and new order inflows hit a 19-month low.

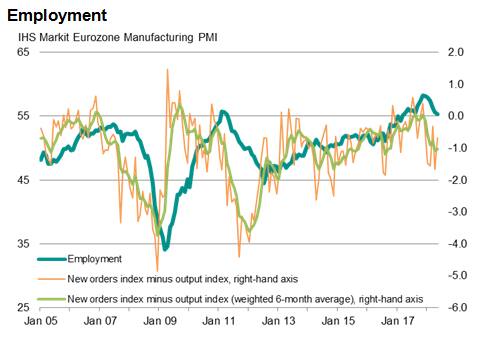

Employment growth meanwhile edged down to a 14-month low as companies scaled back expansion plans in line with the weakened order book trend and increasing caution about the outlook. Expectations of future production sank to a 20-month low.

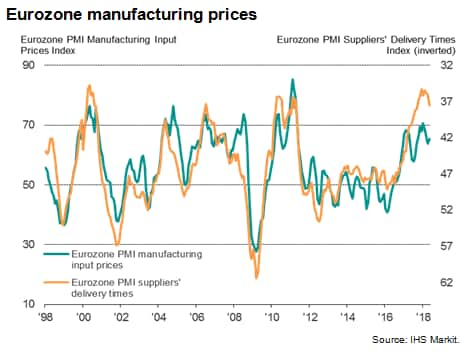

Input buying likewise continued to grow at the weakest rate for one-and-a-half years, taking some pressure off supply chains. Although suppliers' delivery times lengthened markedly again, the incidence of delays was the lowest since last September.

Easing supply constraints

While an easing of supply chain constraints had helped take some upward pressure off factory input prices in April, higher oil costs meant average input price inflation picked up again in May, though remained below rates seen earlier in the year. The rate of increase in average prices charged for goods leaving the factory gate eased to a five-month low however, hinting at a squeeze on profit margins.

Export drag

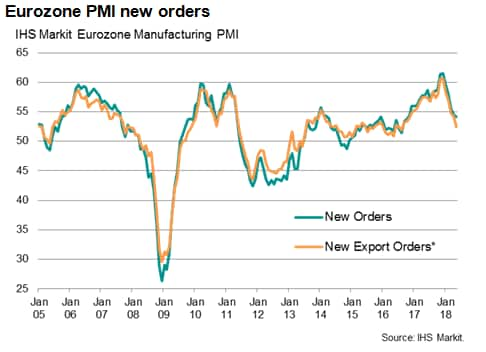

A key drag on both production and order book growth was a further slowing of export sales, with new export orders showing the smallest increase for 21 months.

The export orders index* has fallen from a peak of 60.7 last November to just 52.4 in May. Companies have blamed the appreciation of the euro, up around 5% against the US dollar in recent months, alongside concerns about US protectionist measures and signs of a broader slowing in global demand.

Comparing the new orders index against the export orders index suggest that exports are now exerting the biggest drag on order book growth since July 2010.

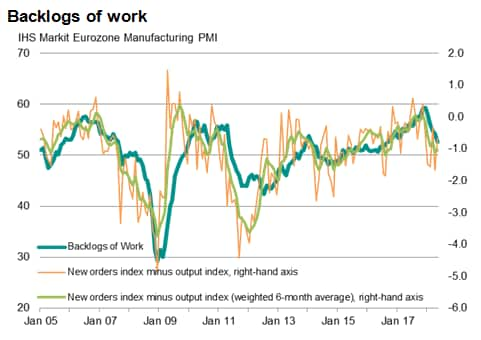

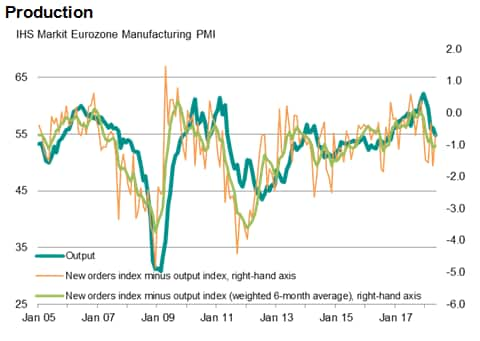

Output growing faster than orders

The recent order book developments suggest that output growth could remain subdued or even weaken in coming months. Whereas new order growth was broadly in line with that of output throughout much of last year, output has now been growing at a faster rate than new orders in each of the past six months.

Growth of backlogs of work has consequently eased considerably since the strong accumulation of uncompleted orders late last year, with May seeing the smallest rise in backlogs since September 2016.

New orders and output comparisons

Historical data suggest that the difference between the PMI's new orders and output indices acts as a useful indicator of future backlogs of work and production trends, and naturally therefore also gives a good insight into future hiring. In the following charts we use a weighted six-month moving average of the divergence between the new orders and output indices, with the most recent months carrying the highest weight. The measure picked up slightly in May but remained at one of the lowest levels seen in the past year-and-a-half, auguring for further weak production and hiring in coming months unless demand revives.

* Note that the export orders index is based on a weighted average of national PMI data, so includes intra-eurozone trade between member states.

Chris Williamson, Chief Business Economist, IHS Markit

Tel: +44 207 260 2329

chris.williamson@ihsmarkit.com

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

© 2018, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-hint-at-extended-eurozone-manufacturing-soft-patch.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-hint-at-extended-eurozone-manufacturing-soft-patch.html&text=Order+book+and+production+divergence+hints+at+extended+eurozone+manufacturing+soft+patch+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-hint-at-extended-eurozone-manufacturing-soft-patch.html","enabled":true},{"name":"email","url":"?subject=Order book and production divergence hints at extended eurozone manufacturing soft patch | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-hint-at-extended-eurozone-manufacturing-soft-patch.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Order+book+and+production+divergence+hints+at+extended+eurozone+manufacturing+soft+patch+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsurvey-data-hint-at-extended-eurozone-manufacturing-soft-patch.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}